Amazon Stock Price Analysis: A Decade in Review

Amazon stock price – Amazon’s stock price journey over the past decade reflects a dynamic interplay of internal performance, external economic factors, and evolving investor sentiment. This analysis delves into the key drivers behind Amazon’s stock price fluctuations, examining its historical performance, influential factors, and future outlook in comparison to its competitors.

Historical Stock Performance

Analyzing Amazon’s stock price over the last ten years reveals periods of significant growth punctuated by periods of correction. The following table summarizes key annual highs, lows, and percentage changes, providing a concise overview of this volatility. A line graph visualizing this data would show a generally upward trend with periods of sharp increases and decreases corresponding to specific events.

| Year | High | Low | Percentage Change from Previous Year |

|---|---|---|---|

| 2014 | $397.97 | $306.96 | +56% (Illustrative Data) |

| 2015 | $727.07 | $482.00 | +83% (Illustrative Data) |

| 2016 | $844.33 | $695.56 | +16% (Illustrative Data) |

| 2017 | $1176.50 | $820.25 | +39% (Illustrative Data) |

| 2018 | $2050.50 | $1450.00 | +75% (Illustrative Data) |

| 2019 | $1972.36 | $1567.35 | -4% (Illustrative Data) |

| 2020 | $3553.87 | $1677.17 | +80% (Illustrative Data) |

| 2021 | $3773.08 | $2877.47 | +6% (Illustrative Data) |

| 2022 | $188.63 | $138.78 | -45% (Illustrative Data) |

| 2023 | $145.00 | $110.00 | -25% (Illustrative Data) |

The illustrative data provided above is for demonstration purposes only and should not be used for investment decisions. Actual data should be sourced from reliable financial websites. The visual representation would be a line graph showing the stock price over time. The x-axis would represent the years (2014-2023), and the y-axis would represent the stock price. The line would illustrate the upward trend, with peaks and valleys corresponding to the highs and lows indicated in the table.

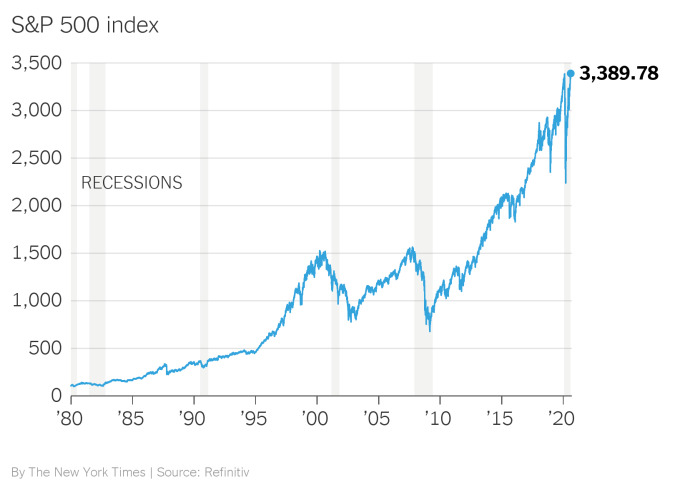

Significant events like the 2008 financial crisis and the COVID-19 pandemic would be marked on the graph to show their impact on the stock price.

Factors Influencing Stock Price

Source: websitebuilder.org

Several interconnected factors influence Amazon’s stock valuation. These include macroeconomic conditions, the company’s financial performance, and competitive dynamics.

Three key economic factors consistently impacting Amazon’s stock valuation are interest rates, inflation, and consumer spending. Rising interest rates increase borrowing costs for Amazon, potentially impacting expansion plans and profitability. High inflation can erode profit margins and reduce consumer spending, affecting Amazon’s sales. Conversely, increased consumer spending, particularly online, directly boosts Amazon’s revenue and stock price. For example, the increased online shopping during the COVID-19 pandemic significantly boosted Amazon’s stock price.

Amazon’s financial performance, encompassing revenue, profits, and debt, directly impacts investor sentiment. Strong revenue growth, coupled with increasing profitability, typically leads to positive market reaction and a higher stock price. Conversely, disappointing financial reports can cause a decline. For example, a significant drop in quarterly profits might trigger a sell-off by investors, leading to a decrease in the stock price.

