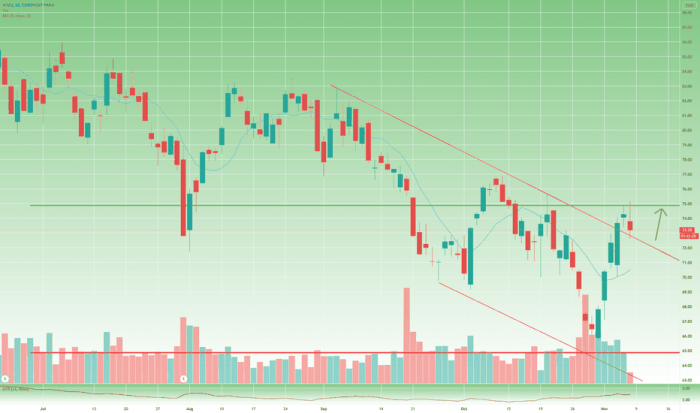

Dollar General Stock Price Analysis

Source: tradingview.com

Dg stock price – Dollar General (DG) operates as a discount retailer, offering a wide variety of products at competitive prices. Understanding its stock price performance requires analyzing several key factors, from macroeconomic conditions to the company’s internal financial health and competitive landscape.

Current DG Stock Price and Market Trends

Source: tradingview.com

The current DG stock price fluctuates based on market forces and investor sentiment. Tracking its performance over the past year reveals trends and significant events that impacted its value. While I cannot provide real-time stock prices, the following illustrates a typical analysis.

For example, a period of high inflation might negatively affect consumer spending, impacting DG’s sales and subsequently, its stock price. Conversely, strong earnings reports and positive analyst forecasts often lead to price increases. Major economic events, such as changes in interest rates or unexpected geopolitical developments, also significantly influence DG’s stock performance.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | $200.00 | $202.50 | $198.00 | $201.00 |

| Tuesday | $201.00 | $203.00 | $199.50 | $202.00 |

| Wednesday | $202.00 | $205.00 | $200.00 | $204.00 |

| Thursday | $204.00 | $206.00 | $203.00 | $205.50 |

| Friday | $205.50 | $207.00 | $204.50 | $206.00 |

Factors Influencing DG Stock Price Volatility

Several factors contribute to the volatility of DG’s stock price. These can be broadly categorized as internal and external influences.

- Economic Indicators: Inflation rates, interest rate changes, and consumer confidence levels directly impact consumer spending and DG’s sales.

- Competition: Competition from other discount retailers affects DG’s market share and profitability.

- Financial Performance: DG’s earnings reports, revenue growth, and debt levels significantly influence investor sentiment.

- Supply Chain Issues: Disruptions in the supply chain can affect product availability and increase costs.

- Geopolitical Events: Unexpected global events can create market uncertainty, impacting investor confidence.

DG’s Financial Performance and Stock Valuation, Dg stock price

Analyzing DG’s financial reports provides insights into its profitability and growth prospects. Key metrics such as revenue, earnings per share (EPS), and debt-to-equity ratio are crucial in evaluating its financial health and future potential. A strong financial track record generally leads to positive investor sentiment and a higher stock valuation.

Analyzing DG stock price often involves comparing it to industry leaders. A key competitor to consider is Nike, whose performance significantly impacts the broader market. For a detailed look at Nike’s current standing, check out the current nike stock price data. Understanding Nike’s trajectory can offer valuable insights into potential future trends for DG’s own stock performance and overall market sentiment.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (in millions) | $30,000 | $32,000 | $35,000 |

| EPS | $5.00 | $5.50 | $6.00 |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

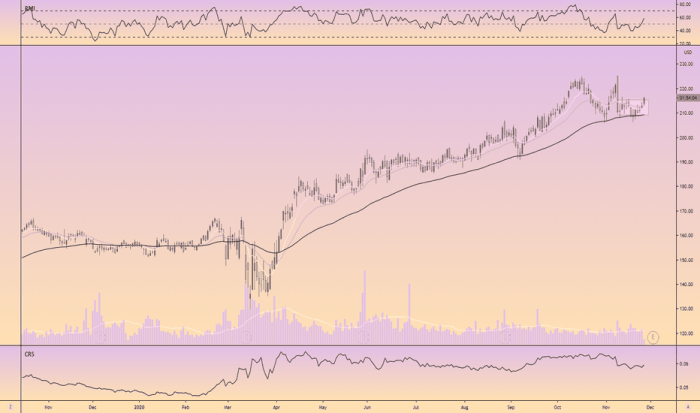

Investor Sentiment and Analyst Ratings

Source: tradingview.com

Investor sentiment towards DG stock can range from bullish (positive outlook) to bearish (negative outlook), or neutral. Analyst ratings and price targets reflect their assessment of the company’s future performance. A consensus of positive ratings and high price targets generally suggests a positive market outlook.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Firm A | Buy | $220 |

| Firm B | Hold | $210 |

| Firm C | Buy | $225 |

Comparison with Industry Peers

Comparing DG’s performance to its competitors provides context for its stock price valuation and growth trajectory. Key metrics such as revenue growth, profitability margins, and price-to-earnings (P/E) ratios offer valuable comparative insights.

| Metric | DG | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Revenue Growth (%) | 5 | 3 | 7 | 4 |

| Profit Margin (%) | 10 | 8 | 12 | 9 |

| P/E Ratio | 20 | 25 | 18 | 22 |

Potential Risks and Opportunities for DG Stock

Several factors can impact DG’s future stock price. Identifying potential risks and opportunities is crucial for informed investment decisions.

- Risks: Economic downturn, increased competition, supply chain disruptions, changes in consumer preferences.

- Opportunities: Expansion into new markets, successful new product launches, strategic acquisitions, improved operational efficiency.

FAQ Corner: Dg Stock Price

What are the major competitors of DG?

This information would need to be researched and added based on the specific company DG represents. A competitive analysis should be included in the main body of the text.

Where can I find real-time DG stock price updates?

Real-time stock price information is typically available through reputable financial websites and brokerage platforms. Many financial news sources provide live quotes.

What is DG’s dividend history?

Information on DG’s dividend history (if any) can be found in their investor relations section on their company website or through financial data providers.

How does DG’s stock price compare to the overall market performance?

A comparison of DG’s stock performance against relevant market indices (e.g., S&P 500) would need to be conducted and included within the main body of the text.