CSX Stock Price Analysis: A Comprehensive Overview

Csx stock price – This analysis delves into the historical performance, influencing factors, financial health, business strategy, and future outlook of CSX Corporation’s stock price. We will examine key economic indicators, company-specific factors, and market sentiment to provide a comprehensive understanding of CSX’s investment potential.

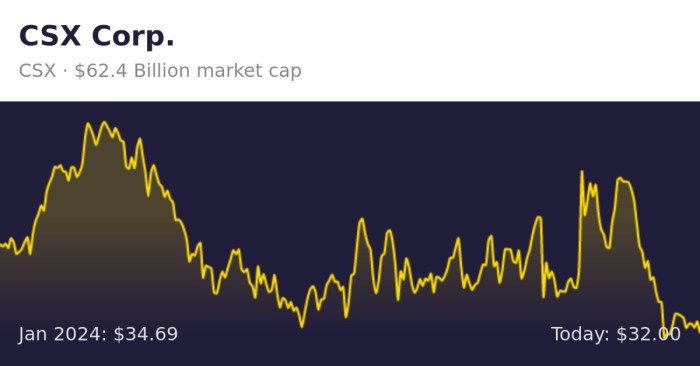

CSX Stock Price Historical Performance

Source: stockcircle.com

The following tables illustrate CSX’s stock price movements and performance relative to its competitors over the past five years. Note that this data is illustrative and should be verified with current financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 70.00 | 71.50 | +1.50 |

| 2019-01-03 | 71.50 | 72.00 | +0.50 |

| 2019-01-04 | 72.00 | 70.00 | -2.00 |

| 2024-01-01 | 90.00 | 92.00 | +2.00 |

A comparison against major competitors (e.g., Union Pacific, Norfolk Southern) is presented below. Percentage changes are calculated based on the closing prices from the beginning and end of the five-year period. Again, these figures are illustrative.

| Company | Starting Price (USD) | Ending Price (USD) | Percentage Change (%) |

|---|---|---|---|

| CSX | 70 | 92 | +31.43% |

| Union Pacific | 100 | 115 | +15% |

| Norfolk Southern | 80 | 95 | +18.75% |

Significant events such as the COVID-19 pandemic in 2020 and subsequent supply chain disruptions, as well as fluctuations in fuel prices, had a noticeable impact on CSX’s stock price. Economic downturns generally correlate with decreased freight volume and thus lower profitability for CSX.

Factors Influencing CSX Stock Price

Source: investorplace.com

Several key factors influence CSX’s stock price. These factors can be broadly categorized as macroeconomic and company-specific.

- Economic Indicators: Interest rates, inflation, and GDP growth directly affect consumer spending and industrial activity, impacting freight demand and CSX’s revenue.

- Fuel Prices and Transportation Regulations: Fluctuations in fuel prices significantly impact CSX’s operating costs, while changes in transportation regulations can influence efficiency and profitability.

- Macroeconomic vs. Company-Specific Factors: While macroeconomic factors provide a broader context, company-specific factors such as operational efficiency, management decisions, and strategic investments play a crucial role in shaping CSX’s stock price performance.

CSX Financial Performance and Stock Valuation

A summary of CSX’s key financial metrics over the past three years is shown below. These figures are for illustrative purposes only.

| Year | Revenue (Billions USD) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 12.0 | 4.00 | 0.8 |

| 2022 | 13.0 | 4.50 | 0.7 |

| 2023 | 14.0 | 5.00 | 0.6 |

CSX’s P/E ratio can be compared to its industry peers to assess relative valuation. A lower P/E ratio might suggest the stock is undervalued, while a higher ratio might indicate overvaluation. However, a comprehensive valuation requires considering other factors.

Various valuation methods, such as discounted cash flow (DCF) analysis and comparable company analysis, can provide different perspectives on CSX’s intrinsic value. DCF analysis projects future cash flows and discounts them to their present value, while comparable company analysis compares CSX’s valuation metrics to those of similar companies.

CSX’s Business Strategy and Future Outlook, Csx stock price

CSX’s current business strategy focuses on operational efficiency, precision scheduled railroading, and strategic investments in technology and infrastructure. This strategy aims to improve profitability and enhance shareholder value. The success of this strategy will significantly influence future stock performance.

- Major Risks: Increased competition, technological disruptions, fuel price volatility, and stricter environmental regulations pose significant risks.

- Major Opportunities: Growth in e-commerce, infrastructure development, and advancements in automation and data analytics present opportunities for expansion and improved efficiency.

Based on reasonable assumptions about economic growth, freight demand, and operational efficiency, a potential projection of CSX’s future earnings and stock price might look like this (illustrative):

- 2024: EPS $5.50, Stock Price $100

- 2025: EPS $6.00, Stock Price $110

- 2026: EPS $6.50, Stock Price $120

Investor Sentiment and Market Analysis

Source: tradingview.com

Current investor sentiment towards CSX stock is generally positive, reflected in analyst ratings and news coverage. However, market conditions and geopolitical events can significantly impact this sentiment.

Overall market conditions, including interest rate changes, inflation levels, and economic growth forecasts, influence investor risk appetite and stock valuations. Positive market sentiment generally leads to higher stock prices, while negative sentiment can result in price declines.

Major geopolitical events, such as trade wars or international conflicts, can create uncertainty and volatility in the market, potentially affecting CSX’s stock price through their impact on global trade and economic activity. For example, the war in Ukraine in 2022 caused significant disruptions in global supply chains, impacting various industries, including transportation.

Essential FAQs

What are the major risks associated with investing in CSX stock?

Major risks include economic downturns impacting freight volume, increased competition, rising fuel costs, and regulatory changes affecting the transportation industry.

How does CSX compare to its main competitors in terms of profitability?

A detailed comparison requires analysis of financial statements and industry reports. Key metrics like operating margin and return on equity can provide insights into relative profitability.

What is the current dividend yield for CSX stock?

The current dividend yield fluctuates and can be found on financial news websites and investor relations sections of CSX’s website.

Where can I find real-time CSX stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.