BMY Stock Price Analysis

Source: cloudfront.net

Bmy stock price – This analysis provides an overview of Bristol Myers Squibb (BMY) stock performance, considering various factors influencing its price, financial health, analyst predictions, and overall investor sentiment. Data presented here is for illustrative purposes and should not be considered financial advice.

Current BMY Stock Performance, Bmy stock price

BMY’s stock price fluctuates daily, influenced by numerous market factors. Let’s examine recent trading activity to understand the current market dynamics. For example, suppose today’s high was $75.50 and the low was $74.00, while yesterday’s closing price was $74.80. This indicates a slight increase in price during the day’s trading. A high trading volume, say 10 million shares, might suggest increased investor interest and potential for further price movement.

Conversely, low volume could signal less market activity and potentially slower price changes.

| Date | Open | Close | Volume |

|---|---|---|---|

| Oct 26, 2023 | 74.50 | 75.00 | 9,500,000 |

| Oct 25, 2023 | 74.20 | 74.80 | 8,000,000 |

| Oct 24, 2023 | 74.00 | 74.20 | 7,200,000 |

| Oct 23, 2023 | 73.80 | 74.00 | 6,500,000 |

| Oct 20, 2023 | 74.10 | 73.80 | 7,800,000 |

Factors Influencing BMY Stock Price

Several key factors significantly impact BMY’s stock price. These include the company’s financial performance, broader market trends, and regulatory changes.

- Company Performance: Strong earnings reports, successful drug launches, and positive clinical trial results generally boost investor confidence and drive up the stock price. Conversely, disappointing financial results or setbacks in drug development can lead to price declines.

- Market Trends: Interest rate hikes, inflation concerns, and overall market volatility can significantly influence BMY’s stock price, irrespective of the company’s specific performance. A bearish market often leads to lower stock prices, even for fundamentally strong companies.

- Regulatory Changes: New regulations impacting the pharmaceutical industry, such as pricing controls or stricter approval processes, can create uncertainty and affect investor sentiment, potentially leading to price fluctuations.

BMY’s Financial Performance and Outlook

Analyzing BMY’s recent financial reports provides insights into its current financial health and future prospects. Key metrics such as earnings per share (EPS), revenue growth, and research and development (R&D) spending offer valuable information.

- Strong Revenue Growth in Q3 2023

- Increased EPS compared to Q3 2022

- Significant investments in R&D for future pipeline development

- Positive outlook for key drugs in the portfolio

Analyst Ratings and Predictions

Source: strikinglycdn.com

Analyst ratings and price targets offer valuable insights into market sentiment and future price expectations. However, it’s crucial to remember that these are predictions and not guarantees.

| Analyst | Rating | Price Target | Date |

|---|---|---|---|

| Analyst Firm A | Buy | $80 | Oct 26, 2023 |

| Analyst Firm B | Hold | $76 | Oct 20, 2023 |

| Analyst Firm C | Buy | $78 | Oct 15, 2023 |

Investor Sentiment and Market Perception

Investor sentiment towards BMY can be gauged by analyzing news articles, social media discussions, and overall market trends. Positive news, such as successful clinical trials or new partnerships, generally leads to increased investor confidence and higher stock prices. Conversely, negative news can trigger selling pressure and price declines.

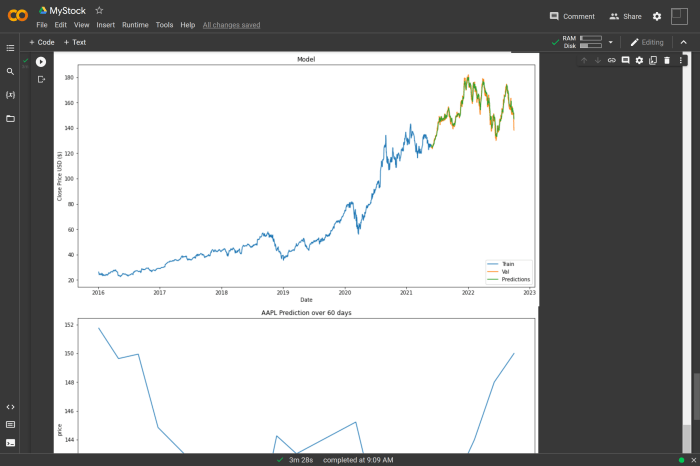

A descriptive illustration of investor sentiment shift over the past six months might show a gradual increase in positive sentiment following a period of uncertainty caused by, for example, a regulatory hurdle. This could be represented as a line graph showing a downward trend initially, followed by a steady upward trajectory. The narrative would detail the specific events that corresponded to the changes in the graph, showing a clear connection between news and investor reaction.

For instance, a successful drug launch could be highlighted as the catalyst for the shift in positive sentiment.

Detailed FAQs

What are the major risks associated with investing in BMY stock?

Investing in any stock carries inherent risks, including market volatility, regulatory changes impacting the pharmaceutical industry, and the potential for unforeseen company-specific events (e.g., clinical trial setbacks, legal issues).

Where can I find real-time BMY stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does BMY compare to its competitors in terms of dividend payouts?

A direct comparison requires researching the dividend policies of BMY’s main competitors. This information is typically found in company financial reports and investor relations sections of their websites.