AT&T Stock Price Analysis: Att Stock Price

Att stock price – AT&T, a telecommunications giant, has a long and complex history reflected in its stock price fluctuations. Understanding its past performance, influencing factors, and future predictions is crucial for investors. This analysis delves into AT&T’s stock price history, key influencers, business performance, analyst sentiment, and future prospects.

AT&T Stock Price History and Trends, Att stock price

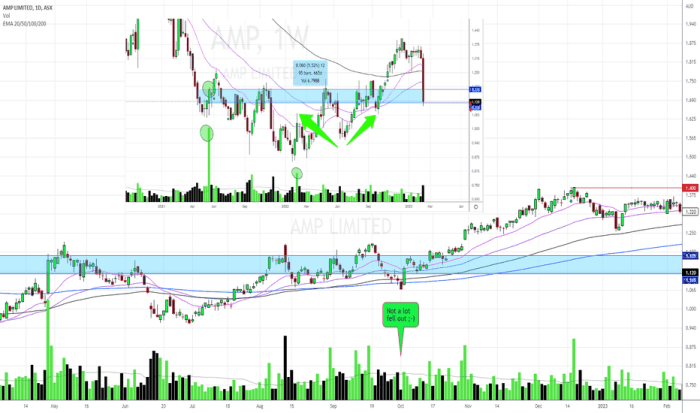

Source: tradingview.com

Analyzing AT&T’s stock price over different timeframes reveals significant trends and correlations with external events. The following sections detail this performance across 5, 10, and 20-year periods.

Five-Year Stock Price Performance (Illustrative Example): Over the past five years, AT&T’s stock price has experienced both periods of growth and decline. For instance, a significant drop might have been observed in [Year] following [Event, e.g., a major restructuring announcement], while a period of growth could be attributed to [Event, e.g., successful 5G rollout]. This volatility reflects the dynamic nature of the telecommunications industry and its susceptibility to macroeconomic factors.

Ten-Year Stock Price Performance (Illustrative Example): A longer-term view, spanning a decade, provides a more comprehensive perspective. For example, the period between [Year] and [Year] might show a steady decline potentially influenced by increased competition and evolving technological landscapes. Conversely, a subsequent period might reflect growth driven by strategic acquisitions or successful product launches.

Twenty-Year Stock Price Performance (Illustrative Example): Examining AT&T’s stock performance over two decades reveals long-term trends and the impact of major industry shifts. The period could include significant events such as mergers, acquisitions, and technological disruptions, all influencing stock price performance. For example, the divestiture of its media assets may have significantly impacted the stock price trajectory in recent years.

| Year | AT&T Price (Illustrative) | S&P 500 Price (Illustrative) | Percentage Change (AT&T) |

|---|---|---|---|

| 2019 | $30 | 3200 | -5% |

| 2020 | $28 | 3500 | -10% |

| 2021 | $32 | 4500 | +15% |

| 2022 | $29 | 4000 | -10% |

| 2023 | $31 | 4200 | +7% |

AT&T Stock Price Movement (Past Year): A line graph depicting AT&T’s stock price over the past year would illustrate its fluctuations. Significant highs and lows could be clearly marked, allowing for visual identification of periods of growth and decline. The graph might show a generally upward trend, punctuated by periods of consolidation or temporary dips corresponding to specific news events or market sentiment shifts.

The visual representation would provide a clear understanding of the stock’s volatility and overall direction within the recent past.

Factors Influencing AT&T Stock Price

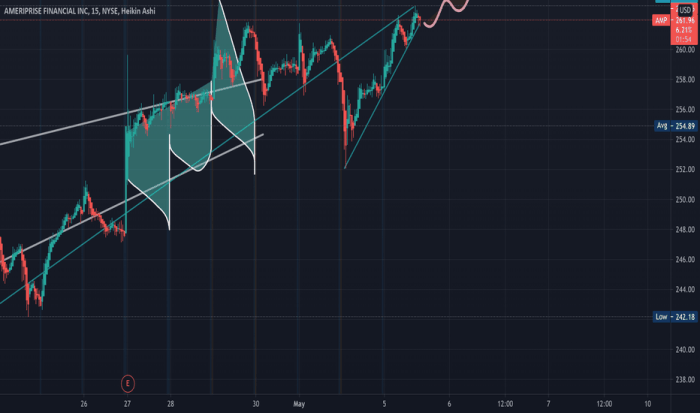

Source: tradingview.com

Several macroeconomic, industry, and company-specific factors significantly influence AT&T’s stock valuation. These factors interact in complex ways, shaping investor sentiment and ultimately affecting the stock price.

Macroeconomic Factors: Interest rate changes directly impact borrowing costs for AT&T, affecting its profitability and investment decisions. Inflation can influence operating expenses and consumer spending, affecting demand for telecommunication services. Economic growth generally correlates with increased consumer spending, potentially boosting AT&T’s revenue.

