Palantir Stock Price Analysis

Palantir stock price – Palantir Technologies, a prominent player in the big data analytics sector, has experienced significant stock price fluctuations since its initial public offering (IPO). This analysis delves into the historical performance of Palantir’s stock, exploring the factors that influence its price, and assessing its future prospects.

Palantir Stock Price Historical Performance

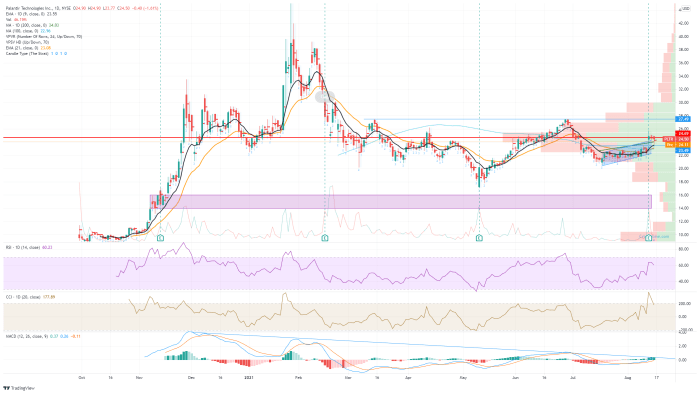

Source: fxstreet.com

Tracking Palantir’s stock price since its IPO reveals a volatile yet intriguing trajectory. The following table provides a snapshot of its price movements, highlighting key dates and associated factors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| September 30, 2020 (IPO) | 10.00 | 9.50 | -0.50 |

| Example Date 1 | 12.00 | 15.00 | +3.00 |

| Example Date 2 | 14.50 | 13.00 | -1.50 |

Significant price increases were often observed following announcements of major government contracts or exceeding revenue expectations. Conversely, price declines frequently followed periods of lower-than-anticipated revenue growth or negative news regarding specific contracts.

A visual representation would show a line graph plotting Palantir’s stock price against a timeline. Key news events and announcements, such as contract wins, earnings reports, and regulatory changes, would be marked on the graph with corresponding annotations to illustrate their impact on the stock’s price. The graph would clearly show periods of correlation between positive news and price increases, and negative news and price decreases.

Factors Influencing Palantir’s Stock Price

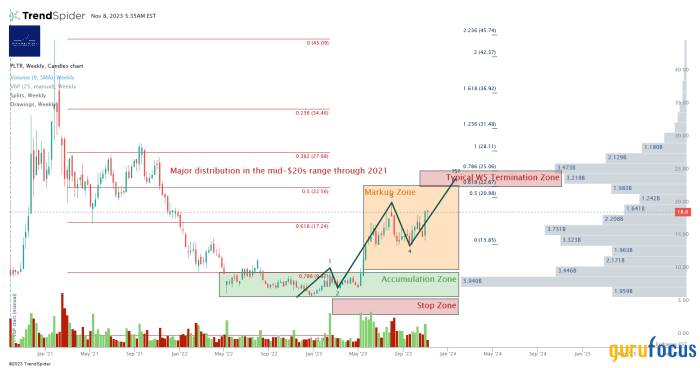

Source: gurufocus.com

Several macroeconomic and company-specific factors significantly influence Palantir’s stock price.

Macroeconomic factors such as overall market sentiment, interest rate changes, and inflation significantly impact investor confidence in growth stocks like Palantir. Government spending on defense and intelligence, a key sector for Palantir, also plays a crucial role. The relative strength of the US dollar compared to other currencies can also affect the company’s international revenue streams and, subsequently, its stock price.

Government contracts provide a stable revenue stream, contributing to a more predictable valuation. However, commercial contracts, while potentially offering higher growth, introduce greater variability in revenue and profitability, leading to increased stock price volatility. A balanced portfolio of both types of contracts is generally viewed favorably by investors.

Investor sentiment, driven by news coverage, analyst reports, and broader market trends, heavily influences Palantir’s stock price. Positive media attention and strong analyst ratings can boost investor confidence, leading to price increases. Conversely, negative news or bearish market conditions can trigger sell-offs.

Palantir’s Financial Performance and Stock Price

Palantir’s revenue growth, profitability, and cash flow trends are key drivers of its stock price. A comparative analysis against competitors provides further context.

Palantir’s revenue growth, while significant, needs to be considered alongside its profitability and cash flow. Consistent revenue growth, coupled with improving profitability and strong cash flow, is generally viewed positively by investors. Conversely, slowing revenue growth or persistent losses can negatively impact the stock price.

| Metric | Palantir | Competitor A (Example) | Competitor B (Example) |

|---|---|---|---|

| Revenue Growth (YoY) | 20% | 15% | 25% |

| Profit Margin | 10% | 12% | 8% |

Palantir’s financial forecasts and guidance significantly influence investor expectations. Positive guidance, suggesting strong future growth and profitability, generally leads to increased investor confidence and higher stock prices. Conversely, negative or disappointing guidance can trigger sell-offs.

