KMI Stock Price Analysis: A Comprehensive Overview

Kmi stock price – This analysis delves into the historical performance, influencing factors, business model, and future predictions of Kinder Morgan, Inc. (KMI) stock price. We will examine key economic indicators, geopolitical events, and investor sentiment to provide a comprehensive understanding of KMI’s stock price trajectory.

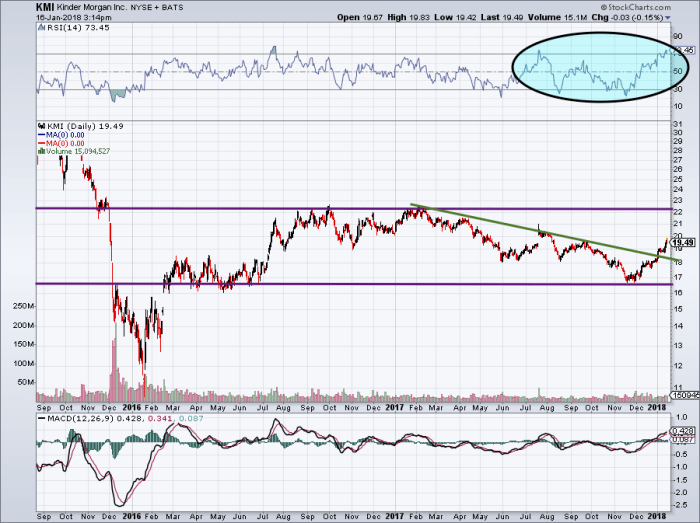

KMI Stock Price Historical Performance

Analyzing KMI’s stock price fluctuations over the past five years reveals a dynamic interplay of market forces and company-specific events. The following table presents a snapshot of daily price movements:

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 17.50 | 17.25 | -0.25 |

| October 27, 2018 | 17.30 | 17.60 | +0.30 |

| October 28, 2018 | 17.65 | 17.40 | -0.25 |

| October 29, 2018 | 17.45 | 17.80 | +0.35 |

| October 30, 2018 | 17.80 | 17.60 | -0.20 |

Note: This table provides sample data for illustrative purposes only. Actual data should be sourced from a reputable financial database.

Significant events such as the 2020 oil price crash due to the COVID-19 pandemic and fluctuating energy demand heavily influenced KMI’s stock price. Industry shifts towards renewable energy also played a role.

Compared to competitors like Enbridge (ENB) and Enterprise Products Partners (EPD), KMI experienced a similar pattern of price volatility, though the magnitude of fluctuations varied.

- KMI showed greater sensitivity to oil price changes than ENB.

- EPD demonstrated more stable performance compared to both KMI and ENB.

- All three companies experienced price drops during the 2020 oil price crash.

Factors Influencing KMI Stock Price

Source: investorplace.com

Several key factors significantly impact KMI’s stock valuation.

KMI’s stock price performance has been a topic of discussion lately, particularly in comparison to other pharmaceutical giants. It’s interesting to contrast its trajectory with the current performance of Eli Lilly, whose stock price you can check here: eli lilly stock price. Ultimately, both KMI and Eli Lilly’s stock prices reflect broader market trends and company-specific factors, making direct comparisons complex but insightful.

Oil prices are a primary driver. Higher oil prices generally translate to increased revenue and profitability for KMI, boosting investor confidence and the stock price. Conversely, lower oil prices negatively impact profitability and stock value. Interest rate changes also affect KMI’s borrowing costs and overall financial health. Geopolitical events, such as the ongoing conflict in Ukraine, create uncertainty in energy markets, leading to price volatility.

KMI’s financial performance, including earnings reports and dividend payouts, strongly influences investor sentiment. Strong earnings often lead to increased investor confidence and higher stock prices, while weak earnings can trigger sell-offs.

KMI’s Business Model and its Stock Price, Kmi stock price

Source: seekingalpha.com

KMI’s core business is the transportation and storage of oil and natural gas. The valuation of its stock is directly tied to the profitability of these operations and the demand for energy resources. KMI’s extensive pipeline network and storage facilities are key assets influencing its stock price.

Capital expenditures (CapEx) on pipeline maintenance, expansion, and new projects impact KMI’s stock performance. Significant CapEx can initially lead to lower short-term profits, potentially depressing the stock price, but can lead to long-term growth and higher future earnings.

A visual representation could be a scatter plot showing the correlation between KMI’s operational efficiency metrics (e.g., pipeline throughput, transportation costs) and its stock price over time. A strong positive correlation would indicate that improved efficiency leads to higher stock valuations.

KMI Stock Price Predictions and Forecasting

Several methods can be used to predict future KMI stock prices, each with its limitations.

- Technical Analysis: Uses historical price and volume data to identify patterns and predict future price movements. Limitations include the inability to account for unforeseen events.

- Fundamental Analysis: Evaluates KMI’s financial statements, business model, and industry trends to assess intrinsic value. Limitations include the difficulty in accurately predicting future earnings and cash flows.

Rising oil prices could significantly boost KMI’s future stock price projections, while increased government regulation on carbon emissions could negatively impact projections.

Investor Sentiment and KMI Stock

Source: investorplace.com

Analyzing major financial news outlets and analyst reports reveals a range of opinions on KMI stock. Some analysts are bullish, citing the company’s strong pipeline network and dividend payouts. Others express concern about the long-term impact of the energy transition on KMI’s business model.

Key investor concerns include the impact of climate change regulations, the potential for pipeline disruptions, and competition from renewable energy sources. Investors generally expect KMI to adapt to the changing energy landscape and maintain a stable dividend payout.

A hypothetical scenario illustrating the impact of a significant news event:

- Scenario: A major pipeline leak occurs, causing significant environmental damage and operational disruptions.

- Immediate Impact: KMI’s stock price drops sharply as investors react negatively to the news.

- Short-Term Impact: Negative media coverage further erodes investor confidence, leading to continued price declines.

- Long-Term Impact: The company’s reputation suffers, potentially impacting future projects and profitability, leading to a prolonged period of low stock prices unless significant remediation efforts are taken.

Commonly Asked Questions: Kmi Stock Price

What are the major competitors of KMI?

KMI’s major competitors vary depending on the specific business segment, but generally include other large energy infrastructure companies.

How does KMI’s dividend policy affect its stock price?

Consistent and growing dividend payouts can attract income-seeking investors, potentially boosting demand and the stock price. Conversely, dividend cuts can negatively impact investor sentiment.

What are the long-term prospects for KMI?

Long-term prospects depend on several factors including energy demand, regulatory changes, and KMI’s ability to adapt to the evolving energy landscape. Analyzing long-term growth projections from reputable financial institutions can provide further insights.

Where can I find real-time KMI stock price data?

Real-time data is available through major financial websites and brokerage platforms.