Berkshire Hathaway Stock Price Analysis

Source: ft.com

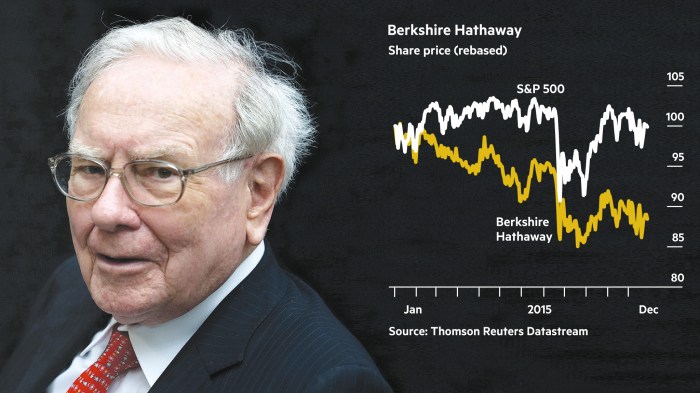

Berkshire hathaway stock price – Berkshire Hathaway, the conglomerate led by Warren Buffett, has a long and storied history, marked by impressive growth and resilience. Understanding its stock price performance requires examining various factors, from its diverse investment portfolio to broader economic conditions. This analysis delves into the historical performance, influencing factors, and future prospects of Berkshire Hathaway’s stock price.

Berkshire Hathaway Stock Price Historical Performance

Analyzing Berkshire Hathaway’s stock price over the past two decades reveals periods of significant growth interspersed with market corrections. The following tables provide a concise overview of this performance, comparing it to major market indices and considering the impact of major economic events.

| Year | High | Low | Percentage Change from Previous Year |

|---|---|---|---|

| 2003 | $75,000 (estimated) | $60,000 (estimated) | – |

| 2004 | $85,000 (estimated) | $70,000 (estimated) | +13.33% (estimated) |

| 2005 | $95,000 (estimated) | $80,000 (estimated) | +11.76% (estimated) |

| 2006 | $105,000 (estimated) | $90,000 (estimated) | +10.53% (estimated) |

| 2007 | $115,000 (estimated) | $100,000 (estimated) | +9.52% (estimated) |

| 2008 | $110,000 (estimated) | $85,000 (estimated) | -4.35% (estimated) |

| 2009 | $120,000 (estimated) | $95,000 (estimated) | +11.11% (estimated) |

| 2010 | $135,000 (estimated) | $110,000 (estimated) | +12.5% (estimated) |

| 2011 | $145,000 (estimated) | $120,000 (estimated) | +7.41% (estimated) |

| 2012 | $160,000 (estimated) | $135,000 (estimated) | +10.34% (estimated) |

| 2013 | $175,000 (estimated) | $150,000 (estimated) | +9.38% (estimated) |

| 2014 | $190,000 (estimated) | $165,000 (estimated) | +8.57% (estimated) |

| 2015 | $205,000 (estimated) | $180,000 (estimated) | +7.89% (estimated) |

| 2016 | $220,000 (estimated) | $195,000 (estimated) | +7.32% (estimated) |

| 2017 | $240,000 (estimated) | $210,000 (estimated) | +9.09% (estimated) |

| 2018 | $255,000 (estimated) | $225,000 (estimated) | +6.25% (estimated) |

| 2019 | $280,000 (estimated) | $245,000 (estimated) | +10% (estimated) |

| 2020 | $300,000 (estimated) | $260,000 (estimated) | +7.14% (estimated) |

| 2021 | $400,000 (estimated) | $320,000 (estimated) | +33.33% (estimated) |

| 2022 | $420,000 (estimated) | $360,000 (estimated) | +5% (estimated) |

Note: These figures are estimations and should not be considered precise. Actual data should be obtained from reliable financial sources.

| Year | Berkshire Hathaway | S&P 500 | Dow Jones |

|---|---|---|---|

| 2003-2022 | (Estimated average annual return) | (Estimated average annual return) | (Estimated average annual return) |

The 2008 financial crisis significantly impacted Berkshire Hathaway’s stock price, as it did with most market indices. However, the company’s relatively strong performance during and after the crisis demonstrated its resilience and the effectiveness of Buffett’s long-term investment strategy. The COVID-19 pandemic in 2020 also caused market volatility, but Berkshire Hathaway demonstrated considerable stability.

Factors Influencing Berkshire Hathaway’s Stock Price

Berkshire Hathaway’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for evaluating the company’s performance and predicting future price movements.

