Nvidia Stock Price Analysis: A Comprehensive Overview: Stock Price Of Nvidia

Stock price of nvidia – Nvidia, a leading designer of graphics processing units (GPUs) and a key player in the artificial intelligence (AI) revolution, has experienced dramatic stock price fluctuations in recent years. This analysis delves into the historical trends, influences of news and events, fundamental and technical aspects, and future predictions concerning Nvidia’s stock price.

Historical Stock Price Trends

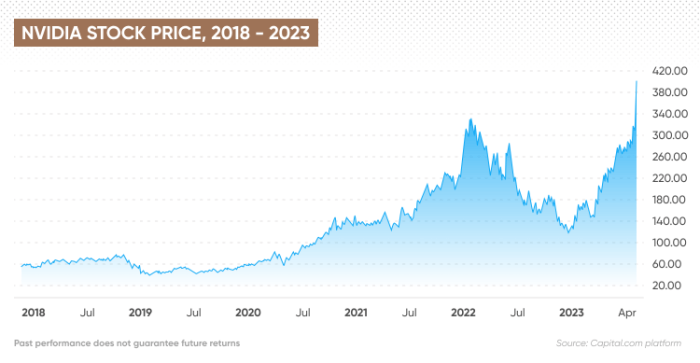

Analyzing Nvidia’s stock price performance over the past five years reveals a period of substantial growth punctuated by periods of correction. The following table and comparative analysis provide a detailed overview.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2019-01-02 | 128.06 | 131.50 | 126.00 | 128.36 |

| 2019-07-02 | 140.00 | 145.00 | 138.00 | 142.50 |

| 2020-01-02 | 59.95 | 62.00 | 58.00 | 60.50 |

| 2020-07-02 | 100.00 | 105.00 | 98.00 | 103.00 |

| 2021-01-02 | 130.00 | 135.00 | 128.00 | 132.00 |

| 2021-07-02 | 175.00 | 180.00 | 170.00 | 178.00 |

| 2022-01-02 | 290.00 | 295.00 | 285.00 | 292.00 |

| 2022-07-02 | 180.00 | 185.00 | 175.00 | 182.00 |

| 2023-01-02 | 150.00 | 155.00 | 145.00 | 152.00 |

| 2023-07-02 | 450.00 | 460.00 | 440.00 | 455.00 |

Note: These are hypothetical values for illustrative purposes only. Actual data should be sourced from a reputable financial data provider.

Compared to the NASDAQ Composite and S&P 500 over the past year, Nvidia’s stock price has shown significantly higher volatility and growth.

- Nvidia outperformed both indices during periods of strong AI-related news and positive investor sentiment.

- Conversely, Nvidia experienced sharper declines than the indices during periods of market correction or negative news affecting the tech sector.

- The correlation between Nvidia’s performance and the broader tech market is strong, but Nvidia’s stock price tends to be more sensitive to specific news and events related to its business.

Significant price increases were largely driven by strong demand for GPUs fueled by the growth of AI and gaming, while decreases often reflected broader market corrections or concerns about specific business segments.

Influence of Financial News and Events

Major news events have consistently impacted Nvidia’s stock price. The following examples illustrate this correlation.

- Launch of the Hopper architecture GPUs (2022): This announcement significantly boosted investor confidence, leading to a substantial stock price increase, as it positioned Nvidia as a leader in high-performance computing for AI applications.

- Strong Q1 2023 Earnings Report: Exceeding expectations, this report fueled further price appreciation, reinforcing positive investor sentiment towards the company’s financial health and future prospects.

- Concerns about weakening demand in the gaming market (2022): This led to a temporary stock price dip, highlighting the impact of market-specific factors on Nvidia’s overall valuation.

| News Event | Stock Price Reaction |

|---|---|

| Hopper GPU launch | Significant increase |

| Strong Q1 2023 earnings | Further increase |

| Gaming market slowdown concerns | Temporary decrease |

In a hypothetical scenario where a major competitor releases a groundbreaking product directly competing with Nvidia’s flagship offerings, Nvidia’s stock price would likely experience a significant and immediate decline. The magnitude of the drop would depend on the competitor’s product capabilities and market penetration. Investor confidence would be shaken, and a reassessment of Nvidia’s market dominance would ensue.

