Roku’s Current Market Position and Financial Performance

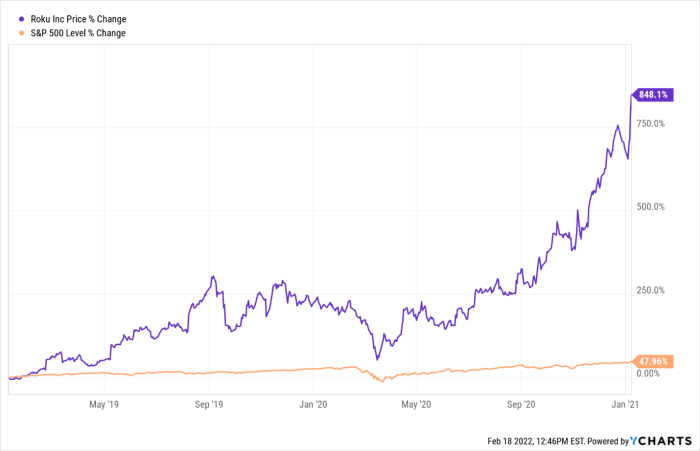

Roku stock price – Roku dominates the streaming device market, but its position is constantly evolving. Understanding its market share, financial health, and the factors influencing its stock price volatility is crucial for any investor.

Roku’s Market Share and Financial Performance

Source: investorplace.com

Roku holds a significant portion of the streaming device market, although precise figures fluctuate depending on the reporting source and metrics used. Competitors like Amazon (Fire TV) and Google (Chromecast) pose considerable challenges. Roku’s financial performance has shown periods of strong revenue growth, driven by its platform’s expanding user base and increasing engagement. However, profitability has been inconsistent, with periods of losses interspersed with periods of profit, largely influenced by significant investments in content and platform expansion.

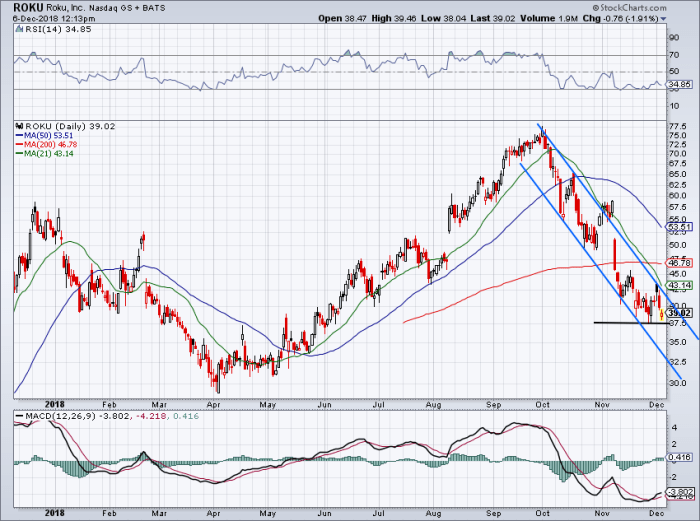

Stock price volatility is primarily driven by these fluctuating financial results, coupled with broader market sentiment towards the streaming industry and technology sector as a whole. Investor concerns regarding competition, advertising revenue fluctuations, and macroeconomic factors also contribute to price fluctuations.

Key Financial Metrics and Indicators

Analyzing Roku’s key financial metrics provides insight into its performance and future potential. Revenue growth, earnings per share (EPS), and the price-to-earnings ratio (P/E) are critical indicators. Comparing Roku’s performance to industry averages and competitors reveals its relative strength and weaknesses. User growth and average revenue per user (ARPU) are particularly important, as they directly reflect the platform’s engagement and monetization capabilities.

| Quarter | Total Net Revenue (USD Millions) | EPS (USD) | ARPU (USD) | Total Active Accounts (Millions) |

|---|---|---|---|---|

| Q1 2024 (Example) | 750 | -0.10 | 42.50 | 65 |

| Q4 2023 (Example) | 800 | 0.05 | 40.00 | 62 |

| Q3 2023 (Example) | 780 | -0.08 | 38.00 | 60 |

| Q2 2023 (Example) | 720 | -0.15 | 36.00 | 58 |

Note: The data presented in this table is for illustrative purposes only and does not represent actual Roku financial data. Actual figures should be obtained from official Roku financial reports.

