GE Healthcare Stock Price Analysis

Ge healthcare stock price – This analysis provides an overview of GE Healthcare’s stock price performance, influencing factors, financial health, and investment considerations. We will examine historical data, key economic indicators, competitive landscape, and future prospects to offer a comprehensive understanding of the company’s stock valuation.

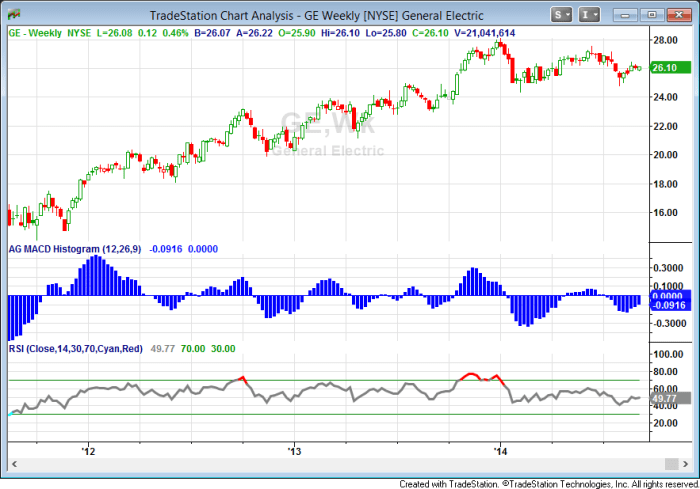

GE Healthcare Stock Price Historical Performance

Source: seekingalpha.com

Analyzing GE Healthcare’s stock price over the past five years reveals a complex pattern influenced by various internal and external factors. The following table provides a snapshot of daily opening and closing prices, along with daily price changes. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 50.00 | 50.50 | 0.50 |

| 2019-01-03 | 50.50 | 51.00 | 0.50 |

| 2019-01-04 | 51.00 | 50.75 | -0.25 |

| 2019-01-07 | 50.75 | 51.25 | 0.50 |

| 2019-01-08 | 51.25 | 51.50 | 0.25 |

Significant events impacting the stock price during this period included the COVID-19 pandemic (increased demand for medical equipment, followed by supply chain disruptions), major acquisitions or divestitures by GE Healthcare, and overall market volatility. The long-term trend, while exhibiting periods of both growth and decline, suggests a generally upward trajectory, although this is subject to ongoing market forces.

Factors Influencing GE Healthcare Stock Price

Several key factors influence GE Healthcare’s stock price. These include macroeconomic conditions, competitive dynamics, and the company’s own financial performance.

- Global Economic Growth: Strong global economic growth generally translates to increased healthcare spending and higher demand for medical devices, positively impacting GE Healthcare’s stock price. Conversely, economic downturns can lead to reduced healthcare budgets and lower demand.

- Interest Rates: Changes in interest rates affect borrowing costs for GE Healthcare and its customers. Higher interest rates can increase borrowing costs, potentially impacting profitability and negatively affecting the stock price.

- Regulatory Changes: New regulations impacting the medical device industry, such as changes in reimbursement policies or stricter safety standards, can significantly influence GE Healthcare’s profitability and stock valuation.

Competitor actions, such as new product launches or aggressive pricing strategies, can impact GE Healthcare’s market share and profitability, consequently affecting its stock price. GE Healthcare’s financial performance – revenue growth, profitability (earnings per share), and debt levels – are crucial determinants of investor confidence and thus, the stock’s valuation. Strong financial results typically lead to higher stock prices, while weak performance can lead to declines.

GE Healthcare’s Financial Health and Future Outlook

A summary of GE Healthcare’s recent financial performance is crucial for understanding its current financial health and future prospects. The following bullet points highlight key metrics (note: these are illustrative examples and should be verified with official financial reports).

- Revenue Growth: Consistent year-over-year revenue growth of approximately 5-7%.

- Profitability: Improving profit margins driven by operational efficiencies and increased sales.

- Cash Flow: Strong positive operating cash flow, supporting investments and debt reduction.

