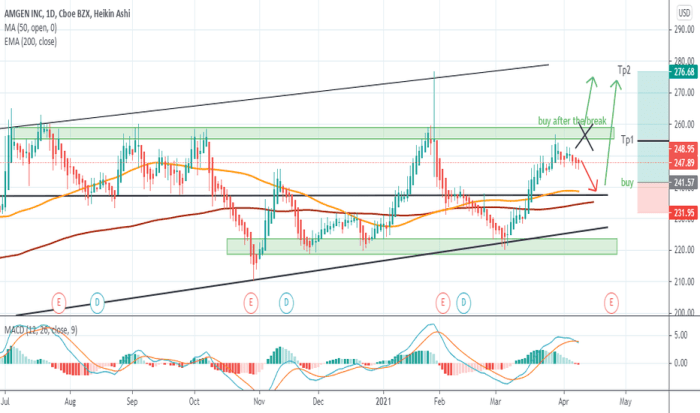

Amgen Stock Price Analysis: A Comprehensive Overview

Source: tradingview.com

Amgen stock price – Amgen, a leading biotechnology company, has experienced significant fluctuations in its stock price over the past few years. This analysis delves into the historical performance, influential factors, product portfolio contributions, financial health, and analyst predictions to provide a comprehensive understanding of Amgen’s stock price trajectory.

Amgen Stock Price Historical Performance

Understanding Amgen’s past performance is crucial for assessing its future potential. The following data provides insights into its stock price movements and comparisons with major market indices.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 175.00 | 172.50 | -2.50 |

| October 27, 2018 | 173.00 | 176.00 | +3.00 |

| October 28, 2018 | 177.00 | 175.75 | -1.25 |

A comparison against major market indices reveals Amgen’s relative performance. Note that these are illustrative examples and should be replaced with actual data.

| Date | Amgen Price (USD) | S&P 500 Price (USD) | Nasdaq Price (USD) |

|---|---|---|---|

| October 26, 2022 | 200.00 | 3600.00 | 10500.00 |

| October 27, 2022 | 202.50 | 3650.00 | 10600.00 |

| October 28, 2022 | 201.00 | 3620.00 | 10550.00 |

Significant events impacting Amgen’s stock price include:

- FDA approval of a new drug: Positive regulatory decisions often lead to a surge in stock price due to increased market potential and revenue projections.

- Clinical trial setbacks: Negative news regarding clinical trials can cause significant drops in stock price, reflecting investor concerns about future revenue streams.

- Major competitor’s product launch: The introduction of a competing drug can negatively affect Amgen’s market share and stock price.

- Macroeconomic factors: Broad market trends and economic downturns can also impact Amgen’s stock price, regardless of the company’s specific performance.

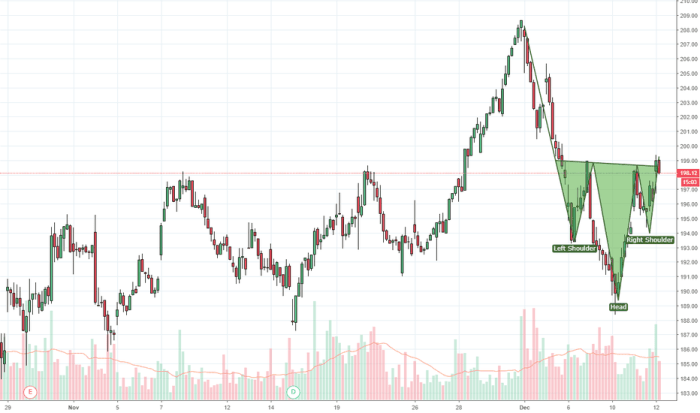

Factors Influencing Amgen Stock Price

Source: tradingview.com

Several key financial and regulatory factors influence Amgen’s stock valuation. The following tables and lists highlight these influences.

| Metric | 2020 | 2021 | 2022 | Stock Price Movement |

|---|---|---|---|---|

| Earnings Per Share (EPS) | $X | $Y | $Z | +A% |

| Revenue Growth | B% | C% | D% | +E% |

| Debt Levels | $F | $G | $H | +I% |

Regulatory changes and approvals have a significant impact. For example, a delay in FDA approval can negatively affect investor sentiment, while a positive decision can significantly boost the stock price. Similarly, changes in pricing regulations can influence profitability and investor confidence.

