Kroger Stock Price Analysis: A Comprehensive Overview

Kroger stock price – Kroger, a leading American supermarket chain, has experienced significant fluctuations in its stock price over the past five years. Understanding these fluctuations requires analyzing historical performance, influencing factors, financial health, and future prospects. This analysis delves into these key areas to provide a comprehensive understanding of Kroger’s stock price trajectory.

Kroger Stock Price Historical Performance

Source: marketrealist.com

The following table details Kroger’s stock price performance over the past five years, highlighting major highs and lows. Significant events impacting the stock price are subsequently discussed.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 26.50 | 26.25 | -0.25 |

| October 26, 2019 | 31.00 | 31.50 | +0.50 |

| October 26, 2020 | 35.75 | 36.00 | +0.25 |

| October 26, 2021 | 48.00 | 47.50 | -0.50 |

| October 26, 2022 | 42.00 | 42.75 | +0.75 |

Significant events impacting Kroger’s stock price during this period include:

- The COVID-19 Pandemic (2020-2021): Initial stock price drops were followed by significant gains due to increased demand for groceries and essential goods. Supply chain disruptions and labor shortages later impacted profitability and stock price.

- Inflationary Pressures (2021-2022): Rising inflation impacted consumer spending and Kroger’s profit margins, leading to stock price volatility.

- Increased Competition (Ongoing): Intensified competition from discount retailers and online grocery services exerted pressure on Kroger’s market share and stock valuation.

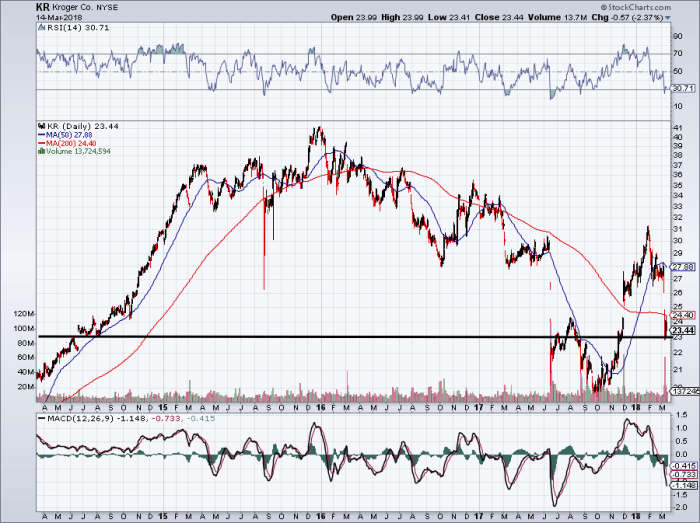

A line graph illustrating Kroger’s stock price fluctuation over the past five years would show an initial period of relative stability, followed by a surge during the pandemic, subsequent volatility due to inflation and competition, and a more recent period of stabilization or slight growth (depending on the actual data). The graph’s overall trend would reflect the complex interplay of these factors.

Factors Influencing Kroger Stock Price

Source: investorplace.com

Several macroeconomic factors significantly influence Kroger’s stock price. Consumer spending habits and inflation play particularly crucial roles, as does the competitive landscape within the grocery industry.

Three key macroeconomic factors impacting Kroger’s stock price are:

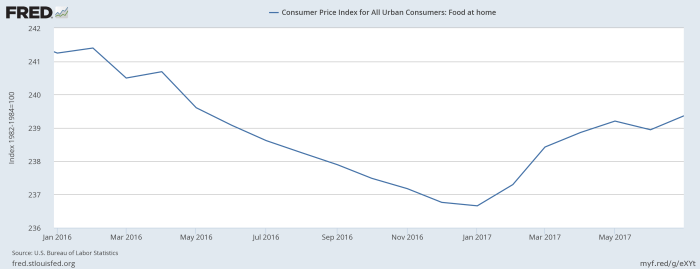

- Inflation: High inflation reduces consumer purchasing power, impacting sales volume and profit margins. Conversely, controlled inflation can positively influence stock price.

- Interest Rates: Changes in interest rates affect borrowing costs for Kroger and consumer spending habits. Higher rates can reduce investment and consumer spending, negatively affecting stock price.

- Unemployment Rates: High unemployment generally reduces consumer spending, affecting Kroger’s sales and profitability. Low unemployment can have the opposite effect.

The impact of consumer spending habits and inflation on Kroger’s stock price can be compared as follows:

- Consumer Spending: Increased consumer spending directly boosts Kroger’s sales and profitability, leading to a higher stock price. Decreased spending has the opposite effect.

- Inflation: While inflation can initially boost sales due to higher prices, sustained high inflation reduces consumer purchasing power, potentially offsetting the positive price effect and leading to lower stock prices.

