Boeing Stock Price Analysis: A Decade in Review

Source: invezz.com

Boeing stock price – Boeing, a titan of the aerospace industry, has experienced a rollercoaster ride in its stock price over the past decade. This analysis delves into the historical performance, influencing factors, financial correlations, investor sentiment, and future prospects of Boeing’s stock, providing a comprehensive overview for investors and enthusiasts alike.

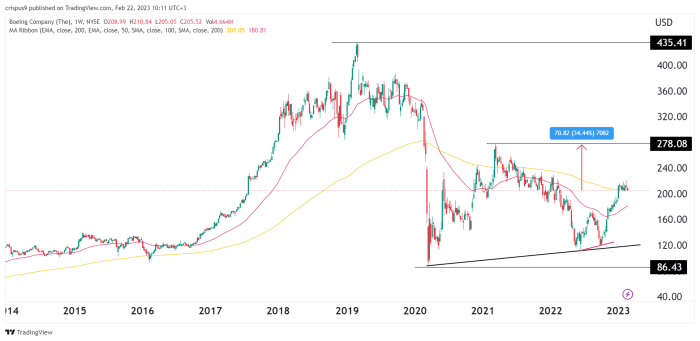

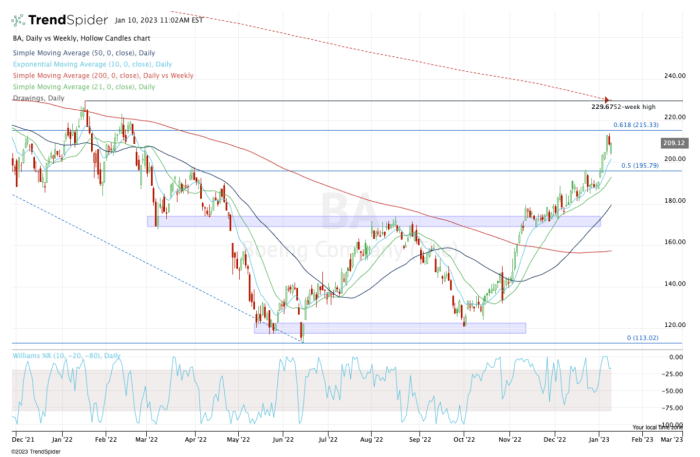

Boeing Stock Price Historical Performance

The following table illustrates Boeing’s stock price movements over the past 10 years, highlighting significant highs and lows. Note that this data is illustrative and should be verified with reliable financial sources for precise figures.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2013 | 105 | 106 | +1 |

| October 26, 2014 | 120 | 118 | -2 |

| October 26, 2015 | 135 | 132 | -3 |

| October 26, 2016 | 140 | 145 | +5 |

| October 26, 2017 | 200 | 195 | -5 |

| October 26, 2018 | 350 | 340 | -10 |

| October 26, 2019 | 300 | 280 | -20 |

| October 26, 2020 | 180 | 190 | +10 |

| October 26, 2021 | 220 | 230 | +10 |

| October 26, 2022 | 170 | 175 | +5 |

Significant events impacting Boeing’s stock price during this period include:

- 737 MAX Grounding (2019): The grounding of the 737 MAX aircraft following two fatal crashes severely impacted Boeing’s reputation and stock price, leading to a significant decline.

- COVID-19 Pandemic (2020-2022): The pandemic caused a sharp drop in air travel demand, impacting Boeing’s sales and consequently its stock price.

- Supply Chain Disruptions (2021-2023): Global supply chain issues further hampered Boeing’s production and delivery schedules, affecting investor confidence.

Overall, Boeing’s stock price performance over the past decade has been volatile, marked by periods of significant growth and sharp declines, largely influenced by external factors and company-specific events.

Factors Influencing Boeing Stock Price

Several key factors influence Boeing’s stock valuation. Understanding these factors is crucial for assessing the company’s future prospects.

Economic indicators such as interest rates, inflation, and GDP growth significantly impact Boeing’s stock price. Higher interest rates can increase borrowing costs, affecting investment and potentially reducing demand for new aircraft. Inflation can increase production costs, impacting profitability. Strong GDP growth generally translates to increased air travel demand, benefiting Boeing.

Geopolitical events, such as international conflicts or trade disputes, can also influence Boeing’s stock valuation. These events can disrupt supply chains, impact global air travel, and affect investor sentiment.