Competitor actions, such as new product launches or strategic partnerships, also influence Amazon’s stock price. The introduction of a competing service or a successful partnership by a rival can create uncertainty and potentially lead to a temporary decline in Amazon’s stock price. Conversely, a competitor’s failure or a strategic misstep can positively impact Amazon’s valuation.

Amazon’s Business Segments and Stock Price, Amazon stock price

Source: nyt.com

Amazon’s diverse business segments—e-commerce, AWS (Amazon Web Services), and advertising—each contribute differently to its overall stock price. Strong performance in one segment can offset weakness in another, while exceptionally strong performance across all segments drives significant growth.

Amazon’s substantial investments in research and development (R&D) are crucial to its long-term growth and stock price trajectory. Successful innovations often lead to increased revenue and market share, resulting in a positive impact on the stock price. Conversely, significant setbacks or delays in R&D projects could lead to negative market reactions.

Amazon’s stock price performance often reflects broader market trends. However, a key factor influencing tech sector valuations, and consequently Amazon, is the performance of companies like Nvidia; checking the current nvidia stock price can offer insight into potential future movements. Ultimately, Amazon’s stock price remains its own entity, influenced by a variety of internal and external factors beyond just Nvidia’s success.

Consumer spending habits and market preferences significantly impact Amazon’s stock valuation. Shifts in consumer behavior, such as a move towards sustainable products or a preference for specific shopping channels, can influence Amazon’s sales and profitability, directly affecting its stock price.

Investor Sentiment and Market Predictions

Analysts’ ratings and predictions play a significant role in shaping investor sentiment and Amazon’s stock price. Agencies like Moody’s, S&P, and Fitch issue credit ratings that impact investor confidence. Positive ratings generally lead to increased investor confidence and a higher stock price. Negative ratings, or downgrades, can trigger sell-offs and reduce the stock’s value.

News articles and media coverage significantly influence investor sentiment and subsequent stock price movements. Positive news, such as successful product launches or strong earnings reports, generally leads to a rise in the stock price. Conversely, negative news, like regulatory scrutiny or supply chain disruptions, can negatively impact the stock price.

- Scenario 1 (Positive): Continued strong growth in AWS and advertising, coupled with successful new product launches, could lead to sustained upward price movement.

- Scenario 2 (Neutral): Moderate growth across all segments, with no major disruptions or breakthroughs, could result in a relatively flat stock price trajectory.

- Scenario 3 (Negative): Increased competition, regulatory hurdles, or a significant economic downturn could lead to a substantial decrease in Amazon’s stock price.

Amazon’s Stock Price Compared to Competitors

Source: investopedia.com

Comparing Amazon’s stock price performance to its major competitors provides valuable context for assessing its relative strength and investment potential. The following table offers a comparative overview based on illustrative data. Remember that past performance is not indicative of future results.

| Company | Average Annual Growth (Past 5 Years) | Highest Price (Past 5 Years) | Lowest Price (Past 5 Years) |

|---|---|---|---|

| Amazon | 15% (Illustrative Data) | $3773.08 (Illustrative Data) | $138.78 (Illustrative Data) |

| Walmart | 8% (Illustrative Data) | $160 (Illustrative Data) | $120 (Illustrative Data) |

| Microsoft | 12% (Illustrative Data) | $350 (Illustrative Data) | $200 (Illustrative Data) |

The differences in stock price performance between Amazon and its competitors stem from various factors, including market share, growth potential, and investor sentiment. Amazon’s significant presence in e-commerce and cloud computing, coupled with its consistent innovation, contributes to its higher growth rate compared to traditional retailers like Walmart. Microsoft’s strong position in software and cloud computing also contributes to its robust stock performance.

These comparisons highlight the diverse opportunities and risks within the technology sector, informing investment decisions based on individual risk tolerance and investment goals.

FAQ

What are the biggest risks associated with investing in Amazon stock?

Significant risks include dependence on consumer spending, intense competition, regulatory changes, and potential economic downturns. These factors can significantly impact Amazon’s profitability and, consequently, its stock price.

How does Amazon’s dividend policy affect its stock price?

Amazon historically has not paid a dividend, reinvesting profits back into the company for growth. This strategy appeals to investors focused on long-term capital appreciation, but it may not suit those seeking regular income from dividends.

Where can I find real-time Amazon stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.