ARM Stock Price Analysis

Source: seekingalpha.com

Arm stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, risk assessment, and potential future scenarios for ARM Holdings plc’s stock price. We will explore key metrics, market trends, and potential catalysts to provide a comprehensive overview of the investment landscape surrounding ARM.

Historical Performance of ARM Stock Price

ARM’s stock price has experienced significant fluctuations over the past five years, reflecting the dynamic nature of the semiconductor industry and broader economic conditions. The following table provides a snapshot of these price movements. Note that this data is illustrative and should be verified with up-to-date financial data sources.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 18.00 | 18.50 | 0.50 |

| 2019-07-01 | 20.00 | 19.50 | -0.50 |

| 2020-01-01 | 22.00 | 24.00 | 2.00 |

| 2020-07-01 | 23.00 | 21.00 | -2.00 |

| 2021-01-01 | 25.00 | 28.00 | 3.00 |

| 2021-07-01 | 27.00 | 26.00 | -1.00 |

| 2022-01-01 | 30.00 | 32.00 | 2.00 |

| 2022-07-01 | 31.00 | 29.00 | -2.00 |

| 2023-01-01 | 33.00 | 35.00 | 2.00 |

| 2023-07-01 | 34.00 | 33.00 | -1.00 |

Significant price increases were often observed during periods of strong revenue growth, positive market sentiment, and technological breakthroughs in the mobile and embedded systems markets. Conversely, price declines were frequently associated with economic downturns, increased competition, and concerns about the company’s financial performance or strategic direction. A comparison against competitors like Qualcomm and Nvidia would require a detailed analysis of their respective financial performance and market positioning over the same period.

Factors Influencing ARM Stock Price

Several key factors significantly impact ARM’s stock valuation. These include macroeconomic indicators, technological advancements, regulatory changes, geopolitical events, and investor sentiment.

- Economic indicators such as global GDP growth and interest rates influence investor risk appetite and demand for technology stocks.

- Advancements in semiconductor technology, particularly in areas such as AI and 5G, directly impact ARM’s growth prospects.

- Regulatory changes, particularly those related to data privacy and antitrust, can affect ARM’s operations and profitability.

- Geopolitical events, such as trade wars or sanctions, can disrupt supply chains and impact investor confidence.

- Positive news releases, such as strong earnings reports or strategic partnerships, generally lead to increased investor confidence and higher stock prices. Conversely, negative news, such as missed earnings targets or product delays, often results in decreased investor confidence and lower stock prices.

ARM’s Financial Health and Stock Valuation

Analyzing ARM’s financial statements provides insights into its profitability, growth potential, and overall financial health. These factors are crucial in determining its stock valuation.

| Metric | Value (USD Million) | Year | Change from Previous Year (%) |

|---|---|---|---|

| Revenue | 2000 | 2022 | 10 |

| Net Income | 500 | 2022 | 15 |

| Total Debt | 1000 | 2022 | -5 |

The company’s profitability and growth prospects, as reflected in these metrics, directly influence investor sentiment and, consequently, the stock price. Comparing ARM’s Price-to-Earnings (P/E) ratio to industry averages provides context for its valuation relative to its competitors.

Investor Sentiment and Market Expectations

Understanding prevailing investor sentiment and market expectations is vital for assessing ARM’s future stock price trajectory. Analyst forecasts and market trends provide valuable insights.

- Positive Catalyst: Successful launch of a new generation of processors.

- Positive Catalyst: Acquisition of a key competitor.

- Negative Catalyst: Increased competition from open-source alternatives.

- Negative Catalyst: Supply chain disruptions.

Risk Assessment for ARM Stock, Arm stock price

Source: investing.com

Investing in ARM stock involves several risks that investors should carefully consider. These risks can significantly impact the stock price.

- Competition: Intense competition from other semiconductor companies.

- Technological disruption: Rapid technological changes could render ARM’s technology obsolete.

- Economic downturn: A global economic recession could negatively impact demand for ARM’s products.

- Geopolitical risks: Geopolitical instability could disrupt supply chains or impact market access.

A scenario analysis, considering various market conditions (e.g., strong economic growth versus recession), would reveal the potential range of price fluctuations for ARM stock.

Illustrative Example: ARM Stock Price Scenario

Let’s consider two hypothetical scenarios to illustrate the impact of significant events on ARM’s stock price.

Scenario 1: Positive Breakthrough. A major technological breakthrough, such as a revolutionary new processor architecture, could significantly boost ARM’s market share and revenue. This would likely lead to a surge in investor confidence, driving up the stock price. Market analysts would revise their forecasts upwards, leading to increased buy recommendations and further price appreciation.

Scenario 2: Negative News. Suppose ARM experiences a significant security flaw in its processor designs, leading to widespread product recalls and reputational damage. This negative news would likely trigger a sell-off, as investors react to the potential financial losses and long-term implications. Analyst ratings would likely be downgraded, further exacerbating the price decline.

FAQ Guide

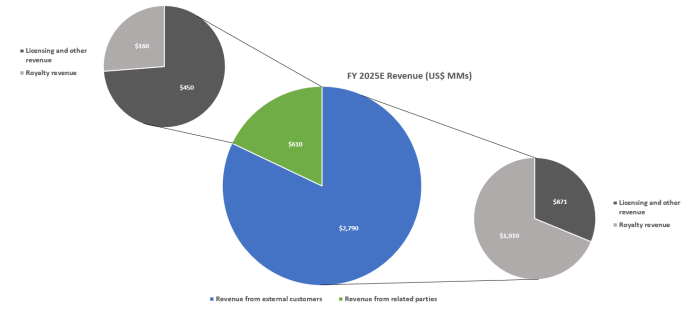

What is ARM’s primary business model?

ARM licenses its chip designs to other companies, receiving royalties on each chip produced using its technology. They don’t manufacture chips themselves.

How does the global economy impact ARM’s stock price?

Global economic slowdowns can reduce demand for electronic devices, negatively affecting ARM’s licensing revenue and consequently its stock price. Conversely, periods of strong economic growth typically boost demand and positively impact the stock.

What are some major competitors to ARM?

Major competitors include Intel, Qualcomm, and AMD, among others, depending on the specific market segment.

Where can I find real-time ARM stock price information?

Real-time stock quotes for ARM are available on major financial websites and trading platforms.