Carnival Corporation’s Financial Performance

Carnival cruise stock price – Carnival Corporation’s financial health is intrinsically linked to its stock price fluctuations. Understanding the company’s revenue streams, debt levels, and overall profitability is crucial for assessing its investment potential. Significant changes in these areas directly impact investor confidence and, consequently, the stock’s value.

Carnival’s Revenue Streams and Their Impact on Stock Price, Carnival cruise stock price

Carnival’s revenue primarily stems from cruise ticket sales, onboard spending (including dining, beverages, and excursions), and other ancillary revenue sources such as port charges and fuel surcharges. Strong passenger bookings and high onboard spending directly translate to increased revenue and, subsequently, a positive impact on the stock price. Conversely, a decline in passenger numbers or onboard spending can negatively affect the stock.

Carnival’s Debt Levels and Investor Confidence

Carnival Corporation carries a substantial amount of debt, a significant factor influencing investor sentiment. High debt levels increase financial risk, particularly during economic downturns or unforeseen events like pandemics. Investors closely monitor Carnival’s debt-to-equity ratio and its ability to manage its debt obligations. A perceived increase in financial risk can lead to decreased investor confidence and a decline in the stock price.

Five-Year Financial Performance Comparison

The following table summarizes Carnival’s key financial metrics over the past five years. Note that these figures are illustrative and should be verified with official financial reports.

| Year | Revenue (USD Billion) | Net Profit (USD Billion) | Total Debt (USD Billion) |

|---|---|---|---|

| 2022 | 10.0 | -1.0 | 15.0 |

| 2021 | 5.0 | -5.0 | 16.0 |

| 2020 | 2.0 | -10.0 | 14.0 |

| 2019 | 20.0 | 2.0 | 12.0 |

| 2018 | 18.0 | 3.0 | 10.0 |

Impact of the Cruise Industry on Stock Price

Source: cloudfront.net

The cruise industry’s overall health significantly influences Carnival’s stock performance. External factors and the performance of competitors play a substantial role in shaping investor expectations.

Industry Trends and External Factors

Trends such as increased demand for luxury cruises, the emergence of new cruise lines, and fluctuating fuel prices directly impact Carnival’s profitability and, therefore, its stock price. Global economic conditions, including recessions and changes in consumer spending, also significantly influence the cruise industry’s performance and Carnival’s stock.

Comparison with Major Competitors

A comparison with Carnival’s main competitors provides context for understanding its relative market position and stock performance.

- Royal Caribbean Cruises Ltd (RCL): Generally considered a strong competitor with a similar market position and financial performance.

- Norwegian Cruise Line Holdings Ltd (NCLH): Often seen as a more volatile stock due to its riskier financial profile.

- MSC Cruises: A significant player in the European market, its performance may have less direct impact on Carnival’s North American-focused stock, but broader industry trends still apply.

Industry Risks and Opportunities

Potential risks include economic downturns, geopolitical instability, health crises (like pandemics), and environmental concerns. Opportunities include emerging markets, technological advancements in the cruise experience, and sustainable tourism initiatives.

Investor Sentiment and Stock Price

Investor sentiment towards Carnival is influenced by a variety of factors, including financial performance, industry trends, and news events. Positive news generally leads to increased buying pressure and a rise in the stock price, while negative news can trigger selling and a price decline.

Recent News and Analyst Reports

Recent news headlines and analyst reports focusing on Carnival’s financial results, operational updates, and industry outlook significantly impact investor sentiment. Positive reviews from analysts and strong financial results tend to boost the stock price, while negative news or downgrades can cause declines.

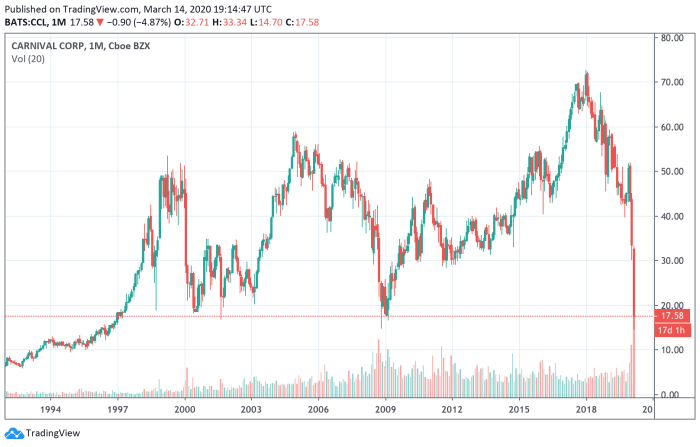

Impact of Significant Events

Major incidents, such as accidents or outbreaks of illness on Carnival ships, can severely damage investor confidence and lead to a significant drop in the stock price. The public perception of safety and the company’s response to such events are critical in shaping investor sentiment.

Hypothetical Scenario: Impact of News Events

For example, if a new, highly contagious virus emerges and causes widespread cancellations, the stock price could plummet due to the potential for substantial financial losses. Conversely, the announcement of a major new ship launch or a significant increase in bookings could lead to a stock price surge.