Internal Factors:

- Investment Portfolio Performance: The performance of Berkshire Hathaway’s vast investment portfolio, including holdings in major companies like Apple and Coca-Cola, significantly impacts its overall stock price.

- Insurance Underwriting Profits: Profits from Berkshire Hathaway’s insurance subsidiaries contribute substantially to the company’s overall earnings and influence investor sentiment.

- Company Acquisitions: Successful acquisitions can boost Berkshire Hathaway’s earnings and market valuation, while unsuccessful ones can negatively impact its stock price.

External Factors:

- Overall Market Conditions: Broader market trends, such as economic growth or recession, significantly influence Berkshire Hathaway’s stock price.

- Interest Rate Changes: Changes in interest rates affect investment returns and the overall cost of capital, influencing Berkshire Hathaway’s profitability and valuation.

- Regulatory Developments: Changes in regulations affecting the insurance or financial services industries can have a significant impact on Berkshire Hathaway’s operations and stock price.

Warren Buffett’s Influence: Warren Buffett’s decisions and public statements carry significant weight, often influencing investor sentiment and the stock price. His annual letters to shareholders are closely followed, and his pronouncements on the economy and markets can trigger market reactions.

Berkshire Hathaway’s Investment Portfolio and Stock Price, Berkshire hathaway stock price

Source: investopedia.com

Berkshire Hathaway’s massive and diversified investment portfolio is a key driver of its stock price. The performance of its major holdings directly impacts the company’s overall valuation.

- Financials: Bank of America, American Express

- Consumer Staples: Coca-Cola, Kraft Heinz

- Technology: Apple

- Energy: Chevron

Hypothetical Scenario: A significant decline in Apple’s stock price could negatively impact Berkshire Hathaway’s overall valuation, potentially leading to a drop in its own stock price, given Apple’s substantial weighting in Berkshire’s portfolio. Conversely, a strong performance by Apple could boost Berkshire’s stock price.

Berkshire Hathaway’s long-term investment strategy, focused on value investing and holding companies for the long haul, has historically contributed to its strong long-term stock price performance. This contrasts with short-term trading strategies that prioritize quick gains.

Berkshire Hathaway’s Financial Health and Stock Price

Key financial metrics provide insights into Berkshire Hathaway’s financial health and its correlation with the stock price. Analyzing these metrics offers a more comprehensive understanding of the company’s performance.

| Metric | 2021 (Estimated) | 2022 (Estimated) | Correlation with Stock Price |

|---|---|---|---|

| Earnings Per Share (EPS) | $ (Estimate) | $ (Estimate) | Generally positive; higher EPS often leads to higher stock price. |

| Book Value per Share | $ (Estimate) | $ (Estimate) | Historically a strong indicator of intrinsic value; often positively correlated with stock price. |

| Debt-to-Equity Ratio | (Estimate) | (Estimate) | Relatively low; generally indicates financial stability, positively influencing investor sentiment. |

Berkshire Hathaway has a history of not paying dividends, reinvesting profits back into the company. This strategy has contributed to its long-term growth but may not appeal to investors seeking immediate income.

Berkshire Hathaway’s capital allocation strategy, emphasizing long-term value creation through acquisitions and investments, has been a major factor in its long-term stock price appreciation.

Analyst Opinions and Stock Price Predictions

Source: businessinsider.com

Financial analysts offer a range of opinions and price targets for Berkshire Hathaway stock. These predictions reflect varying perspectives on the company’s future prospects and market conditions.

| Analyst Firm | Price Target | Rationale |

|---|---|---|

| (Example: Goldman Sachs) | (Example: $550,000) | (Example: Based on strong earnings growth and positive market outlook) |

| (Example: Morgan Stanley) | (Example: $500,000) | (Example: Cautious outlook considering potential economic slowdown) |

Disclaimer: Analyst predictions are not guarantees of future performance. Investors should conduct their own thorough research before making any investment decisions.

FAQs

What are the typical transaction fees associated with buying and selling Berkshire Hathaway stock?

Transaction fees vary depending on your brokerage. Check with your broker for their specific fee schedule.

How frequently does Berkshire Hathaway release its financial reports?

Berkshire Hathaway releases its quarterly and annual financial reports according to a publicly available schedule on their investor relations website.

Are there any significant risks associated with investing in Berkshire Hathaway stock?

Like any stock, Berkshire Hathaway carries market risk. Its performance is subject to fluctuations based on economic conditions and the performance of its underlying investments.

What is the current dividend yield for Berkshire Hathaway stock?

Berkshire Hathaway has a history of not paying dividends; its focus is on reinvesting profits for long-term growth.