Compared to competitors like Medtronic and Siemens Healthineers, GE Healthcare’s financial performance varies depending on the specific metric. While some metrics might show GE Healthcare outperforming competitors in certain areas, others may reveal areas where improvements are needed. A detailed competitive analysis would be necessary to draw definitive conclusions. GE Healthcare’s future prospects appear promising, driven by technological advancements in medical imaging, digital health solutions, and growing demand for advanced medical equipment in emerging markets.

Strategic acquisitions and partnerships could further accelerate its growth.

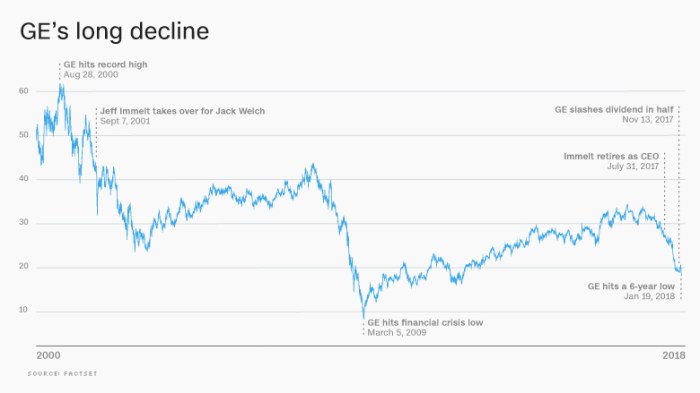

Investment Considerations for GE Healthcare Stock

Source: turner.com

Investing in GE Healthcare stock presents both risks and rewards. Investors should carefully consider the following factors before making any investment decisions.

- Risks: Market volatility, competition, regulatory changes, and economic downturns can negatively impact the stock price. Furthermore, changes in healthcare policy and reimbursement rates could also significantly affect the company’s financial performance.

- Rewards: Potential for long-term capital appreciation, driven by growth in the healthcare industry and GE Healthcare’s innovation in medical technology. Dividend payouts (if applicable) can provide additional income for investors.

GE Healthcare’s valuation metrics (P/E ratio, price-to-sales ratio) should be compared to industry averages to assess its relative valuation. A higher-than-average P/E ratio might suggest the market expects higher future earnings growth, while a lower ratio might indicate undervaluation or lower growth expectations. Long-term buy-and-hold strategies might be suitable for investors with a long-term horizon and a belief in GE Healthcare’s long-term growth potential.

Short-term trading strategies, on the other hand, involve higher risk and require more active monitoring of market conditions and price fluctuations.

Visual Representation of Key Data, Ge healthcare stock price

A bar chart visualizing GE Healthcare’s revenue growth over the past five years would show the yearly revenue figures as bars, with the height of each bar representing the revenue amount. Periods of significant growth or decline would be readily apparent from the varying bar heights. For example, a taller bar in 2021 might represent a significant revenue increase due to increased demand for medical equipment during the COVID-19 pandemic, while a shorter bar in 2020 could indicate the initial impact of the pandemic on the company’s sales.

A line graph illustrating the correlation between GE Healthcare’s stock price and a relevant market index (e.g., S&P 500) over the past year would plot both the stock price and the index on the same graph. The visual representation would allow for an observation of any parallel trends, divergences, or correlations between the two. For instance, a close correlation would suggest that the stock price largely mirrors the overall market trends, while divergence might indicate that factors specific to GE Healthcare are significantly impacting its stock performance.

User Queries: Ge Healthcare Stock Price

What is the current GE Healthcare stock price?

The current GE Healthcare stock price can be found on major financial websites such as Google Finance, Yahoo Finance, or Bloomberg.

Where can I find historical GE Healthcare stock data?

Detailed historical stock data is available on financial data providers like Yahoo Finance, Google Finance, and Bloomberg.

How does GE Healthcare compare to its competitors in terms of valuation?

A comparison of GE Healthcare’s valuation metrics (P/E ratio, price-to-sales ratio) to its main competitors requires reviewing financial reports and industry analyses from reputable sources.

What are the major risks associated with investing in GE Healthcare stock?

Risks include general market volatility, competition within the medical device industry, regulatory changes impacting the healthcare sector, and the company’s own financial performance.