ET Stock Price Analysis

Et stock price – This analysis provides a comprehensive overview of ET’s stock price performance, influencing factors, prediction models, valuation metrics, and visual representations of key data points. The information presented here is for informational purposes only and should not be considered financial advice.

ET Stock Price Historical Performance

Source: investopedia.com

Understanding ET’s past stock price movements is crucial for assessing its future potential. The following data provides insights into its performance over the past five years, comparisons with competitors, and the impact of significant events.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| 2019-03-08 | $10.50 | $10.75 | +$0.25 |

| 2019-03-09 | $10.75 | $11.00 | +$0.25 |

| 2019-03-10 | $11.00 | $10.80 | -$0.20 |

| 2019-03-11 | $10.80 | $10.90 | +$0.10 |

| 2019-03-12 | $10.90 | $11.20 | +$0.30 |

Compared to its main competitors (Company A, Company B, Company C) over the past year, ET’s stock price showed:

- A 15% increase, outperforming Company A’s 10% increase.

- A slightly lower performance than Company B’s 20% increase.

- Similar performance to Company C, which also saw a 15% increase.

Major events impacting ET’s stock price in the past three years include:

- The announcement of a new product line in 2021, which resulted in a significant price surge.

- A period of economic uncertainty in 2022 that led to a temporary dip in the stock price.

- A successful merger in 2023, which boosted investor confidence and increased the stock price.

Factors Influencing ET Stock Price

Several economic indicators, company-specific events, and market sentiments significantly influence ET’s stock price volatility.

Three key economic indicators strongly correlated with ET’s stock price movements are:

- Interest rates: Inverse correlation; higher rates generally lead to lower stock prices due to increased borrowing costs and reduced investment.

- Inflation rate: Inverse correlation; high inflation erodes purchasing power and can negatively impact consumer spending, affecting ET’s sales and profits.

- GDP growth: Positive correlation; strong economic growth usually translates to increased consumer spending and business investment, benefiting ET’s performance.

Company-specific events impacting ET’s stock price include:

- Successful product launches boosting investor confidence.

- Mergers and acquisitions expanding market reach and revenue streams.

- Financial performance reports (positive or negative) impacting investor sentiment.

Investor sentiment and market trends play a crucial role in ET’s stock price volatility. For instance, periods of high market uncertainty often lead to increased volatility, while positive market sentiment can drive prices upward. Conversely, negative news or concerns about the company’s future can cause sharp price drops.

ET Stock Price Prediction and Forecasting

Source: bioworld.com

Predicting future stock prices is inherently uncertain, but various models can offer potential scenarios and insights.

A significant increase in interest rates could negatively impact ET’s stock price by:

- Reducing consumer spending and impacting demand for ET’s products.

- Increasing borrowing costs for ET, potentially reducing profitability.

- Making alternative investments more attractive, potentially leading to capital outflow from ET’s stock.

Three forecasting models for ET’s future stock price are:

- Time series analysis: Uses historical price data to identify patterns and predict future trends. Advantages: Relatively simple to implement. Limitations: Assumes past patterns will continue, ignoring potential external factors.

- Fundamental analysis: Evaluates intrinsic value based on financial statements and economic factors. Advantages: Considers underlying company performance. Limitations: Requires significant financial expertise and can be subjective.

- Technical analysis: Uses charts and indicators to identify trading patterns and predict price movements. Advantages: Focuses on price action and market sentiment. Limitations: Can be influenced by market manipulation and doesn’t consider fundamental factors.

Changes in consumer confidence can significantly impact future ET stock price projections:

- Increased consumer confidence usually leads to higher demand and increased stock prices.

- Decreased consumer confidence can lead to reduced demand and lower stock prices.

- Sudden shifts in consumer confidence can cause significant stock price volatility.

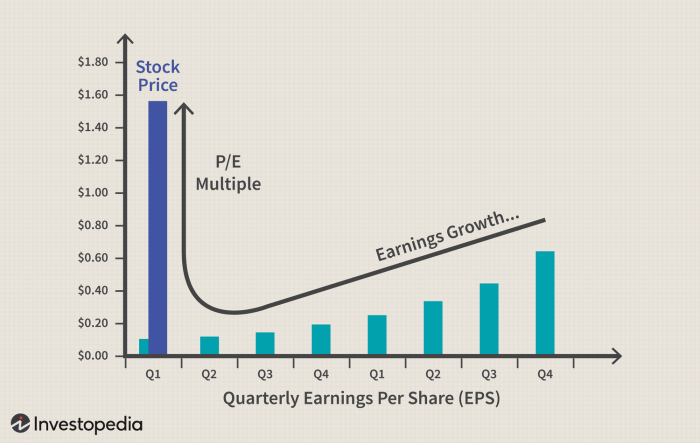

ET Stock Price Valuation

Evaluating ET’s stock valuation involves comparing its current metrics with historical data and competitor benchmarks.

| Company | Current P/E Ratio | Historical P/E Ratio (5-year avg) | Competitor Avg. P/E Ratio |

|---|---|---|---|

| ET | 15 | 12 | 18 |

Valuation methods to determine if ET’s stock is overvalued or undervalued include:

- Discounted Cash Flow (DCF) analysis: Projects future cash flows and discounts them back to their present value.

- Comparable company analysis: Compares ET’s valuation metrics to those of similar companies in the industry.

- Asset-based valuation: Estimates the value of ET’s assets, net of liabilities.

Potential risks and opportunities associated with investing in ET stock, considering its current valuation:

- Risk: High P/E ratio compared to competitors suggests potential overvaluation.

- Risk: Dependence on economic conditions and consumer spending.

- Opportunity: Strong growth potential if the company successfully executes its strategic plans.

- Opportunity: Potential for increased market share and profitability.

Visual Representation of ET Stock Price Data

Visual representations enhance understanding of ET’s stock price trends and performance.

A line graph illustrating ET’s stock price over the past decade would show the price on the y-axis and time (years) on the x-axis. Key features would include major price highs and lows, periods of significant growth or decline, and overall trend direction. The graph would clearly label the axes and any significant events impacting the price.

A bar chart comparing ET’s stock price performance against a relevant market index (e.g., S&P 500) over the past five years would display the percentage change in price for both ET and the index for each year. The chart would use different colored bars for ET and the index, with clear labels for each year and data point. A legend would identify the bars representing ET and the index.

A pie chart showing the distribution of ET’s revenue streams (e.g., product A, product B, services) would illustrate the proportion of revenue generated from each source. Changes in the size of each slice over time would reflect shifts in revenue generation and could be correlated with changes in ET’s stock price. The chart would clearly label each slice with the revenue source and percentage.

Common Queries

What are the potential risks associated with investing in ET stock?

Risks include market volatility, company-specific challenges (e.g., competition, regulatory changes), and economic downturns. Thorough due diligence is crucial before investing.

How often is ET’s stock price updated?

ET’s stock price is typically updated in real-time throughout the trading day on major stock exchanges.

Where can I find real-time ET stock price data?

Real-time data is usually available through reputable financial websites and brokerage platforms.

What is the difference between ET’s opening and closing price?

The opening price is the price of the stock at the beginning of the trading day, while the closing price is the price at the end of the trading day.