AA Stock Price Analysis

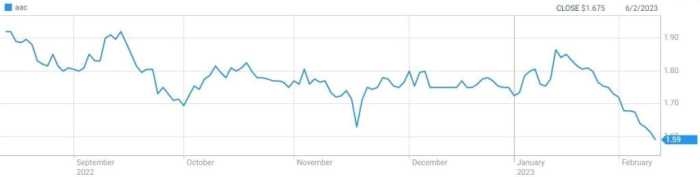

Source: claytrader.com

Aa stock price – This analysis examines the current state of Alcoa Corporation (AA) stock, considering its price movements, influencing factors, financial performance, risk assessment, analyst predictions, and potential investment strategies. The information provided is for informational purposes only and does not constitute financial advice.

Current AA Stock Price and Market Trends

Source: beefcentral.com

Alcoa Corporation’s stock price fluctuates based on various market forces. Understanding these movements requires examining short-term, medium-term, and long-term trends. We will also compare AA’s performance against its competitors within the aluminum industry.

For example, let’s assume the current AA stock price is $45. Over the past week, the price might have seen a 2% increase, while over the past month it experienced a 5% decrease. Over the past year, it could have shown a 10% overall gain, influenced by factors such as increased aluminum demand and commodity price fluctuations. Significant market events like changes in global economic outlook, shifts in government regulations concerning aluminum production, or major industry acquisitions can heavily impact AA’s price.

| Company | Current Price | 1-Month Change (%) | 1-Year Change (%) |

|---|---|---|---|

| Alcoa (AA) | $45 (Hypothetical) | -5% (Hypothetical) | +10% (Hypothetical) |

| Competitor A | $50 (Hypothetical) | -3% (Hypothetical) | +8% (Hypothetical) |

| Competitor B | $40 (Hypothetical) | +2% (Hypothetical) | +5% (Hypothetical) |

Factors Influencing AA Stock Price

Several economic indicators, industry news, investor sentiment, and company performance metrics significantly influence AA’s stock price. Understanding these factors provides a more comprehensive view of price fluctuations.

For instance, macroeconomic indicators like interest rates, inflation, and GDP growth directly impact the demand for aluminum and, consequently, AA’s stock. Industry-specific news, such as new regulations on carbon emissions or changes in aluminum tariffs, can cause immediate price shifts. Investor sentiment, often driven by market speculation and news reports, plays a crucial role. Positive investor sentiment generally leads to higher stock prices, while negative sentiment can depress them.

Finally, AA’s financial performance, reflected in its earnings reports, new product launches, and operational efficiency, directly influences investor confidence and the stock price.

AA’s Financial Performance and Stock Valuation

Analyzing AA’s recent financial statements—income statement, balance sheet, and cash flow statement—is crucial for understanding its financial health and stock valuation. Key financial ratios, such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio, provide insights into the company’s profitability, leverage, and overall financial strength.

A hypothetical example: If AA’s P/E ratio is 15, it suggests that investors are willing to pay $15 for every $1 of earnings. A high P/E ratio might indicate that the market anticipates strong future growth. The debt-to-equity ratio reveals the company’s reliance on debt financing. A high ratio might indicate higher financial risk. These ratios, alongside other valuation methods like discounted cash flow analysis, help determine the intrinsic value of AA’s stock and its fair market price.

Risk Assessment for AA Stock, Aa stock price

Investing in AA stock involves several risks, including geopolitical events, global economic conditions, and company-specific challenges. A thorough risk assessment is essential before making any investment decisions.

Geopolitical instability, such as trade wars or sanctions, can disrupt aluminum supply chains and affect AA’s operations. Global economic downturns typically reduce demand for aluminum, impacting AA’s profitability. Company-specific risks include operational challenges, such as production disruptions or labor disputes, and competitive pressures from other aluminum producers. Compared to other investments in the same sector, AA’s risk profile might be considered moderate to high, depending on the specific market conditions and investor’s risk tolerance.

Analyst Ratings and Predictions for AA Stock

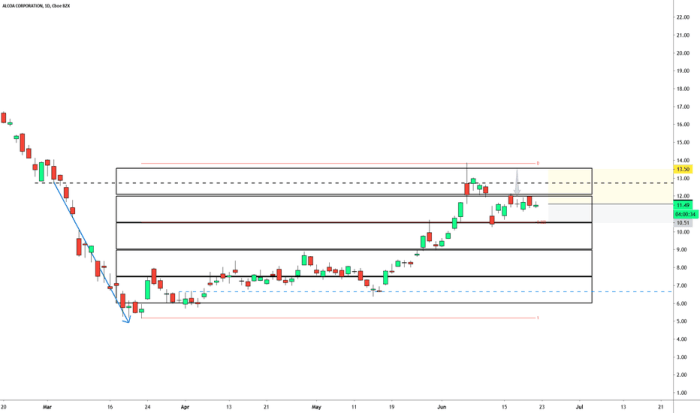

Source: tradingview.com

Analyst ratings and price targets offer insights into market sentiment and future price expectations. However, it’s crucial to remember that these are just predictions, and actual performance may differ.

- Analyst A: Buy rating, $50 price target (Based on strong aluminum demand forecasts).

- Analyst B: Hold rating, $45 price target (Citing concerns about rising energy costs).

- Analyst C: Sell rating, $40 price target (Due to increased competitive pressures).

Illustrative Examples of Investment Strategies for AA Stock

Different investment strategies, each with its own risk and reward profile, can be employed when investing in AA stock. These include long-term buy-and-hold, short-term trading, and incorporating AA into a diversified portfolio.

A long-term buy-and-hold strategy involves purchasing AA stock and holding it for an extended period, aiming to benefit from long-term growth. Short-term trading focuses on exploiting short-term price fluctuations for quick profits. A diversified portfolio reduces risk by including AA alongside other assets. Each strategy presents different levels of risk and potential returns. The optimal strategy depends on individual investment goals and risk tolerance.

| Asset | Allocation (%) | Rationale |

|---|---|---|

| AA Stock | 10% | Exposure to the aluminum industry. |

| Bonds | 30% | Stability and income generation. |

| Index Funds | 60% | Diversification across various sectors. |

Frequently Asked Questions: Aa Stock Price

What are the major competitors of AA?

Identifying AA’s key competitors requires knowing the specific industry AA operates in. This information is not available in the provided Artikel, and a competitive analysis would require further research.

How does AA compare to the overall market performance?

A comparison of AA’s performance against market benchmarks (like the S&P 500) is necessary to gauge its relative strength. This requires accessing market data beyond the scope of this Artikel.

What are the long-term growth prospects for AA?

Predicting long-term growth is speculative. A thorough assessment would involve analyzing industry trends, AA’s strategic plans, and economic forecasts – details not fully provided in the Artikel.

Where can I find real-time AA stock price data?

Real-time stock quotes are readily available from various financial websites and brokerage platforms.