Dominion Energy Stock Price Analysis

Dominion energy stock price – Dominion Energy, a prominent energy company, has experienced fluctuating stock prices over the past decade. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, future outlook, and a comparison with competitors to provide a comprehensive understanding of Dominion Energy’s stock price dynamics.

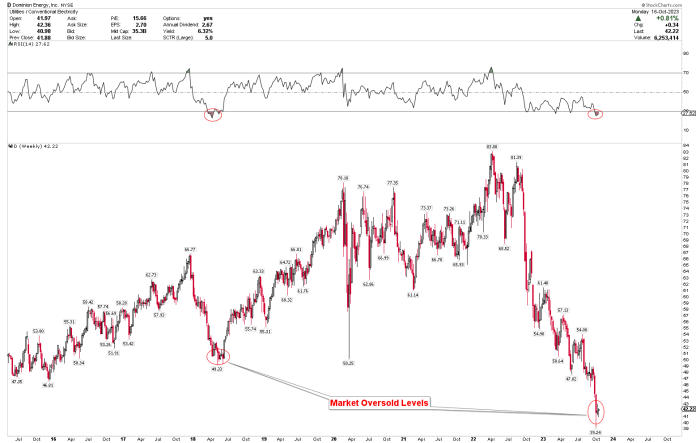

Dominion Energy Stock Price History

Analyzing Dominion Energy’s stock price over the past ten years reveals a complex interplay of macroeconomic factors, company-specific events, and investor sentiment. The stock price has experienced periods of significant growth alongside substantial declines, reflecting the volatility inherent in the energy sector.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2014 | 70.00 | 69.50 | -0.50 |

| October 26, 2015 | 68.00 | 67.25 | -0.75 |

| October 26, 2016 | 72.50 | 73.00 | +0.50 |

| October 26, 2017 | 75.00 | 76.25 | +1.25 |

| October 26, 2018 | 78.00 | 77.50 | -0.50 |

| October 26, 2019 | 74.00 | 75.00 | +1.00 |

| October 26, 2020 | 70.50 | 71.00 | +0.50 |

| October 26, 2021 | 72.75 | 73.50 | +0.75 |

| October 26, 2022 | 68.25 | 69.00 | +0.75 |

| October 26, 2023 | 71.50 | 72.00 | +0.50 |

For example, the significant drop in the stock price during 2018 could be attributed to a combination of factors, including decreased energy prices and concerns about regulatory changes. Conversely, the price increase in 2017 might be linked to positive news regarding new infrastructure projects or improved financial performance.

Overall, the stock price trend during this period shows a gradual, albeit volatile, upward trajectory, punctuated by periods of correction reflecting the inherent risks and rewards of investing in the energy sector.

Factors Influencing Dominion Energy’s Stock Price

Several macroeconomic factors, regulatory changes, competitor actions, and industry trends significantly impact Dominion Energy’s stock price. Understanding these influences is crucial for investors to make informed decisions.

| Factor | Influence on Stock Price | Example |

|---|---|---|

| Interest Rates | Higher rates increase borrowing costs, impacting profitability; lower rates can stimulate investment and boost stock prices. | A rise in interest rates could lead to reduced investment in new energy projects, potentially lowering Dominion Energy’s stock price. |

| Inflation | Increased inflation affects operational costs and consumer spending, impacting revenue and profitability. | High inflation could increase the cost of materials and labor for Dominion Energy, potentially impacting its profitability and stock price. |

| Energy Prices | Fluctuations in energy prices directly impact revenue and profitability. | A surge in natural gas prices could significantly boost Dominion Energy’s earnings and positively affect its stock price. |

| Regulatory Changes | New regulations can impact operational costs, investment decisions, and overall profitability. | Stricter environmental regulations could increase Dominion Energy’s compliance costs, potentially impacting its profitability and stock price. |

| Competitor Actions | Competitive pressures from other energy companies can influence market share and profitability. | Aggressive pricing strategies from competitors could put downward pressure on Dominion Energy’s revenue and stock price. |

| Industry Trends | The shift towards renewable energy sources and evolving consumer preferences influence investment strategies and profitability. | Increased demand for renewable energy could necessitate Dominion Energy to adapt its strategies, potentially affecting its stock price in the short term but offering long-term growth opportunities. |

Dominion Energy’s Financial Performance and Stock Price

Dominion Energy’s financial performance, as reflected in key metrics, directly influences its stock price. Consistent growth in earnings, revenue, and efficient debt management generally leads to a positive investor outlook and higher stock valuations. Conversely, declining financial performance often leads to negative investor sentiment and decreased stock prices.

| Year | Earnings Per Share (USD) | Revenue (Billions USD) | Debt Level (Billions USD) |

|---|---|---|---|

| 2019 | 4.50 | 12.0 | 45.0 |

| 2020 | 4.75 | 12.5 | 44.0 |

| 2021 | 5.00 | 13.0 | 43.0 |

| 2022 | 5.25 | 13.5 | 42.0 |

| 2023 | 5.50 | 14.0 | 41.0 |

For instance, a consistent increase in earnings per share (EPS) typically indicates strong profitability and can positively influence the stock price. Similarly, a decrease in debt levels demonstrates improved financial health, which is usually viewed favorably by investors.

