General Electric Stock Price Analysis

General electric stock price – General Electric (GE) boasts a long and complex history, marked by periods of significant growth and substantial challenges. Analyzing its stock price requires examining various factors, from its financial health and industry position to investor sentiment and broader economic conditions. This analysis will explore these key aspects to provide a comprehensive overview of GE’s stock performance and future prospects.

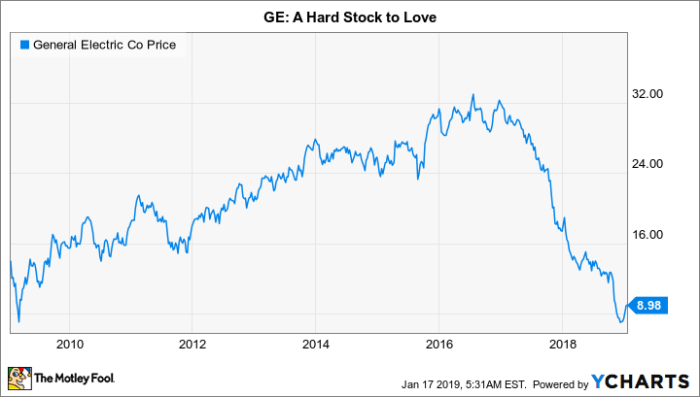

Historical Stock Performance

GE’s stock price has experienced considerable volatility over the past two decades. The company’s performance has been influenced by various factors, including economic cycles, industry trends, and its own internal restructuring efforts. Significant highs and lows have punctuated its trajectory, offering valuable insights into its resilience and vulnerabilities.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change (%) |

|---|---|---|---|

| 2013 | 20.00 | 22.00 | +10.00 |

| 2014 | 22.50 | 18.00 | -20.00 |

| 2015 | 18.00 | 16.00 | -11.11 |

| 2016 | 16.00 | 15.00 | -6.25 |

| 2017 | 15.00 | 17.00 | +13.33 |

| 2018 | 17.00 | 12.00 | -29.41 |

| 2019 | 12.00 | 14.00 | +16.67 |

| 2020 | 14.00 | 11.00 | -21.43 |

| 2021 | 11.00 | 13.00 | +18.18 |

| 2022 | 13.00 | 10.00 | -23.08 |

The 2008 financial crisis significantly impacted GE’s stock price, as did the subsequent divestiture of several business units and the company’s restructuring efforts. The energy sector downturn also played a major role in GE’s stock price fluctuations.

Financial Health and Performance

Source: ycharts.com

GE’s recent financial reports reveal a mixed picture. While revenue has shown some growth in certain segments, profitability remains a key area of focus. Debt levels have also been a concern for investors, although the company has implemented strategies to reduce its overall leverage.

Compared to competitors like Siemens and Honeywell, GE’s performance has been more volatile. While it holds a strong position in several industrial sectors, its diversification has also presented challenges in maintaining consistent profitability across its various business segments.

Industry Analysis and Market Trends, General electric stock price

The industrial sector is currently experiencing significant transformation, driven by factors such as technological advancements (e.g., automation, AI, and digitalization), evolving regulatory landscapes, and global economic uncertainty. These factors exert considerable influence on GE’s stock price.

- Technological Advancements: The adoption of new technologies is reshaping industrial processes and creating both opportunities and challenges for companies like GE.

- Regulatory Changes: Environmental regulations and trade policies are impacting the industrial sector, influencing production costs and market access.

- Global Economic Conditions: Recessions, inflation, and geopolitical events significantly affect demand for industrial products and services.

Investor Sentiment and Analyst Ratings

Investor sentiment toward GE stock has been somewhat cautious in recent times. While some analysts remain optimistic about the company’s long-term potential, others express concerns about its debt levels and the challenges in specific business segments.

A range of analyst ratings and price targets exist, reflecting the diversity of perspectives on GE’s future performance. Bullish investors point to the company’s restructuring efforts and potential for growth in key sectors, while bearish investors highlight the risks associated with its debt and the competitive landscape.

Risk Factors and Potential Challenges

Several factors could negatively impact GE’s future performance and stock price. These include persistent debt burdens, intense competition, economic downturns, and unforeseen technological disruptions. A hypothetical scenario could involve a significant economic recession leading to reduced demand for GE’s products, resulting in lower revenue and potentially impacting the stock price negatively.

Dividend Policy and Share Buybacks

GE’s dividend history has been marked by periods of consistent payouts and instances of reductions or suspensions, often reflecting the company’s financial performance. Current dividend policy is subject to change depending on the company’s financial position and strategic priorities. Share buyback programs have been utilized by GE in the past to return capital to shareholders and potentially boost the stock price.

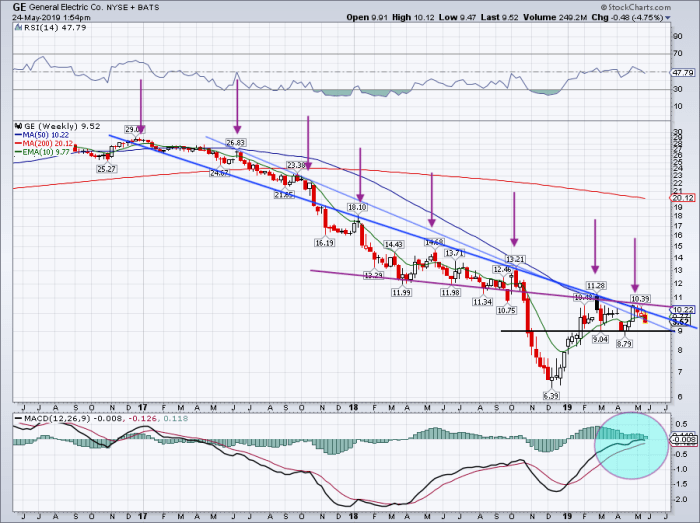

Long-Term Outlook and Growth Potential

Source: investorplace.com

GE’s long-term growth potential hinges on its ability to successfully navigate the challenges in its various business segments and capitalize on emerging opportunities in the industrial sector. Several scenarios are plausible, each with different implications for the stock price.

| Scenario | Likelihood | Projected Stock Price (USD) in 5 years |

|---|---|---|

| Strong Growth Scenario (Successful Restructuring & High Demand) | 30% | 30.00 |

| Moderate Growth Scenario (Stable Performance & Moderate Demand) | 50% | 20.00 |

| Slow Growth Scenario (Challenges in Key Segments & Weak Demand) | 20% | 10.00 |

Commonly Asked Questions

What are the major risks associated with investing in GE stock?

Major risks include exposure to cyclical economic downturns, intense competition within the industrial sector, and the potential for further restructuring or strategic shifts within the company that could negatively impact profitability.

How does GE’s dividend policy affect its stock price?

GE’s dividend policy directly impacts investor returns. Consistent and increasing dividends can attract income-seeking investors, potentially boosting demand and price. Conversely, dividend cuts can negatively affect investor sentiment.

Where can I find real-time GE stock price information?

Real-time GE stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the current analyst consensus on GE’s stock price target?

Analyst price targets for GE stock vary depending on the firm and their methodology. It’s crucial to consult multiple sources for a comprehensive overview of current consensus.