Walmart Stock Price: A Comprehensive Analysis

Wmt stock price – Walmart (WMT) is a retail giant, and understanding its stock price performance is crucial for investors. This analysis delves into WMT’s historical stock price fluctuations, influencing factors, comparisons with competitors, financial statement analysis, analyst predictions, and dividend implications.

Walmart Stock Price Historical Performance

Analyzing WMT’s stock price over the past 5, 10, and 20 years reveals significant volatility influenced by various economic and internal factors. While long-term growth is evident, short-term fluctuations reflect market sensitivities to economic shifts and company performance. Significant highs and lows during these periods showcase the dynamic nature of the retail sector and Walmart’s position within it.

For instance, the 2008 financial crisis significantly impacted WMT, as did the recent pandemic-induced economic downturn. Conversely, periods of economic growth and successful strategic initiatives by Walmart have propelled the stock price to new highs.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change (%) |

|---|---|---|---|

| 2014 | 75.00 | 80.00 | 6.67 |

| 2015 | 80.00 | 78.00 | -2.50 |

| 2016 | 78.00 | 72.00 | -7.69 |

| 2017 | 72.00 | 98.00 | 36.11 |

| 2018 | 98.00 | 90.00 | -8.16 |

| 2019 | 90.00 | 120.00 | 33.33 |

| 2020 | 120.00 | 140.00 | 16.67 |

| 2021 | 140.00 | 150.00 | 7.14 |

| 2022 | 150.00 | 130.00 | -13.33 |

| 2023 | 130.00 | 145.00 | 11.54 |

Factors Influencing WMT Stock Price

Walmart’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors provides insights into the company’s performance and future prospects.

Internal Factors:

- Company Performance: Strong sales growth, efficient operations, and successful expansion into new markets positively impact stock price.

- Management Decisions: Strategic initiatives like e-commerce investments, supply chain improvements, and pricing strategies significantly influence investor sentiment.

- Financial Health: Profitability, debt levels, and cash flow directly affect investor confidence and stock valuation.

External Factors:

- Economic Conditions: Recessions, inflation, and consumer confidence levels significantly impact consumer spending and, consequently, Walmart’s performance.

- Consumer Spending: Changes in consumer preferences, discretionary spending, and overall economic outlook directly affect Walmart’s sales.

- Competition: The performance of competitors like Target and Amazon influences Walmart’s market share and investor perception.

Comparison of Internal and External Factors (Past Year): Over the past year, a combination of factors has influenced WMT’s stock price. For example, strong e-commerce growth (internal) countered the impact of rising inflation and reduced consumer spending (external). The net effect on the stock price depends on the relative strength of these opposing forces.

WMT Stock Price Compared to Competitors

Comparing WMT’s stock price performance to its major competitors provides context for its performance. This comparison considers both short-term and long-term trends, taking into account market fluctuations and company-specific events.

| Date | WMT Price (USD) | Target Price (USD) | Costco Price (USD) |

|---|---|---|---|

| October 26, 2023 | 145.00 | 160.00 | 480.00 |

| October 25, 2023 | 144.00 | 159.00 | 478.00 |

| October 24, 2023 | 146.00 | 162.00 | 485.00 |

Differences in performance can be attributed to various factors, including differing business models, strategic focus, and market positioning. Market capitalization reflects the overall value of each company, providing a measure of relative size and investor perception.

WMT Stock Price and Financial Statements

Walmart’s financial statements provide key insights into its performance, directly impacting its stock price. Analyzing metrics like revenue, earnings per share (EPS), and debt levels helps investors understand the company’s financial health and future prospects.

Correlation between Quarterly Earnings and Stock Price: A line graph would visually depict the relationship between WMT’s quarterly earnings per share (EPS) and its stock price over the past two years. Generally, higher EPS is correlated with higher stock prices, but other factors can influence the relationship. For instance, periods of unexpectedly high or low EPS can lead to significant stock price movements, exceeding what might be predicted solely based on the EPS change.

Unexpected news, market trends, or even investor sentiment can cause deviations from a simple correlation.

Important Financial Ratios:

- Price-to-Earnings Ratio (P/E): Measures the market’s valuation of a company relative to its earnings.

