Snapchat Stock Price: A Comprehensive Analysis

Snapchat stock price – Snapchat, the popular social media platform known for its ephemeral messaging and augmented reality features, has experienced a dynamic journey since its initial public offering (IPO). This analysis delves into the historical performance of Snapchat’s stock price, examining key factors influencing its valuation, its business model, analyst predictions, associated risks, and future prospects.

Snapchat Stock Price History

Source: techcrunch.com

Snapchat’s stock price performance since its IPO in March 2017 has been characterized by significant volatility. Initial optimism following the IPO was followed by periods of both substantial gains and considerable losses, mirroring the broader tech sector’s fluctuations and Snapchat’s own operational challenges and successes.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2017 | $29.44 | $12.66 | -57% |

| 2018 | $18.02 | $5.44 | -70% |

| 2019 | $17.30 | $9.78 | -43% |

| 2020 | $39.61 | $18.74 | -53% |

| 2021 | $70.96 | $48.25 | -32% |

| 2022 | $40.82 | $10.27 | -75% |

| 2023 (YTD) | $15.20 | $11.50 | -24% |

Major price fluctuations were often linked to earnings reports, revealing either strong revenue growth or disappointing user engagement metrics. Market-wide downturns also significantly impacted Snapchat’s stock, as investors reassessed risk profiles across the tech sector. Competitor actions, such as new feature releases from Instagram or TikTok, also played a role in influencing investor sentiment.

Factors Influencing Snapchat’s Stock Price, Snapchat stock price

Several key financial metrics drive investor interest in Snapchat’s stock. These include revenue growth, demonstrating the effectiveness of its advertising business; daily active users (DAU) and average revenue per user (ARPU), reflecting user engagement and monetization; and profitability, indicating the company’s ability to generate sustainable earnings.

| Metric | Snapchat | Meta (Facebook/Instagram) | TikTok (ByteDance) |

|---|---|---|---|

| Daily Active Users (DAU) (Millions) | 375 (estimated) | 2900 (estimated) | 1000 (estimated) |

| Average Revenue Per User (ARPU) | $5 (estimated) | $10 (estimated) | $2 (estimated) |

| Revenue Growth (Year-over-Year) | Variable, dependent on market conditions | Variable, dependent on market conditions | Variable, dependent on market conditions |

Note: These figures are estimates and may vary depending on the source and reporting period. Direct comparison is difficult due to varying reporting methodologies across companies.

Regulatory changes concerning data privacy and advertising practices can significantly impact Snapchat’s valuation. Similarly, evolving social media trends and the emergence of new competitors constantly reshape the competitive landscape, influencing investor confidence.