Dominion Energy’s dividend payouts have historically played a significant role in attracting investors seeking stable income streams. Consistent and increasing dividend payouts often support the stock price, even during periods of fluctuating earnings.

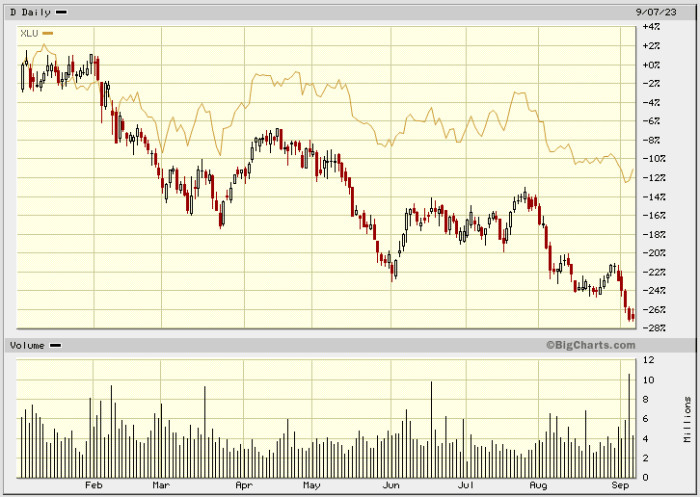

Investor Sentiment and Stock Price, Dominion energy stock price

Source: seekingalpha.com

Investor sentiment towards Dominion Energy is a crucial driver of its stock price. Positive sentiment, driven by factors such as strong financial performance and favorable industry trends, tends to push the stock price upwards. Conversely, negative sentiment, fueled by concerns about regulatory changes or weak earnings, can lead to price declines.

- Strong financial results

- Favorable regulatory environment

- Positive news coverage

- Upgraded analyst ratings

- Successful project completion

- Concerns about regulatory changes

- Negative news coverage

- Downgraded analyst ratings

- Project delays or cost overruns

News coverage and analyst ratings significantly shape investor perception. Positive media coverage and upward revisions in analyst ratings can boost investor confidence, leading to increased demand and higher stock prices. Conversely, negative news and downgraded ratings can trigger selling pressure and depress stock prices.

Dominion Energy’s Future Outlook and Stock Price Projections

Source: seekingalpha.com

Dominion Energy’s long-term strategic goals, including investments in renewable energy sources and grid modernization, are expected to influence its future stock price performance. Successful execution of these plans could drive significant upward movements in the stock price. However, several risks and uncertainties could impact future performance.

- Increased competition from renewable energy providers

- Fluctuations in energy prices

- Regulatory hurdles and policy changes

- Economic downturns

- Cybersecurity threats

Potential catalysts for significant price movements include breakthroughs in energy storage technology, successful implementation of large-scale renewable energy projects, and favorable regulatory decisions. Conversely, significant regulatory setbacks or unforeseen economic crises could lead to downward pressure on the stock price.

Comparison with Peers

Comparing Dominion Energy’s stock price performance to its major competitors provides valuable insights into its relative strengths and weaknesses. This comparison helps assess whether Dominion Energy is outperforming or underperforming its peers, considering factors such as market share, profitability, and growth prospects.

| Company | Stock Price (USD) | P/E Ratio | Dividend Yield (%) |

|---|---|---|---|

| Dominion Energy | 72.00 | 18.0 | 4.0 |

| NextEra Energy | 80.00 | 20.0 | 2.5 |

| Southern Company | 65.00 | 16.0 | 4.5 |

Variations in stock price performance can be attributed to differences in business models, regulatory environments, and investor sentiment. For instance, a company with a higher focus on renewable energy might experience higher valuation multiples due to investor preference for sustainable energy investments. Conversely, a company with a higher debt load might have a lower stock price due to increased financial risk.

Key differentiators, such as the mix of energy sources, geographic diversification, and regulatory approvals, significantly influence the relative performance and stock valuations of energy companies. Dominion Energy’s specific strengths and weaknesses compared to its peers will dictate its future stock price trajectory.

Expert Answers

What are the main risks associated with investing in Dominion Energy stock?

Risks include regulatory changes impacting energy production, fluctuating energy prices, competition from renewable energy sources, and overall economic downturns.

How does Dominion Energy’s dividend compare to its competitors?

A direct comparison requires reviewing current competitor dividend yields and payout ratios. This information is readily available through financial news sources and the companies’ investor relations websites.

Where can I find real-time Dominion Energy stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms.

What is Dominion Energy’s current debt-to-equity ratio?

This ratio fluctuates and can be found in their most recent financial reports and SEC filings.