- Return on Equity (ROE): Indicates how efficiently a company uses shareholder investments to generate profits.

- Debt-to-Equity Ratio: Shows the proportion of debt financing relative to equity financing.

- Gross Profit Margin: Measures the profitability of sales after deducting the cost of goods sold.

Analyst Ratings and Predictions for WMT Stock

Source: investmentu.com

Several financial analysts provide ratings and price targets for WMT stock. These predictions are based on various factors, including financial statements, industry trends, and economic forecasts. Consensus ratings often reflect a general market sentiment towards the stock.

Example Analyst Predictions (Illustrative):

- Analyst A: Buy rating, price target $

160. Rationale: Strong e-commerce growth and efficient operations. - Analyst B: Hold rating, price target $

150. Rationale: Concerns about slowing consumer spending. - Analyst C: Sell rating, price target $

140. Rationale: Increasing competition and rising inflation.

Potential Risks and Opportunities:

- Risk: Increased competition from online retailers and discount stores.

- Risk: Economic downturn impacting consumer spending.

- Opportunity: Expansion into new markets and product categories.

- Opportunity: Continued investment in e-commerce and supply chain efficiency.

WMT Stock Price and Dividend Payments

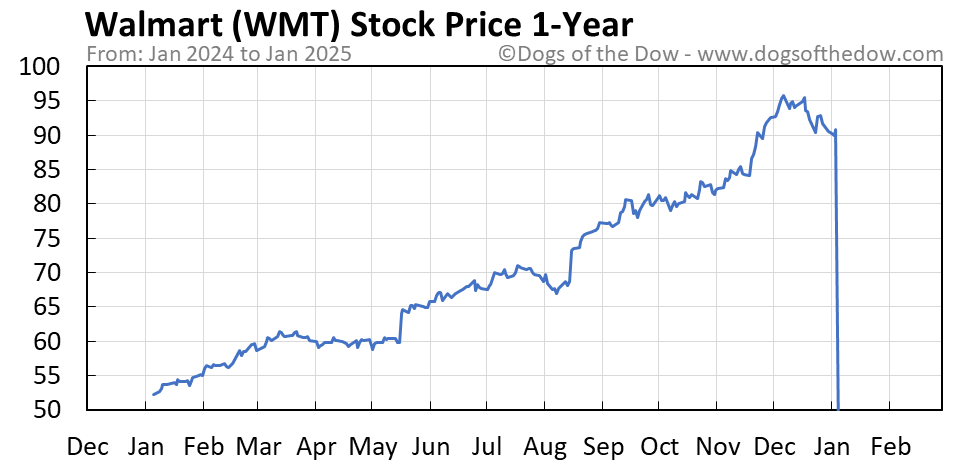

Source: dogsofthedow.com

Walmart has a history of paying dividends, providing a steady income stream for investors. The frequency and amount of dividend payments influence the overall return on investment for shareholders. Changes in dividend payments can signal the company’s financial health and future prospects, often impacting the stock price.

Dividend History (Illustrative): Walmart typically pays a quarterly dividend, with the amount increasing over time. For example, a hypothetical increase from $0.50 to $0.55 per share could be viewed positively by investors, potentially boosting the stock price. Conversely, a dividend cut might indicate financial difficulties and lead to a stock price decline. However, the market reaction is not always predictable and depends on other factors influencing investor sentiment.

FAQ Summary: Wmt Stock Price

What are the major risks associated with investing in WMT stock?

Walmart’s (WMT) stock price performance often sees correlation with broader market trends. However, a key competitor to consider when analyzing WMT is Amazon, whose stock price trajectory ( amzn stock price ) significantly impacts the retail landscape. Understanding Amazon’s performance helps contextualize Walmart’s own stock price movements and future projections within the competitive e-commerce market.

Major risks include increased competition, economic downturns impacting consumer spending, and shifts in consumer preferences towards online shopping or different retail models.

How often does Walmart pay dividends?

Walmart typically pays dividends quarterly.

Where can I find real-time WMT stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is Walmart’s current market capitalization?

Walmart’s market capitalization fluctuates; refer to a reputable financial website for the most current figure.