Gilead Sciences: A Deep Dive into Stock Performance

Gilead stock price – Gilead Sciences, a biopharmaceutical giant, has a long and impactful history in the industry. This analysis delves into the company’s performance, exploring its history, financial standing, market position, and future prospects to provide a comprehensive understanding of its stock price fluctuations.

Gilead Sciences Company Overview

Source: seekingalpha.com

Founded in 1987, Gilead Sciences rapidly established itself as a leader in antiviral therapies. Initially focusing on HIV/AIDS treatments, the company expanded its portfolio to encompass hepatitis B and C, influenza, and other infectious diseases. Gilead’s primary business segments are focused on the research, development, and commercialization of innovative therapeutics. Revenue streams are generated through the sales of its patented drugs, licensing agreements, and collaborations with other pharmaceutical companies.

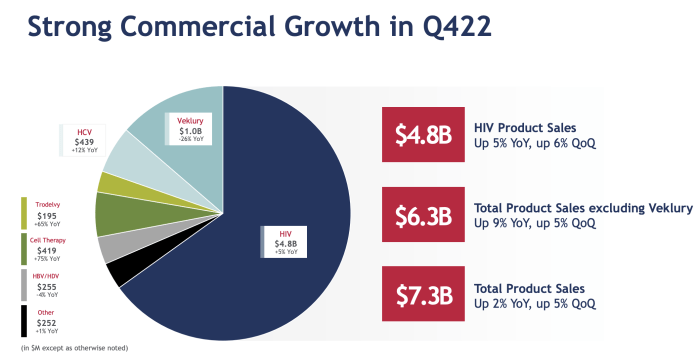

Gilead’s current product portfolio includes several blockbuster drugs. Key examples include Biktarvy (HIV treatment), Veklury (COVID-19 treatment), and several hepatitis C treatments. These drugs have significantly contributed to the company’s revenue and market dominance. The company’s research and development pipeline is actively pursuing new treatments in various therapeutic areas, including oncology, inflammation, and immunology, ensuring a continued flow of potential future revenue streams.

Factors Influencing Gilead Stock Price

Numerous factors influence Gilead’s stock price. These factors range from macroeconomic conditions to specific company events and industry trends.

| Factor | Impact | Description | Source |

|---|---|---|---|

| Macroeconomic Conditions (e.g., interest rates, inflation) | Significant | Broad economic trends affect investor sentiment and overall market performance, influencing demand for Gilead’s stock. Higher interest rates, for example, can reduce investment in riskier assets like pharmaceutical stocks. | Financial News Outlets, Economic Reports |

| Regulatory Environment (FDA approvals, pricing policies) | High | FDA approvals for new drugs or changes in pricing regulations directly impact Gilead’s revenue and profitability, subsequently affecting its stock price. Delays or rejections can negatively impact the stock. | FDA announcements, Pharmaceutical industry publications |

| Competitor Performance (new drug launches, market share) | Moderate to High | The success or failure of competing drugs significantly influences Gilead’s market share and revenue, impacting investor confidence. | Market research reports, competitor financial statements |

| Clinical Trial Results | High | Positive clinical trial results for new drugs can boost investor confidence and drive up the stock price, while negative results can have the opposite effect. For example, a successful Phase 3 trial for a new oncology drug would likely be met with a positive market response. | Clinical trial publications, company press releases |

Gilead’s Financial Performance

Analyzing Gilead’s recent financial reports reveals key trends in revenue, earnings, and profit margins. While specific numbers will vary depending on the reporting period, a consistent examination of these metrics is crucial for understanding the company’s financial health.

A graphical representation of Gilead’s revenue growth over the past five years would show a trend line. The x-axis would represent the years, and the y-axis would represent revenue in billions of dollars. The trend line would illustrate the overall growth or decline in revenue during this period. For example, a consistently upward sloping line would indicate strong revenue growth, while a flat or downward sloping line would suggest stagnation or decline.

Key inflection points, such as significant increases or decreases in revenue, should be clearly labeled and explained. Comparing Gilead’s performance to industry averages would require benchmarking against similar pharmaceutical companies and analyzing relative performance.

Investor Sentiment and Market Analysis

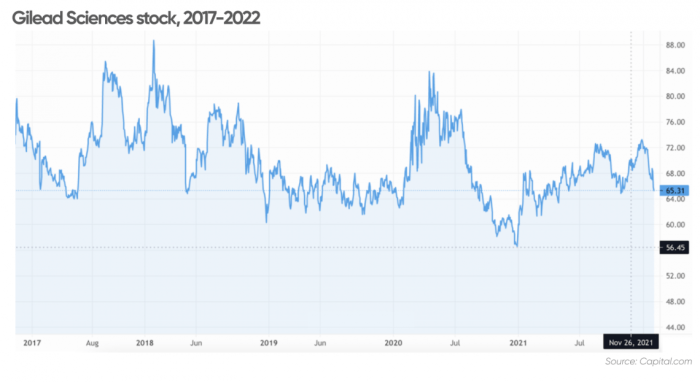

Source: capital.com

Current investor sentiment towards Gilead Sciences is generally positive, although it can fluctuate based on news events and market conditions. Major news events, such as FDA approvals, significant clinical trial results, or major partnerships, often have a substantial impact on Gilead’s stock price. For instance, the approval of a new drug would likely lead to a short-term increase in the stock price.

The current market valuation of Gilead is determined by factors such as its earnings, growth prospects, and risk profile. Comparing Gilead’s price-to-earnings ratio (P/E) to its competitors provides insights into its relative valuation within the market.

Future Outlook and Predictions

Potential future growth drivers for Gilead include the continued success of existing drugs, the launch of new drugs from its pipeline, and strategic acquisitions or partnerships. However, potential risks and challenges include competition from other pharmaceutical companies, pricing pressures, and regulatory hurdles. A hypothetical scenario illustrating the potential impact of a significant new drug launch would involve projecting increased revenue and market share, resulting in a higher stock price.

For example, a successful launch of a new cancer treatment could significantly boost revenue and earnings, leading to a substantial increase in the stock price.

Predicting Gilead’s stock price in the next 12 months is inherently speculative. However, based on current market conditions, the company’s financial performance, and its future growth prospects, a reasoned prediction could be made. This prediction should be based on a combination of quantitative and qualitative factors, taking into account potential risks and uncertainties. For example, a prediction might be based on an estimated growth rate for revenue and earnings, along with an assessment of the overall market environment.

Such a prediction would include a range of possible outcomes, reflecting the inherent uncertainty involved in any market forecast. A successful track record in drug approvals and market penetration could support a positive outlook, while regulatory challenges or unexpected competition could temper expectations.

FAQ Compilation: Gilead Stock Price

What are the major risks associated with investing in Gilead stock?

Major risks include competition from other pharmaceutical companies, regulatory hurdles for new drug approvals, potential patent expirations affecting existing revenue streams, and fluctuations in the overall stock market.

How does Gilead’s dividend payout compare to its competitors?

A direct comparison requires researching competitor dividend yields and payout ratios. This information is readily available through financial news sources and investor relations websites.

What is Gilead’s current debt-to-equity ratio?

This ratio can be found in Gilead’s financial statements, usually within their quarterly or annual reports available on their investor relations website.

Where can I find real-time Gilead stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms.