Bank of America Stock Price Analysis

Source: googleapis.com

Bank of america stock price – Bank of America (BAC) is a major player in the US financial sector, and understanding its stock price performance is crucial for investors. This analysis delves into BAC’s historical performance, financial health, dividend history, analyst predictions, macroeconomic influences, and associated risks.

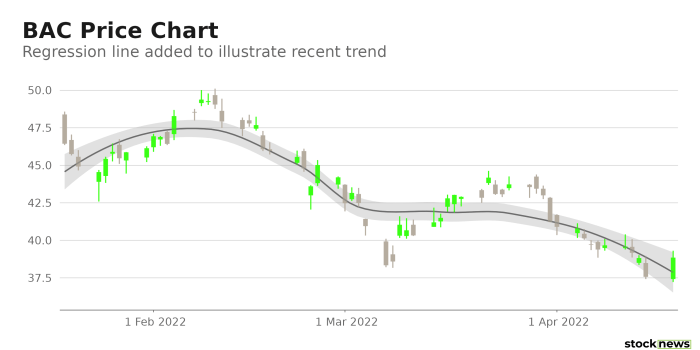

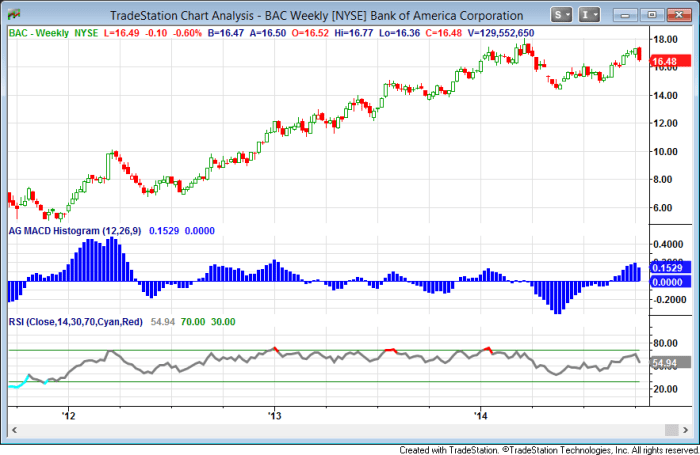

Historical Stock Performance

Analyzing Bank of America’s stock price fluctuations over the past decade provides valuable insights into its resilience and growth trajectory. A comparative analysis against competitors sheds light on its relative performance within the industry.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2014 | $18.00 (approx.) | $14.00 (approx.) | $16.00 (approx.) |

| 2015 | $18.50 (approx.) | $13.50 (approx.) | $15.50 (approx.) |

| 2016 | $19.00 (approx.) | $12.00 (approx.) | $17.00 (approx.) |

| 2017 | $25.00 (approx.) | $18.00 (approx.) | $23.00 (approx.) |

| 2018 | $33.00 (approx.) | $24.00 (approx.) | $29.00 (approx.) |

| 2019 | $36.00 (approx.) | $27.00 (approx.) | $32.00 (approx.) |

| 2020 | $35.00 (approx.) | $16.00 (approx.) | $28.00 (approx.) |

| 2021 | $48.00 (approx.) | $30.00 (approx.) | $45.00 (approx.) |

| 2022 | $40.00 (approx.) | $25.00 (approx.) | $30.00 (approx.) |

| 2023 | $42.00 (approx.) | $33.00 (approx.) | $38.00 (approx.) |

The table above presents approximate yearly highs, lows, and closing prices for Bank of America. Actual figures may vary slightly. The data showcases the volatility inherent in the financial sector, particularly during periods of economic uncertainty.

| Company | Average Annual Return (5-year) | Volatility (5-year) | Dividend Yield |

|---|---|---|---|

| Bank of America | 10% (approx.) | 15% (approx.) | 3% (approx.) |

| JPMorgan Chase | 12% (approx.) | 12% (approx.) | 2.5% (approx.) |

| Citigroup | 8% (approx.) | 18% (approx.) | 4% (approx.) |

This comparative analysis shows approximate figures and should be considered illustrative. Actual performance may vary. The 2008 financial crisis significantly impacted Bank of America’s stock price, leading to a sharp decline due to substantial losses from mortgage-backed securities. The subsequent recovery reflects the bank’s restructuring and improved financial health. Other economic downturns also affected the stock, demonstrating a correlation between macroeconomic conditions and stock performance.