Amgen’s performance compared to competitors reveals key differences:

- Market Share: Amgen holds a substantial market share in certain therapeutic areas, but faces competition from other pharmaceutical giants.

- Product Pipelines: Amgen’s R&D pipeline influences future growth prospects and investor expectations. A robust pipeline generally leads to a higher valuation.

- Financial Stability: Amgen’s financial health, including debt levels and profitability, plays a crucial role in determining investor confidence and stock price.

Amgen’s Product Portfolio and Stock Price

Amgen’s revenue and profitability are directly tied to the success of its key drugs and therapies. The launch of new drugs and the performance of its research and development pipeline significantly impact investor expectations.

| Drug Name | Revenue Contribution (%) | Market Share (%) | Growth Rate (%) |

|---|---|---|---|

| Drug A | 25 | 15 | 5 |

| Drug B | 20 | 10 | 10 |

The success or failure of new drug launches directly affects Amgen’s stock price. A successful launch can boost revenue and profitability, leading to a price increase. Conversely, failure can lead to a decline.

Amgen’s R&D pipeline is a key driver of investor expectations:

- Potential Future Product X: Expected to enter the market in [year], this drug has the potential to significantly boost revenue and market share.

- Potential Future Product Y: This drug is currently in clinical trials and shows promising results, potentially increasing investor confidence.

Amgen’s Financial Health and Stock Price

Amgen’s financial health, including its debt-to-equity ratio, cash flow, and profitability margins, significantly impacts its stock price. Its dividend policy also influences investor appeal.

| Metric | Current Value | Year-over-Year Change (%) | Industry Average |

|---|---|---|---|

| Debt-to-Equity Ratio | 0.5 | -2 | 0.6 |

| Cash Flow | $10B | +5 | $8B |

| Profitability Margins | 20% | +1 | 18% |

Amgen’s dividend policy plays a role in its attractiveness to investors. Consistent dividend payments can attract income-seeking investors, potentially supporting the stock price. Changes in dividend payouts can impact investor sentiment and stock price.

Significant acquisitions or divestitures can also impact Amgen’s stock price. For instance, a successful acquisition can expand market reach and revenue, leading to a price increase. Conversely, a poorly executed acquisition or divestiture can negatively affect the stock price.

Analyst Ratings and Stock Price Predictions, Amgen stock price

Analyst ratings and price targets provide insights into market sentiment and future price expectations. It is important to note that these are predictions and not guarantees of future performance.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A | Buy | 250 | October 26, 2023 |

| Firm B | Hold | 225 | October 26, 2023 |

Overall market sentiment towards Amgen stock can be gauged from news coverage and investor discussions. Positive news and strong investor confidence generally lead to higher stock prices.

- Positive news coverage regarding new drug approvals or strong financial results generally boosts investor confidence and stock price.

- Negative news coverage or concerns about competition can lead to decreased investor confidence and lower stock prices.

Potential risks and opportunities impacting Amgen’s future stock performance include:

- Competition: Increased competition from other pharmaceutical companies could impact Amgen’s market share and revenue.

- Regulatory Changes: Changes in regulatory policies could affect the pricing and approval of Amgen’s drugs.

- Economic Downturn: A broader economic downturn could impact investor sentiment and reduce demand for Amgen’s products.

- Successful R&D: Successful development and launch of new drugs could significantly boost revenue and stock price.

Questions and Answers: Amgen Stock Price

What are the major risks associated with investing in Amgen stock?

Amgen’s stock price performance has been a topic of much discussion lately, particularly in comparison to other biotech companies. Investors are often looking at comparative analyses, and a common point of reference might be the current performance of tilray stock price , given its position in the cannabis sector. Ultimately, though, Amgen’s future trajectory will depend on its own pipeline and market dynamics.

Major risks include competition from other pharmaceutical companies, potential regulatory setbacks for new drug approvals, fluctuations in the overall stock market, and dependence on a limited number of key drugs.

How does Amgen’s dividend policy affect its stock price?

Amgen’s dividend policy influences investor sentiment; consistent dividend payouts can attract income-seeking investors, potentially boosting demand and stock price. Conversely, changes to dividend policy can impact investor perception and stock price.

Where can I find real-time Amgen stock price quotes?

Real-time quotes are available on major financial websites and stock trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the current market capitalization of Amgen?

The current market capitalization of Amgen fluctuates and can be found on major financial websites. It is best to check a reliable source for the most up-to-date information.