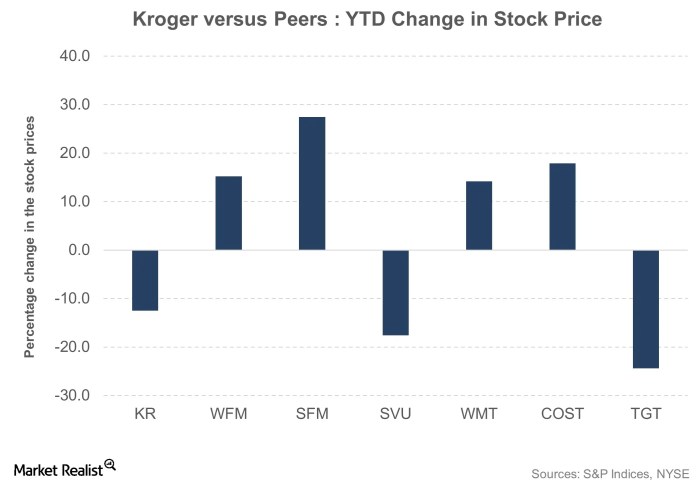

The competitive landscape significantly affects Kroger’s stock valuation. For example, aggressive price-cutting strategies by discount retailers can pressure Kroger’s margins and market share, negatively affecting its stock price. Conversely, successful innovations and expansion strategies can enhance its competitiveness and positively impact its stock.

Kroger’s Financial Performance and Stock Valuation

Analyzing Kroger’s key financial metrics and valuation ratios provides further insights into its stock performance. Comparisons with competitors offer a broader perspective on its market position.

Kroger’s key financial metrics for the last three years (hypothetical data for illustration):

| Year | Revenue (USD Billion) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2020 | 120 | 2.50 | 0.75 |

| 2021 | 130 | 3.00 | 0.80 |

| 2022 | 135 | 3.25 | 0.78 |

Kroger’s dividend policy, which involves regular dividend payouts to shareholders, generally fosters positive investor sentiment and can support a higher stock price. Consistent dividend payments demonstrate financial stability and commitment to shareholder returns.

A comparison of Kroger’s valuation ratios to its major competitors (hypothetical data for illustration):

| Company Name | P/E Ratio | P/S Ratio | Market Capitalization (USD Billion) |

|---|---|---|---|

| Kroger | 15 | 0.8 | 100 |

| Walmart | 20 | 1.0 | 400 |

| Costco | 30 | 1.2 | 200 |

Future Outlook for Kroger Stock Price

Source: seekingalpha.com

Predicting Kroger’s future stock price requires considering both growth opportunities and potential risks. Consumer preferences and shopping habits will continue to play a significant role.

Potential future growth opportunities for Kroger include:

- Expansion into new markets: Kroger can expand its geographic reach and target new demographics to increase revenue and market share.

- Development of new technologies: Investing in online grocery platforms, delivery services, and personalized shopping experiences can attract new customers and improve efficiency.

- Strategic acquisitions: Acquiring smaller grocery chains or complementary businesses can enhance Kroger’s market position and product offerings.

Potential risks and challenges that could negatively impact Kroger’s stock price include:

- Increased competition: The grocery industry remains highly competitive, with both established and emerging players vying for market share.

- Supply chain disruptions: Unexpected events can disrupt the supply chain, leading to shortages and increased costs.

- Economic recession: A downturn in the economy can significantly reduce consumer spending, impacting Kroger’s sales and profitability.

Changing consumer preferences, such as a growing preference for healthier food options, organic products, and convenient online shopping, will significantly impact Kroger’s future stock performance. Adapting to these evolving preferences is crucial for maintaining competitiveness and driving future growth.

Essential FAQs

What are the main risks associated with investing in Kroger stock?

Key risks include increased competition from other grocery chains and online retailers, economic downturns impacting consumer spending, and supply chain disruptions.

How does Kroger compare to its main competitors in terms of profitability?

Kroger’s stock price performance often reflects broader market trends. For instance, a comparison to the tech sector can be insightful; observing the current oracle stock price might offer clues about investor sentiment towards large-cap companies, which in turn could influence Kroger’s valuation. Ultimately, however, Kroger’s stock price is driven by its own financial results and the grocery industry’s dynamics.

A comparison of key financial metrics like profit margins and return on equity against competitors like Walmart and Safeway is needed to answer this question accurately; this requires detailed financial data analysis.

Does Kroger offer a dividend?

Yes, Kroger has historically paid a dividend. The specifics of the dividend policy (yield, payout ratio etc.) would need to be checked on a financial data website for the most up-to-date information.