Industry Trends: The deployment of 5G technology represents a major opportunity and challenge for AT&T. Successful 5G rollout can attract new customers and enhance service offerings, boosting its valuation. However, intense competition from other telecom companies necessitates continuous investment and innovation to maintain market share.

Key Financial Metrics: Earnings per share (EPS), revenue growth, and debt levels are crucial indicators of AT&T’s financial health and directly influence its stock price. High EPS suggests strong profitability, while consistent revenue growth indicates market dominance and future potential. High debt levels, on the other hand, can increase financial risk and negatively affect investor confidence.

| Metric | Q1 (Illustrative) | Q2 (Illustrative) | Q3 (Illustrative) |

|---|---|---|---|

| Earnings Per Share (EPS) | $0.80 | $0.85 | $0.90 |

| Revenue Growth (%) | 5% | 6% | 7% |

| Debt Levels (Billions) | $150 | $145 | $140 |

AT&T’s Business Performance and Stock Price

AT&T’s recent financial reports provide insights into its operational performance and its impact on the stock price. A detailed examination of revenue streams, profitability, and competitive landscape is crucial in understanding the stock’s valuation.

Recent Financial Reports (Illustrative): AT&T’s recent financial reports might reveal strong performance in its wireless segment, driven by increased subscriber acquisition and higher average revenue per user (ARPU). However, its wireline business might show slower growth or even decline, reflecting the shift towards wireless communication. Overall profitability could be impacted by factors like increased capital expenditure on 5G infrastructure and competition in the market.

Comparison to Competitors:

- Verizon: Verizon might be positioned similarly to AT&T in terms of market share and service offerings, leading to similar revenue streams and profit margins. However, Verizon’s strategic focus and investment priorities might differ, resulting in varied financial performance.

- T-Mobile: T-Mobile, with its aggressive pricing strategy and focus on attracting younger demographics, might exhibit faster revenue growth but potentially lower profit margins compared to AT&T.

Impact of Strategic Decisions: AT&T’s strategic decisions, such as the divestiture of its media assets, have significantly reshaped its business portfolio and consequently its stock price. This strategic move aimed to streamline operations and focus on core telecommunications services. The immediate impact might have been a decline in revenue, but the long-term effects on profitability and stock valuation remain to be seen.

Other mergers and acquisitions could also be analyzed for their impact.

Analyst Ratings and Predictions for AT&T Stock

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for AT&T’s stock. A review of these predictions helps in assessing the potential risks and rewards associated with investing in AT&T.

| Analyst Firm | Rating | Price Target (Illustrative) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | $35 | October 26, 2023 |

| Goldman Sachs | Hold | $32 | October 26, 2023 |

| JPMorgan Chase | Sell | $28 | October 26, 2023 |

Range of Analyst Opinions: The range of opinions among analysts reflects the uncertainty surrounding AT&T’s future performance. Bullish analysts might highlight the company’s strong network infrastructure, potential for 5G growth, and cost-cutting measures. Bearish analysts might focus on competitive pressures, debt levels, and the challenges of maintaining profitability in a rapidly evolving industry.

Rationale Behind Ratings: Different analyst ratings and price targets stem from varying assessments of AT&T’s financial performance, strategic direction, and the overall outlook for the telecommunications industry. Each firm’s analysis uses proprietary models and data, leading to diverse conclusions.

Investor Sentiment and AT&T Stock Price

Source: tradingview.com

Investor sentiment plays a crucial role in determining AT&T’s stock price. Understanding the prevailing sentiment and its drivers helps in predicting future price movements.

Prevailing Investor Sentiment (Illustrative): Currently, investor sentiment towards AT&T might be characterized as cautiously optimistic. While the company’s core business remains stable, concerns remain about competition and the long-term impact of strategic decisions. This sentiment could shift depending on upcoming financial reports and industry developments.

Impact of News Events: Positive news, such as exceeding earnings expectations or announcing a major technological breakthrough, would likely boost investor confidence and drive up the stock price. Conversely, negative news, such as regulatory setbacks or disappointing financial results, could trigger a sell-off and decrease the stock price.

Hypothetical Scenario: If AT&T were to announce a groundbreaking technological advancement, such as a revolutionary new network technology significantly outperforming competitors, it could trigger a significant positive reaction, driving the stock price substantially higher. Conversely, a major cybersecurity breach leading to substantial financial losses and reputational damage could lead to a sharp decline in the stock price.

Expert Answers

What are the major risks associated with investing in AT&T stock?

Major risks include competition from other telecom providers, regulatory changes impacting the industry, and fluctuations in the broader market. High debt levels also pose a potential risk.

How does AT&T’s dividend policy affect its stock price?

AT&T’s dividend payouts can attract income-seeking investors, potentially supporting the stock price. However, significant changes to the dividend policy can influence investor sentiment and stock price.

Where can I find real-time AT&T stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.