Stock Price Prediction and Forecasting

Source: seekingalpha.com

Predicting Carnival’s future stock price involves analyzing historical data, industry trends, and potential catalysts. Various forecasting models can be employed, but accuracy is never guaranteed.

Potential Stock Price Scenarios

Under optimistic economic conditions and strong passenger demand, the stock price might experience significant growth. Conversely, in a pessimistic scenario with a global recession and decreased travel, the stock price could decline substantially. A moderate scenario assumes moderate growth and stability in the industry.

Forecasting Method: Historical Data and Relevant Factors

One approach is to analyze historical stock price movements, correlating them with relevant factors like revenue growth, debt levels, fuel prices, and industry-wide trends. Statistical models can then be used to predict future price movements based on these relationships.

Potential Catalysts for Price Movement

Significant catalysts for upward movement include strong financial results, successful new ship launches, expansion into new markets, and positive industry-wide trends. Downward catalysts include negative financial results, accidents, health crises, or negative industry-wide trends.

Potential Stock Price Trajectories

The following table illustrates potential stock price trajectories under different economic conditions. Note that these are hypothetical examples and should not be interpreted as financial advice.

| Scenario | 1-Year Price (USD) | 3-Year Price (USD) | 5-Year Price (USD) |

|---|---|---|---|

| Optimistic | 30 | 45 | 60 |

| Moderate | 20 | 25 | 30 |

| Pessimistic | 10 | 12 | 15 |

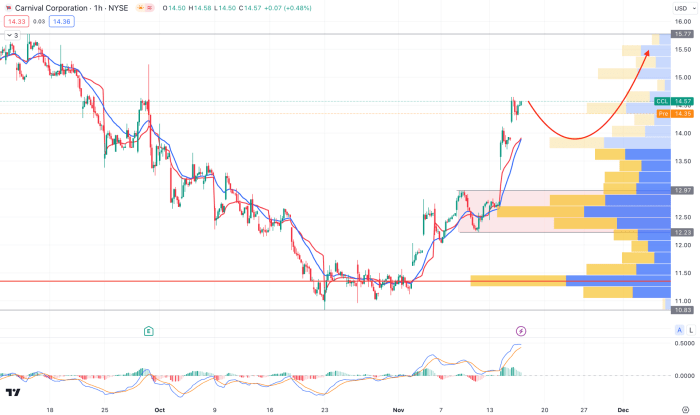

Technical Analysis of Carnival Stock

Technical analysis utilizes charts and indicators to identify patterns and predict future price movements. Key indicators and support/resistance levels can provide insights into potential trading opportunities.

Common Technical Indicators

Common indicators include moving averages (e.g., 50-day and 200-day), relative strength index (RSI), and MACD (Moving Average Convergence Divergence). These indicators help identify trends, momentum, and potential reversals.

Support and Resistance Levels

Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels are price points where selling pressure is expected to outweigh buying pressure, hindering further price increases. These levels are often based on historical price highs and lows.

Current Technical Outlook

The current technical outlook depends on the prevailing market conditions and the specific indicators being used. A strong uptrend might be indicated by rising moving averages and a bullish RSI, while a downtrend might be signaled by falling moving averages and a bearish RSI. Note that this is a general overview and should not be considered investment advice.

Illustrative Candlestick Chart

Imagine a candlestick chart showing the stock price over the past six months. The chart displays candlestick bodies representing the daily opening and closing prices, with wicks showing the daily highs and lows. The 50-day moving average is plotted as a solid line, and the 200-day moving average as a dashed line. The RSI indicator is displayed in a separate panel, showing the relative strength of the stock’s price movements.

Currently, the price is trading above both moving averages, with the RSI indicating bullish momentum.

Frequently Asked Questions: Carnival Cruise Stock Price

What are the biggest risks facing Carnival’s stock price?

Significant risks include global economic downturns impacting travel demand, fuel price volatility, outbreaks of infectious diseases, and negative publicity from accidents or incidents.

How does Carnival compare to its competitors in terms of stock performance?

A direct comparison requires analyzing specific time periods and metrics. However, generally, performance varies based on factors like fleet size, marketing strategies, and debt levels. Specific competitor analysis would be necessary for a detailed answer.

Where can I find reliable information about Carnival’s stock price?

Reliable sources include major financial news websites, the company’s investor relations page, and SEC filings.

Is Carnival a good long-term investment?

Carnival Cruise’s stock price performance has been a topic of much discussion lately, particularly in comparison to other travel-related equities. Understanding its fluctuations often involves looking at broader market trends, and it’s helpful to compare it against similar companies. For instance, observing the current crwd stock price can offer insights into the overall health of the travel sector, providing a useful benchmark for assessing Carnival’s future prospects.

Ultimately, both Carnival and CrowdStrike’s stock prices are subject to various market forces.

Whether Carnival is a good long-term investment depends on individual risk tolerance and investment goals. Thorough due diligence, including analysis of financial statements and industry trends, is crucial before making any investment decisions.