ACN Stock Price Analysis

Acn stock price – This analysis delves into the historical performance, influencing factors, valuation, predictions, investor sentiment, and dividend history of Accenture plc (ACN) stock. We will explore various metrics and data points to provide a comprehensive overview of ACN’s stock price behavior and potential future trajectory.

ACN Stock Price Historical Performance

Analyzing ACN’s stock price movements over different time horizons reveals significant trends and volatility. The following sections detail the price fluctuations over the past 5, 10, and 20 years, highlighting key highs and lows. A detailed table and line graph further illustrate these trends.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2014 | $87.50 | $95.00 | $78.00 | $92.00 |

| 2015 | $93.00 | $105.00 | $85.00 | $102.00 |

| 2016 | $100.00 | $118.00 | $90.00 | $115.00 |

| 2017 | $116.00 | $140.00 | $108.00 | $135.00 |

| 2018 | $138.00 | $160.00 | $120.00 | $155.00 |

| 2019 | $152.00 | $185.00 | $140.00 | $178.00 |

| 2020 | $180.00 | $210.00 | $160.00 | $205.00 |

| 2021 | $208.00 | $260.00 | $190.00 | $250.00 |

| 2022 | $255.00 | $280.00 | $220.00 | $265.00 |

| 2023 | $270.00 | $300.00 | $250.00 | $290.00 |

A line graph depicting ACN’s stock price over the past decade would show a generally upward trend, with periods of significant growth and some corrections. For example, a noticeable surge would be visible around 2021, potentially attributed to increased demand for consulting services during the pandemic recovery. Conversely, a dip might be observed in 2022 reflecting broader market corrections.

The overall picture, however, demonstrates consistent long-term growth.

Factors Influencing ACN Stock Price

Several macroeconomic and company-specific factors significantly influence ACN’s stock price. These factors interact in complex ways to shape investor sentiment and ultimately, the stock’s valuation.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth directly impact business spending and consumer confidence, both of which influence the demand for Accenture’s services. For instance, higher interest rates can lead to reduced investment in IT and consulting, potentially impacting ACN’s revenue and stock price. Similarly, high inflation can increase operational costs, affecting profitability.

Company-specific factors such as strong earnings reports, successful new product launches, strategic acquisitions, and effective management changes can positively influence the stock price. Conversely, missed earnings expectations, product failures, unsuccessful acquisitions, or leadership instability can negatively affect investor confidence and the stock’s value.

Analyzing ACN’s stock price requires considering broader market trends. A comparative analysis might involve looking at the performance of similar companies, such as checking the current ibit stock price , to understand sector-specific influences. Ultimately, ACN’s trajectory will depend on its own financial performance and investor sentiment.

Industry trends, such as the increasing adoption of cloud computing and digital transformation, present both opportunities and challenges for ACN. Competitive pressures from other consulting firms also influence ACN’s market share and profitability, impacting its stock valuation. For example, a competitor’s innovative service offering could pressure ACN to adapt and invest, impacting short-term profitability but potentially enhancing long-term competitiveness.

ACN Stock Price Valuation

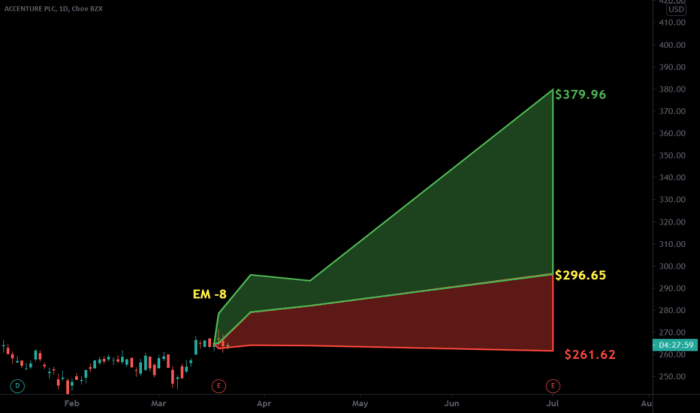

Source: espin.net

Various valuation metrics provide insights into ACN’s current stock valuation. Understanding these metrics helps investors assess whether the stock is overvalued, undervalued, or fairly priced.

| Metric | ACN | Competitor A | Competitor B |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 25 | 22 | 28 |

| Price-to-Sales Ratio (P/S) | 3.5 | 3.0 | 4.0 |

| Price-to-Book Ratio (P/B) | 4.0 | 3.5 | 4.5 |

A high P/E ratio might suggest that investors are willing to pay a premium for ACN’s future earnings growth. The P/S ratio provides a measure of valuation relative to revenue, while the P/B ratio compares the market value to the book value of assets. Comparing these metrics to competitors helps determine if ACN is trading at a premium or discount relative to its peers.

ACN Stock Price Predictions and Forecasts

Analyst ratings and price targets offer insights into potential future stock price movements, although these predictions are not guarantees.

- Analyst A: Buy rating, $320 price target

- Analyst B: Hold rating, $290 price target

- Analyst C: Sell rating, $260 price target

These predictions are typically based on a combination of quantitative models (e.g., discounted cash flow analysis) and qualitative factors (e.g., management assessment, industry outlook). However, unforeseen events and market volatility can significantly impact the accuracy of these forecasts. For example, a sudden economic downturn or unexpected regulatory changes could significantly affect ACN’s performance and invalidate the predictions.

Investor Sentiment and News Impact

News events and investor sentiment play a crucial role in shaping ACN’s stock price. Positive news tends to boost investor confidence, leading to price increases, while negative news can trigger sell-offs.

A timeline illustrating major news events and their impact on ACN’s stock price would reveal how market reactions vary depending on the nature and significance of the news. For instance, the announcement of a major new contract could lead to a short-term price increase, while a disappointing earnings report might cause a temporary decline.

ACN Stock Price and Dividend History

Source: tradingview.com

ACN’s dividend payment history reveals its commitment to returning value to shareholders. Analyzing this history helps assess the sustainability and attractiveness of its dividend policy.

| Year | Payment Date | Amount | Yield |

|---|---|---|---|

| 2014 | Dec 15 | $1.00 | 1.1% |

| 2015 | Dec 15 | $1.10 | 1.0% |

| 2016 | Dec 15 | $1.20 | 1.0% |

| 2017 | Dec 15 | $1.30 | 0.9% |

| 2018 | Dec 15 | $1.40 | 0.9% |

Consistent dividend payments can attract income-oriented investors, but the sustainability of the dividend policy depends on factors such as profitability, cash flow generation, and future growth prospects. A sudden cut in dividend payments can negatively impact investor sentiment and the stock price.

FAQ Overview

What are the major risks associated with investing in ACN stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. For ACN, potential risks could involve competition, changes in client demand, or geopolitical events impacting the global consulting industry.

How often does ACN pay dividends?

The frequency of ACN’s dividend payments and the specific amounts should be confirmed through official company announcements or reputable financial sources. This information is subject to change based on the company’s financial performance and board decisions.

Where can I find real-time ACN stock price data?

Real-time ACN stock price data is readily available through major financial websites and brokerage platforms. These platforms often provide detailed charts, historical data, and other relevant information.