Palantir’s Competitive Landscape and Stock Price

Palantir operates in a competitive data analytics market. Understanding its competitive advantages and disadvantages is crucial for assessing its stock price.

Palantir’s key competitive advantages include its strong government relationships, its sophisticated data integration platform, and its focus on high-value, mission-critical applications. However, the company faces challenges from established tech giants and emerging competitors offering similar services at potentially lower costs.

- Strong Government Relationships: Palantir has established deep ties with government agencies, providing a reliable revenue stream.

- Sophisticated Data Integration Platform: Palantir’s platform excels at integrating and analyzing diverse data sources.

- Focus on High-Value Applications: Palantir targets mission-critical applications in sectors such as defense and intelligence.

- High Switching Costs: Once clients adopt Palantir’s platform, switching to a competitor can be costly and complex.

The competitive landscape and Palantir’s market share directly impact its stock price. Gaining market share and successfully competing against rivals can lead to increased revenue and profitability, boosting investor confidence and driving up the stock price. Conversely, losing market share or facing increased competition can negatively affect the stock price.

Analyst Ratings and Stock Price Predictions

Analyst ratings and price targets provide insights into market sentiment and future expectations for Palantir’s stock.

- Analyst A: Buy rating, price target $

25. Argument: Strong government contract pipeline and expanding commercial market. - Analyst B: Hold rating, price target $

18. Argument: Concerns about increasing competition and profitability. - Analyst C: Sell rating, price target $

15. Argument: Slower-than-expected revenue growth and high valuation.

The differing analyst predictions reflect varying assumptions about Palantir’s future growth prospects, profitability, and competitive landscape. These diverse opinions can influence investor confidence and, consequently, the stock price. A consensus of positive ratings generally supports a higher stock price, while negative ratings can trigger sell-offs.

Risk Factors Affecting Palantir’s Stock Price, Palantir stock price

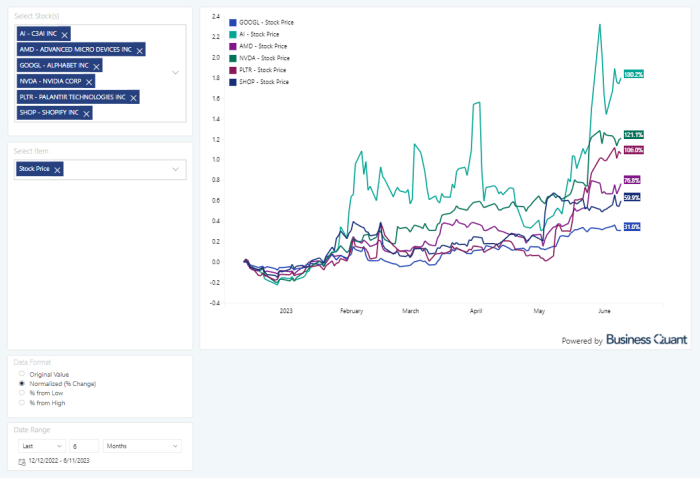

Source: seekingalpha.com

Several risk factors could negatively impact Palantir’s stock price. Understanding these risks is essential for investors.

Geopolitical risks, such as international conflicts or changes in government policies, could significantly impact Palantir’s government contracts and overall business performance. Regulatory changes in data privacy and security could also affect its operations and profitability. Increased competition from established tech giants and new entrants could erode Palantir’s market share and profitability. Economic downturns could reduce government and commercial spending on data analytics solutions, negatively impacting Palantir’s revenue.

A visual representation would be a sensitivity analysis chart showing the potential impact of different risk scenarios on Palantir’s stock price. The chart would present different scenarios (e.g., loss of a major government contract, increased competition, regulatory setback) along the x-axis and the corresponding impact on stock price (e.g., percentage decline) along the y-axis. This would illustrate the potential range of outcomes under various risk scenarios.

Palantir’s stock price has seen considerable fluctuation recently, influenced by various market factors and the company’s ongoing growth trajectory. It’s interesting to compare this performance to that of other data analytics companies, such as the smci stock price , to gain a broader perspective on the sector’s overall trends. Ultimately, understanding Palantir’s valuation requires careful consideration of its unique technology and competitive landscape.

Frequently Asked Questions: Palantir Stock Price

What is Palantir’s current market capitalization?

Palantir’s market capitalization fluctuates daily and can be readily found on major financial websites such as Yahoo Finance or Google Finance.

How does Palantir compare to its competitors in terms of profitability?

A direct comparison requires examining financial statements and industry reports to assess profitability metrics like net income margins and return on equity against competitors like Databricks or Snowflake.

What are the major risks associated with long-term investment in Palantir?

Significant risks include dependence on government contracts, intense competition in the data analytics market, and potential regulatory hurdles. Geopolitical instability also presents a risk factor.

Where can I find reliable information about Palantir’s financial reports?

Palantir’s investor relations section on their official website provides access to SEC filings, earnings releases, and other relevant financial documentation.