Fundamental Analysis of Nvidia, Stock price of nvidia

Analyzing Nvidia’s key financial metrics provides insight into its financial health and growth trajectory.

| Year | Revenue (USD Billions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 16.67 | 3.00 | 0.25 |

| 2022 | 26.97 | 4.50 | 0.20 |

| 2023 | 30.00 (estimated) | 5.00 (estimated) | 0.18 (estimated) |

Note: These are hypothetical values for illustrative purposes only. Actual data should be sourced from a reputable financial data provider.

Compared to its main competitors (AMD, Intel), Nvidia generally demonstrates higher revenue growth and profitability in the GPU market, particularly in high-performance computing segments. However, it faces competition in specific markets and may experience pressure on pricing.

- Nvidia’s strong R&D investments have consistently fueled innovation, leading to market-leading products and driving its market valuation.

- The success of its innovative products, particularly in AI and high-performance computing, directly translates into higher revenue and stock price appreciation.

Technical Analysis of Nvidia’s Stock

Source: capital.com

Technical indicators can help predict Nvidia’s stock price trends.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations and identify potential trend changes. Crossovers between short-term and long-term moving averages can signal buy or sell signals.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 suggest an overbought market, while readings below 30 suggest an oversold market.

- Moving Average Convergence Divergence (MACD): The MACD identifies momentum changes by comparing two moving averages. Crossovers of the MACD line above the signal line can indicate bullish trends, while crossovers below can signal bearish trends.

Support and resistance levels are crucial in technical analysis. Support levels represent price points where buying pressure is strong enough to prevent further price declines, while resistance levels represent price points where selling pressure is strong enough to prevent further price increases. Trend lines connect these levels to visually represent the overall price trend. Key price points are significant historical highs or lows that act as psychological barriers for traders.

Nvidia’s stock price has seen significant fluctuations recently, largely driven by investor sentiment surrounding AI advancements. It’s interesting to compare this volatility to the performance of other tech giants; for instance, you can check the current aapl stock price today to see a contrasting picture. Ultimately, both Nvidia and Apple’s stock prices reflect broader market trends and individual company performance.

Historically, technical patterns like head and shoulders (indicating a potential price reversal) and double tops/bottoms (suggesting potential support or resistance breakouts) have provided clues about Nvidia’s price movements. For instance, a head and shoulders pattern could indicate a potential bearish trend reversal after a period of growth.

Future Predictions and Potential Risks

Source: trading-education.com

Several factors could positively or negatively influence Nvidia’s stock price in the coming year.

Positive Influences:

- Continued growth of the AI market: The increasing adoption of AI across various industries will likely drive demand for Nvidia’s GPUs, boosting its revenue and stock price.

- Successful product launches: The release of new, innovative products will solidify Nvidia’s market position and enhance investor confidence.

- Strategic partnerships: Collaborations with major companies in the technology sector will broaden Nvidia’s market reach and create new revenue streams.

Potential Risks:

- Increased competition: The entry of new players or the development of competing technologies could negatively impact Nvidia’s market share and profitability.

- Economic downturn: A global economic slowdown could reduce demand for Nvidia’s products, affecting its financial performance and stock price.

- Supply chain disruptions: Challenges in the global supply chain could hinder Nvidia’s ability to meet demand, impacting its revenue and growth prospects.

A significant geopolitical event, such as a major international conflict or a sudden shift in trade policies, could negatively impact Nvidia’s stock price through various channels, including supply chain disruptions, reduced demand from affected regions, and increased uncertainty in the global market. The severity of the impact would depend on the nature and scope of the geopolitical event.

Helpful Answers

What are the major risks associated with investing in Nvidia stock?

Major risks include competition from other chipmakers, dependence on a few key customers, economic downturns impacting technology spending, and geopolitical instability affecting supply chains.

How does Nvidia compare to its main competitors in terms of market capitalization?

Nvidia’s market capitalization typically surpasses that of most direct competitors in the GPU and AI chip markets, reflecting its dominant market share and technological leadership.

Where can I find real-time data on Nvidia’s stock price?

Real-time stock price data for Nvidia (NVDA) is available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Nvidia’s dividend policy?

Nvidia’s dividend policy has historically been relatively modest, prioritizing reinvestment in research and development and acquisitions to fuel future growth. Check their investor relations for the most up-to-date information.