Snapchat’s Business Model and Stock Price

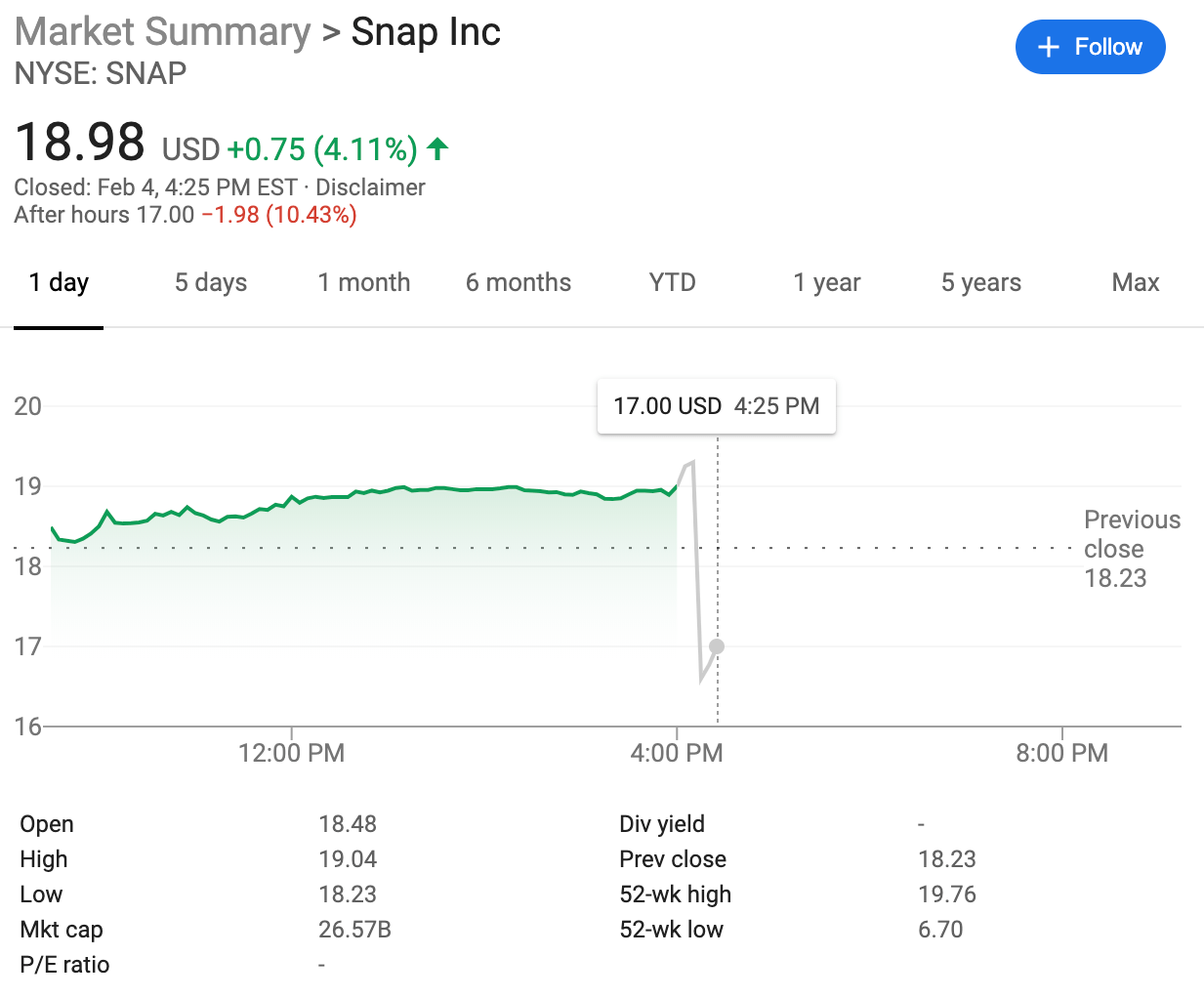

Source: stockprice.com

Snapchat’s primary revenue source is advertising, integrated seamlessly into its user experience. Subscription revenue contributes less significantly but is growing. The effectiveness of its advertising platform and its ability to attract and retain advertisers directly influence its stock price. Strong user growth is crucial, as it expands the potential advertising audience and increases ARPU.

Significant changes in advertising revenue, whether positive or negative, directly impact investor sentiment. Consistent revenue growth signals a healthy business, while a decline often leads to stock price corrections.

Analyst Ratings and Predictions for Snapchat Stock

Analyst opinions on Snapchat’s future performance vary. These predictions are based on factors such as projected user growth, advertising revenue trends, and competitive pressures.

- Analyst A: Buy rating, $20 price target. Rationale: Strong user growth in key demographics.

- Analyst B: Hold rating, $15 price target. Rationale: Concerns about competition and profitability.

- Analyst C: Sell rating, $12 price target. Rationale: Slower-than-expected user growth and increasing marketing costs.

These diverse perspectives reflect the inherent uncertainties in predicting the future performance of a tech company operating in a rapidly evolving market.

Risk Factors Associated with Investing in Snapchat Stock

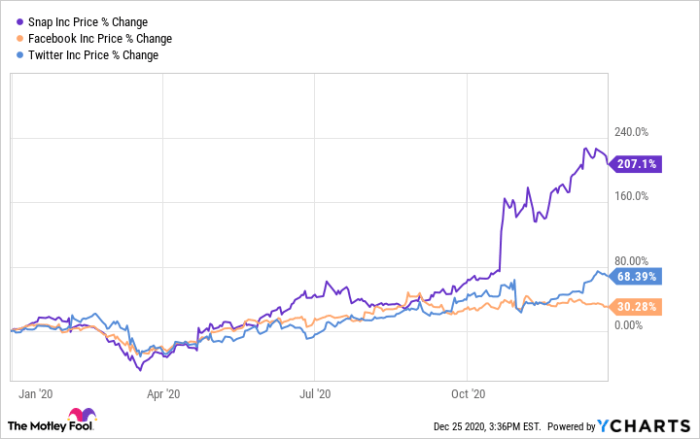

Source: ycharts.com

Investing in Snapchat stock carries several inherent risks. These include intense competition from established social media giants and emerging platforms, regulatory risks related to data privacy and content moderation, and the cyclical nature of the advertising market, making it vulnerable to economic downturns.

- Diversify your portfolio to mitigate the impact of any single stock’s underperformance.

- Conduct thorough due diligence before investing, understanding the company’s financial performance and competitive landscape.

- Establish a clear investment strategy and risk tolerance before making any investment decisions.

These risks could significantly impact Snapchat’s future stock price. Careful consideration of these factors is essential for investors.

Visual Representation of Stock Price Trends

Snapchat’s stock price has shown a generally volatile trajectory since its IPO. Initially, the stock experienced a period of sharp decline, followed by periods of consolidation and recovery, often correlating with positive earnings reports or new product launches. However, larger market trends, such as the overall tech sector downturn in 2022, also played a significant role in influencing its price.

There have been instances of sharp inclines, representing periods of significant positive investor sentiment, and conversely, steep declines indicating market anxieties and concerns regarding the company’s future performance. These fluctuations reflect the inherent risks associated with investing in a high-growth technology company.

For potential investors, understanding this volatility is crucial. A long-term perspective and a tolerance for risk are essential when considering investing in Snapchat’s stock.

FAQ Guide

What is the current Snapchat stock price?

The current Snapchat stock price fluctuates constantly and can be found on major financial websites like Google Finance, Yahoo Finance, or Bloomberg.

Where can I buy Snapchat stock?

Snapchat stock (SNAP) can be purchased through most reputable online brokerage accounts.

How often does Snapchat report earnings?

Snapchat typically reports its quarterly earnings on a regular schedule, the specific dates of which are announced in advance.

What are the major risks associated with investing in Snapchat?

Major risks include intense competition, changes in user engagement, dependence on advertising revenue, and regulatory uncertainty.