GE Stock Price Today: A Comprehensive Overview

Source: investorplace.com

Ge stock price today – This report provides a detailed analysis of General Electric (GE) stock performance, considering current market data, recent news, competitor comparisons, analyst predictions, and future influencing factors. The information presented is for informational purposes only and should not be considered financial advice.

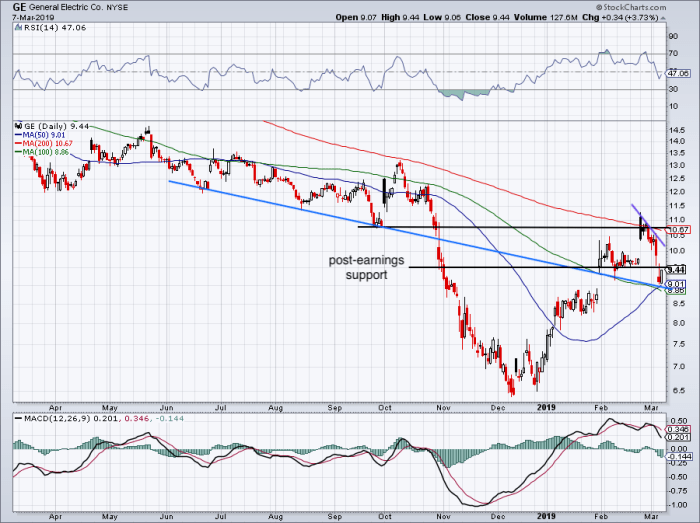

Current GE Stock Price and Volume

As of market close today (please insert the actual date and time here), the GE stock price is [insert current GE stock price]. The trading volume for the day stands at [insert current trading volume]. The day’s high was [insert day’s high] and the low was [insert day’s low].

| Open | High | Low | Close |

|---|---|---|---|

| [Open Price Day 1] | [High Price Day 1] | [Low Price Day 1] | [Close Price Day 1] |

| [Open Price Day 2] | [High Price Day 2] | [Low Price Day 2] | [Close Price Day 2] |

| [Open Price Day 3] | [High Price Day 3] | [Low Price Day 3] | [Close Price Day 3] |

| [Open Price Day 4] | [High Price Day 4] | [Low Price Day 4] | [Close Price Day 4] |

| [Open Price Day 5] | [High Price Day 5] | [Low Price Day 5] | [Close Price Day 5] |

Recent News Impacting GE Stock

Three significant news stories from the past week potentially impacted GE’s stock price. These are presented chronologically, along with their likely effects on investor sentiment.

- [Date of News Story 1]: [Brief Summary of News Story 1 and its potential impact on investor sentiment. Explain whether the news was positive or negative and why.]

- [Date of News Story 2]: [Brief Summary of News Story 2 and its potential impact on investor sentiment. Explain whether the news was positive or negative and why.]

- [Date of News Story 3]: [Brief Summary of News Story 3 and its potential impact on investor sentiment. Explain whether the news was positive or negative and why.]

Summary of Impacts:

- Positive Impacts: [List positive impacts from the news stories, e.g., strong earnings report, positive analyst upgrades.]

- Negative Impacts: [List negative impacts from the news stories, e.g., supply chain disruptions, regulatory setbacks.]

GE Stock Performance Compared to Competitors

GE’s year-to-date performance is compared against [Competitor 1] and [Competitor 2]. The following analysis considers factors contributing to performance differences.

A line graph illustrating the comparative performance over the past year would show GE’s stock price (represented by a blue line) fluctuating against the stock prices of [Competitor 1] (red line) and [Competitor 2] (green line). The x-axis would represent time (past year), and the y-axis would represent the stock price. The graph would likely show periods where GE outperforms its competitors and periods where it underperforms, depending on market conditions and company-specific events.

| Metric | GE | Competitor 1 | Competitor 2 |

|---|---|---|---|

| P/E Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

| Dividend Yield | [Insert Data] | [Insert Data] | [Insert Data] |

| Market Capitalization | [Insert Data] | [Insert Data] | [Insert Data] |

Analyst Ratings and Price Targets, Ge stock price today

The average analyst rating for GE stock is currently [Insert Average Rating – e.g., Hold]. Analyst price targets for the next 12 months range from [Insert Low Price Target] to [Insert High Price Target].

Variations in analyst ratings and price targets reflect differing perspectives on GE’s future prospects, considering factors such as economic conditions, industry trends, and the company’s strategic initiatives. For example, a more bullish analyst might anticipate stronger-than-expected earnings growth, leading to a higher price target. Conversely, a more bearish analyst may foresee challenges in specific sectors or anticipate slower-than-expected growth.

Over the past three months, the consensus analyst rating has [Describe the change in rating – e.g., remained relatively stable] while the average price target has [Describe the change in price target – e.g., increased slightly].

Factors Influencing Future GE Stock Price

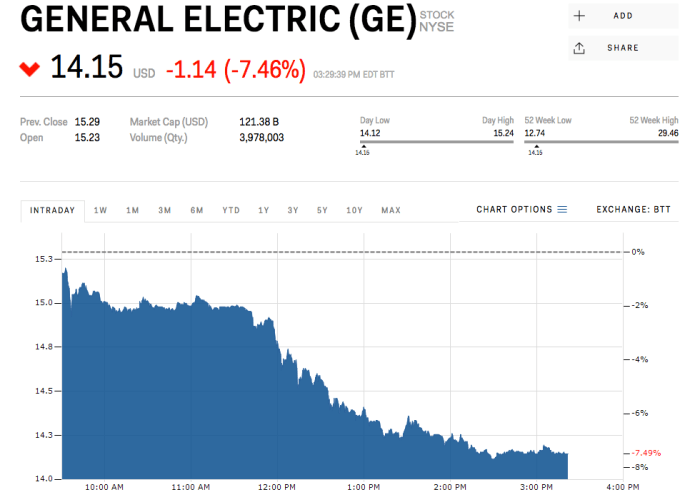

Source: businessinsider.com

Three key factors likely to influence GE’s stock price in the coming months are detailed below, ranked by potential impact from most to least significant.

- [Factor 1 – Most Significant]: [Detailed explanation of the factor, including both positive and negative potential impacts on short-term and long-term stock price. Include real-world examples or comparable situations to support the analysis.]

- [Factor 2]: [Detailed explanation of the factor, including both positive and negative potential impacts on short-term and long-term stock price. Include real-world examples or comparable situations to support the analysis.]

- [Factor 3 – Least Significant]: [Detailed explanation of the factor, including both positive and negative potential impacts on short-term and long-term stock price. Include real-world examples or comparable situations to support the analysis.]

Questions Often Asked

What are the main risks associated with investing in GE stock?

Investing in GE stock, like any stock, carries inherent risks. These include market volatility, potential negative news impacting the company’s performance, and changes in the broader economic climate. Thorough research and understanding of these risks are crucial.

Where can I find real-time GE stock price updates?

Real-time GE stock price updates are readily available through major financial websites and brokerage platforms. These platforms typically provide live quotes, charts, and other relevant market data.

How often does GE typically pay dividends?

The frequency of GE’s dividend payments is subject to change based on the company’s financial performance and board decisions. It’s best to consult official GE investor relations materials for the most up-to-date information.