Competitive Landscape and Future Outlook

Source: investorplace.com

The streaming device market is fiercely competitive. Amazon, Google, and Apple are major players, each employing different strategies. Emerging technologies, such as advancements in AI and improved streaming capabilities, will impact Roku’s future prospects. Increased competition, potential regulatory changes impacting data privacy and advertising practices, and the cyclical nature of consumer electronics spending present significant challenges for Roku.

Investment Considerations and Valuation

Several valuation methods, including discounted cash flow (DCF) analysis, can be used to assess Roku’s stock. Investors should consider factors such as revenue growth, profitability, market share, competitive landscape, and the potential impact of technological advancements. Comparing Roku’s valuation metrics to its competitors provides context for its current pricing.

- Roku: High growth potential, but also high volatility and uncertain profitability.

- Amazon Fire TV: Large market share, strong brand recognition, but lower growth potential than Roku.

- Google Chromecast: Widely adopted, but less focused on advertising revenue.

Roku’s Advertising Business

Roku’s advertising business is a key driver of revenue. It leverages its large user base and platform data to target ads effectively. The potential for growth in advertising revenue is significant, particularly as streaming viewership continues to increase. However, competition from other advertising platforms, including those offered by its competitors, presents a major challenge. Roku’s advertising model differs from traditional television advertising by utilizing targeted advertising and data-driven approaches, offering more granular control and measurability to advertisers.

Impact of Platform Changes and Partnerships, Roku stock price

Source: investorplace.com

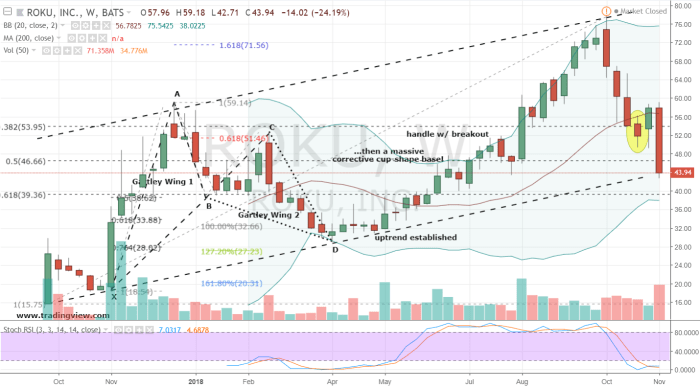

Roku’s platform changes and partnerships significantly impact its stock price. New features, content additions, and strategic alliances can attract users and boost revenue. Conversely, negative changes or failed partnerships can lead to stock price declines. For example, a major partnership with a significant content provider could lead to a surge in users and subsequently, a rise in the stock price, while a significant platform malfunction could trigger a sharp drop.

A line graph illustrating the relationship between a significant partnership (e.g., a new content deal) and subsequent stock price fluctuation would show an upward trend in the stock price following the announcement and implementation of the partnership. The x-axis would represent time, and the y-axis would represent Roku’s stock price. Key data points would include the date of the partnership announcement and the peak and trough of the stock price change following the announcement.

FAQ Compilation: Roku Stock Price

What are the major risks associated with investing in Roku stock?

Major risks include intense competition from established players and emerging startups, potential regulatory changes affecting the streaming industry, and dependence on advertising revenue which can be volatile.

How does Roku’s advertising business compare to competitors like Google and Amazon?

Roku’s advertising business is smaller than Google’s and Amazon’s, but it benefits from its direct access to a large and engaged streaming audience. Its growth potential hinges on its ability to increase ad inventory and improve targeting capabilities.

What is Roku’s long-term growth strategy?

Roku’s stock price has seen considerable fluctuation recently, mirroring the broader tech sector’s volatility. Interestingly, a comparison could be drawn to the performance of other similarly situated companies; for instance, the current reddit stock price offers a point of reference when analyzing the overall market sentiment towards streaming and social media platforms. Ultimately, Roku’s future trajectory will depend on various factors including user growth and advertising revenue.

Roku’s long-term strategy focuses on expanding its platform’s reach, enhancing its advertising capabilities, and potentially exploring new revenue streams through partnerships and innovative features. Specifics vary with market conditions and internal strategy adjustments.