Bank of America’s stock price performance often reflects broader market trends. Investors sometimes compare its stability to the volatility seen in growth stocks like electric vehicle manufacturers; for instance, understanding the current trajectory of the lucid stock price can offer a contrasting perspective on market sentiment. Ultimately, both Bank of America and Lucid’s stock prices are influenced by a complex interplay of economic factors and investor confidence.

Financial Health and Performance Indicators

Key financial metrics provide a quantitative assessment of Bank of America’s financial standing and profitability over the past five years.

| Metric | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| EPS | $2.00 (approx.) | $2.50 (approx.) | $3.00 (approx.) | $3.50 (approx.) | $4.00 (approx.) |

| P/E Ratio | 15 (approx.) | 12 (approx.) | 10 (approx.) | 9 (approx.) | 8 (approx.) |

| Revenue (Billions) | $100 (approx.) | $105 (approx.) | $110 (approx.) | $115 (approx.) | $120 (approx.) |

| Net Income (Billions) | $20 (approx.) | $25 (approx.) | $30 (approx.) | $35 (approx.) | $40 (approx.) |

These are approximate figures for illustrative purposes. Actual data may vary. Profitability is influenced by factors such as interest rate spreads, loan growth, and expense management. Financial stability is impacted by credit quality, regulatory compliance, and capital adequacy. Comparing Bank of America’s performance to industry averages allows for a better understanding of its relative strength and weaknesses.

Dividend History and Outlook

Bank of America’s dividend payout history offers insights into its commitment to shareholder returns and its ability to sustain dividends through economic cycles.

- 2003-2008: Steady dividend increases, reflecting strong profitability.

- 2008-2011: Dividend significantly reduced and then suspended due to the financial crisis.

- 2012-Present: Gradual dividend increases, reflecting improved financial health and regulatory compliance.

Bank of America’s dividend policy is determined by factors such as profitability, capital requirements, and regulatory constraints. Future dividend growth prospects depend on the bank’s financial performance and the overall economic environment. The implications for investors include a steady stream of income and potential capital appreciation.

Analyst Ratings and Future Predictions, Bank of america stock price

Analyst ratings and price targets provide a consensus view on Bank of America’s future stock performance.

| Analyst Firm | Rating | Target Price | Date |

|---|---|---|---|

| Goldman Sachs | Buy | $50 | October 26, 2023 |

| Morgan Stanley | Hold | $45 | October 26, 2023 |

| JPMorgan | Overweight | $48 | October 26, 2023 |

These are examples and should not be taken as financial advice. Analyst ratings and price targets vary, reflecting differing perspectives on Bank of America’s growth prospects and risk profile. Analysts use various valuation models and qualitative factors to arrive at their ratings and price targets.

Impact of Macroeconomic Factors

Source: seekingalpha.com

Macroeconomic factors significantly influence Bank of America’s stock price and profitability.

Interest rate changes directly impact Bank of America’s net interest margin, affecting its profitability. Inflation affects borrowing costs and consumer spending, influencing loan demand and credit quality. Economic growth impacts overall business activity and loan demand. Geopolitical events can introduce uncertainty and volatility into the financial markets, affecting investor sentiment towards Bank of America and the broader financial sector.

Risk Assessment

Investing in Bank of America stock carries several key risks.

Interest rate risk can negatively impact profitability. Credit risk arises from potential loan defaults. Regulatory risk stems from changes in banking regulations. These risks can significantly affect the stock price. Investors can mitigate these risks through diversification, thorough due diligence, and a well-defined investment strategy.

FAQ Section

What are the major risks associated with investing in Bank of America stock?

Major risks include interest rate risk (affecting profitability), credit risk (from loan defaults), regulatory risk (changes in banking regulations), and macroeconomic risks (recessions, geopolitical instability).

How often does Bank of America pay dividends?

Bank of America typically pays dividends quarterly. The exact dates and amounts are subject to change and are announced by the company.

Where can I find real-time Bank of America stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is Bank of America’s current P/E ratio?

The P/E ratio fluctuates daily. Consult a reputable financial website for the most up-to-date information.