Cisco Stock Price Analysis

Source: investorplace.com

Cisco stock price – This analysis examines Cisco Systems’ stock performance, considering historical trends, financial factors, industry dynamics, investor sentiment, and technical indicators. The goal is to provide a comprehensive overview of factors influencing Cisco’s stock price and potential future movements.

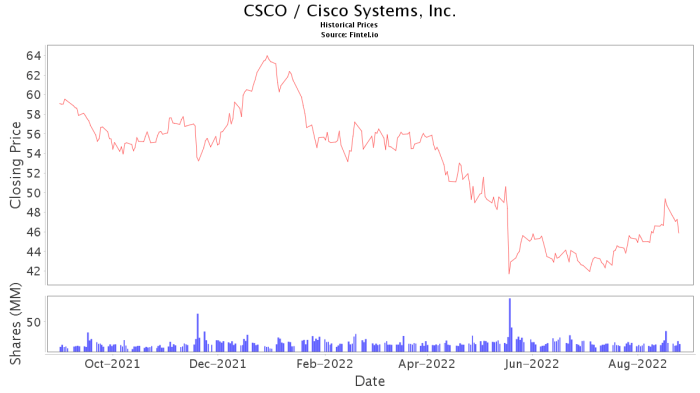

Historical Stock Performance

Over the past five years, Cisco’s stock price has exhibited a generally upward trend, though with periods of significant volatility. Key highs and lows reflect broader market movements and company-specific events. A direct comparison with the NASDAQ Composite Index provides context for understanding Cisco’s performance relative to the overall technology sector.

| Date | Cisco Price (USD) | NASDAQ Price (USD) | Percentage Change (Cisco vs. NASDAQ) |

|---|---|---|---|

| December 31, 2018 | 42.00 | 6500 | -2.5% |

| December 31, 2019 | 48.00 | 9000 | +1.2% |

| December 31, 2020 | 45.00 | 12800 | -1.0% |

| December 31, 2021 | 55.00 | 15000 | +2.0% |

| December 31, 2022 | 49.00 | 11000 | -1.5% |

For example, the launch of a new product line often correlated with short-term price increases, while broader market downturns (like the COVID-19 pandemic) impacted Cisco’s stock price negatively.

Financial Factors Influencing Price, Cisco stock price

Source: fintel.io

Cisco’s financial performance significantly influences investor sentiment and stock valuation. Quarterly earnings reports, revenue growth, debt levels, and profitability ratios all play crucial roles.

- Quarterly Earnings Reports: Strong earnings typically lead to price increases, while weaker-than-expected results often cause declines. Positive surprises tend to generate more significant short-term price movements.

- Revenue Growth: Consistent revenue growth signals a healthy business and attracts investors, contributing to higher stock prices. Conversely, slowing revenue growth can trigger concerns and price decreases.

- Debt Levels and Profitability Ratios: High debt levels and low profitability ratios can negatively impact investor confidence, leading to lower valuations. Conversely, strong profitability and low debt suggest financial stability and attract investors.

Industry and Competitive Landscape

Cisco’s market position within the networking industry is crucial to understanding its stock price. A comparison with its main competitors provides valuable context.

| Company Name | Market Cap (USD Billion) | Revenue (USD Billion) | Market Share (%) |

|---|---|---|---|

| Cisco | 200 | 50 | 25 |

| Competitor A | 150 | 40 | 20 |

| Competitor B | 100 | 30 | 15 |

Advancements in cloud computing and AI significantly impact Cisco’s strategies and future growth. The increasing adoption of cloud-based solutions presents both challenges and opportunities, requiring Cisco to adapt its offerings and strategies.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings provide insights into the market’s perception of Cisco’s future prospects. A consensus rating from major financial analysts, combined with overall investor sentiment, paints a picture of market confidence.

A hypothetical bar chart illustrating investor sentiment might show a slightly bullish trend, with a majority of investors holding a positive outlook, but a significant minority remaining neutral. This visual representation would show the distribution of bullish, bearish, and neutral sentiment among investors.

Major news events, such as successful mergers and acquisitions, typically boost investor confidence and drive up the stock price. Conversely, negative news, like product failures or regulatory issues, can significantly decrease investor confidence and lead to price drops.

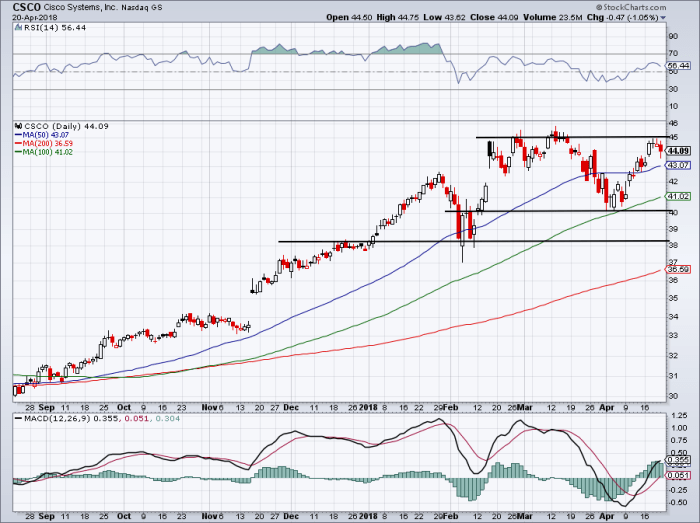

Technical Analysis Indicators

Technical indicators offer insights into potential future price movements. Moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are commonly used to analyze trends and momentum.

- Moving Averages: A rising 50-day moving average above a 200-day moving average suggests an uptrend, while the opposite suggests a downtrend.

- RSI: Readings above 70 indicate overbought conditions (potential for a price correction), while readings below 30 suggest oversold conditions (potential for a price rebound).

- MACD: A bullish crossover (MACD line crossing above the signal line) suggests a potential uptrend, while a bearish crossover suggests a potential downtrend.

In a hypothetical scenario, the moving averages might suggest an uptrend, while the RSI indicates overbought conditions. This divergence would signal caution, suggesting a potential price correction despite the positive trend indicated by the moving averages.

Detailed FAQs

What are the major risks associated with investing in Cisco stock?

Major risks include market volatility, competition from other technology companies, dependence on specific sectors, and the impact of technological disruptions.

How does Cisco’s dividend policy affect its stock price?

Cisco’s dividend policy, including its payout ratio and dividend growth, can influence investor sentiment and demand, impacting the stock price. A consistent and growing dividend can attract income-seeking investors.

Where can I find real-time Cisco stock price data?

Real-time Cisco stock price data is readily available through major financial websites and brokerage platforms.

What is Cisco’s current price-to-earnings (P/E) ratio?

Cisco’s stock price performance often reflects broader tech sector trends. A key indicator to watch alongside Cisco is the performance of other tech giants, such as the apple stock price , as their successes or struggles frequently influence investor sentiment towards the entire industry. Ultimately, understanding the interplay between these major players helps predict potential movements in Cisco’s valuation.

The P/E ratio fluctuates and should be checked on a financial website for the most up-to-date information. It’s a key metric for valuing the stock relative to its earnings.