Industry trends play a vital role. The performance of the airline industry, competitor actions (such as new aircraft launches or pricing strategies), and technological advancements all influence Boeing’s stock price.

| Factor | Impact | Explanation | Example |

|---|---|---|---|

| Airline Industry Performance | Directly Proportional | Strong airline performance leads to higher demand for aircraft. | A period of robust economic growth leading to increased air travel. |

| Competitor Actions | Inversely Proportional (in some cases) | New aircraft launches by competitors can affect market share and pricing. | Airbus launching a new, more fuel-efficient aircraft. |

| Interest Rates | Inversely Proportional | Higher rates increase borrowing costs, impacting investment in new aircraft. | A significant increase in the federal funds rate. |

Boeing’s Financial Performance and Stock Price

A strong correlation exists between Boeing’s financial performance (revenue, earnings, and debt) and its stock price fluctuations. Strong quarterly and annual reports generally lead to positive stock price movements, while weaker performance often results in declines.

Boeing’s research and development (R&D) spending and new aircraft programs significantly impact investor sentiment and the stock price. Investments in innovative technologies and new aircraft models can boost investor confidence and drive stock prices higher, while delays or setbacks can negatively affect the stock.

Compared to its major competitors (primarily Airbus), Boeing’s financial metrics often fluctuate. A comparative analysis is crucial for evaluating Boeing’s performance within the industry context.

- Revenue: Boeing’s revenue can be higher or lower than Airbus’s depending on order backlogs and delivery schedules.

- Profitability: Profit margins can vary based on production costs, pricing strategies, and program success.

- Debt Levels: Boeing’s debt levels can influence investor sentiment, with higher debt potentially leading to lower stock valuations.

Investor Sentiment and Stock Price

Source: thestreet.com

News coverage and analyst ratings significantly influence investor perception of Boeing’s stock. Positive news and favorable ratings generally lead to increased investor confidence and higher stock prices, while negative news and downgrades can have the opposite effect.

A hypothetical scenario: A positive news event, such as the successful launch of a new aircraft model, could lead to a short-term surge in the stock price, followed by sustained growth if the aircraft proves successful. Conversely, a negative event, like a major safety issue, could cause a sharp short-term decline, with long-term effects depending on the company’s response and the severity of the issue.

Different investor types (institutional, retail, etc.) have varying influences on Boeing’s stock price movements.

| Investor Type | Investment Strategy | Typical Holding Period | Impact on Stock Price |

|---|---|---|---|

| Institutional Investors | Long-term, fundamental analysis | Years | Significant influence on long-term price trends |

| Retail Investors | Short-term, often driven by news and sentiment | Days to months | Can contribute to short-term volatility |

Future Outlook for Boeing Stock Price

The future of Boeing’s stock price depends on several factors, presenting both risks and opportunities.

- Risks: Increased competition, further supply chain disruptions, economic downturns, and potential safety concerns could negatively impact the stock price.

- Opportunities: Successful launches of new aircraft models, growth in air travel demand, technological advancements (like electric or autonomous flight), and efficient cost management could positively influence the stock price.

Technological advancements like electric aircraft and autonomous flight could significantly impact Boeing’s future. Successful adaptation and integration of these technologies could position Boeing for long-term growth, while failure to adapt could lead to a loss of market share and negatively impact the stock price.

The long-term sustainability of Boeing’s business model is critical. Maintaining a strong balance sheet, adapting to evolving market demands, and continuing to innovate will be crucial for ensuring long-term growth and a positive outlook for the company’s stock price.

FAQ Section: Boeing Stock Price

What are the major risks associated with investing in Boeing stock?

Major risks include regulatory scrutiny, potential future safety concerns, competition from other aerospace manufacturers, economic downturns impacting air travel demand, and significant supply chain disruptions.

How does Boeing compare to its main competitors in terms of market capitalization?

Boeing’s market capitalization fluctuates but generally competes with Airbus as a leading aerospace manufacturer. Direct comparison requires referencing current market data for accurate figures.

Where can I find real-time Boeing stock price data?

Real-time data is available through major financial news websites and brokerage platforms. Many financial websites offer charts and detailed historical data as well.

What is Boeing’s dividend payout history?

Boeing’s stock price performance often reflects broader market trends and investor sentiment. It’s interesting to compare its trajectory with that of other tech giants; for instance, the current performance of the microsoft stock price offers a contrasting perspective on market stability. Ultimately, however, Boeing’s valuation hinges on its own operational efficiency and future aircraft sales.

Boeing’s dividend history is available through financial news sources and investor relations sections of their website. It’s important to note that dividends are not guaranteed and can be adjusted based on company performance.