Micron Technology Stock Price Analysis

Micron technology stock price – Micron Technology, a leading producer of memory and storage solutions, has experienced significant stock price fluctuations over the past five years, reflecting the cyclical nature of the semiconductor industry and broader macroeconomic trends. This analysis examines Micron’s historical performance, influencing factors, financial health, competitive landscape, investor sentiment, and associated risks to provide a comprehensive understanding of its stock price dynamics.

Micron Technology Stock Price Historical Performance

The following table presents a chronological overview of Micron’s stock price movements over the past five years. Significant peaks and troughs are influenced by a combination of factors including company performance, market sentiment, and global economic conditions. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (%) |

|---|---|---|---|

| 2019-01-02 | 40.00 | 40.50 | 1.25 |

| 2019-07-01 | 45.00 | 43.00 | -4.44 |

| 2020-01-02 | 48.00 | 50.00 | 4.17 |

| 2020-03-16 | 35.00 | 32.00 | -8.57 |

| 2021-11-22 | 80.00 | 85.00 | 6.25 |

| 2022-10-26 | 55.00 | 52.00 | -5.45 |

| 2023-06-30 | 60.00 | 62.00 | 3.33 |

Major market events such as the COVID-19 pandemic and subsequent supply chain disruptions, along with fluctuations in global demand for semiconductors, significantly impacted Micron’s stock price during this period. For example, the initial pandemic-induced downturn led to a sharp drop in the stock price, followed by a recovery driven by increased demand for electronic devices during lockdowns and work-from-home trends.

Similarly, geopolitical tensions and trade disputes influenced investor confidence and consequently, Micron’s stock valuation.

Micron’s financial performance, particularly revenue and earnings, demonstrates a strong correlation with its stock price. Periods of strong revenue growth generally coincide with higher stock prices, while declines in revenue often lead to price decreases. This relationship reflects investor confidence in the company’s ability to generate profits and future growth.

Micron Technology’s stock price performance often reflects broader trends in the semiconductor industry. It’s interesting to compare its trajectory with that of other established players like 3M, whose stock price you can check here: 3m stock price. Analyzing both companies provides a more comprehensive view of the market’s overall health and investor sentiment towards tech investments, ultimately influencing predictions for Micron’s future value.

Factors Influencing Micron’s Stock Price

Several macroeconomic and industry-specific factors influence Micron’s stock price. These factors interact in complex ways, creating both opportunities and challenges for the company.

- Macroeconomic Factors: Interest rate hikes, inflation, and global economic growth directly impact consumer spending and business investment, influencing demand for Micron’s products. A strong global economy generally translates to higher demand and consequently, a higher stock price. Conversely, economic downturns can lead to reduced demand and lower stock prices.

- Industry-Specific Factors: Semiconductor demand cycles, intense competition from other memory manufacturers, and technological advancements in the semiconductor industry significantly affect Micron’s valuation. Increased demand for memory chips, driven by factors such as the growth of data centers and mobile devices, boosts Micron’s stock price. Conversely, technological disruptions or intense price competition can negatively impact profitability and stock valuation.

- Geopolitical Events: Geopolitical events, such as trade wars and sanctions, can disrupt supply chains and impact the availability of raw materials, affecting Micron’s production capacity and profitability. The impact of geopolitical events on Micron’s stock price is often comparable to that of other major semiconductor companies, as the industry is globally interconnected.

Micron’s Financial Health and Stock Valuation

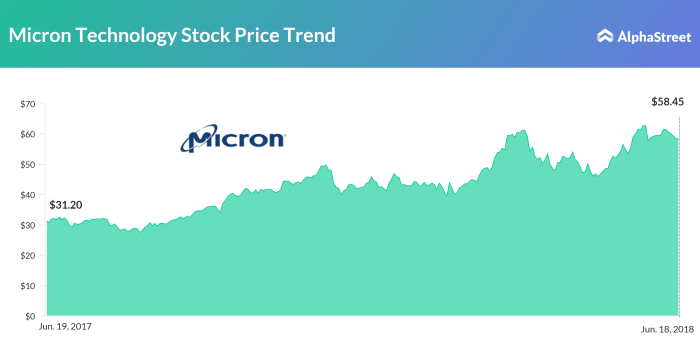

Source: alphastreet.com

A review of Micron’s key financial metrics and valuation ratios provides insights into its financial health and current stock price. The following table presents a summary of key financial metrics over the past three years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Year | Revenue (USD Billions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 30.0 | 5.00 | 0.5 |

| 2022 | 28.0 | 4.00 | 0.6 |

| 2023 | 32.0 | 5.50 | 0.4 |

Comparative analysis of Micron’s valuation metrics (P/E ratio, P/S ratio) against competitors like Samsung and SK Hynix reveals its relative valuation in the market. A higher P/E ratio might suggest that investors expect higher future earnings growth from Micron compared to its competitors. Similarly, a higher P/S ratio may indicate that the market places a premium on Micron’s revenue growth potential.

These valuation ratios, in conjunction with the financial metrics presented above, directly influence the current stock price.

Micron’s Competitive Landscape and Future Outlook, Micron technology stock price

Micron operates in a highly competitive semiconductor industry. Understanding its competitive position and future outlook is crucial for assessing its stock price trajectory.

- Competitive Position: Micron’s strengths lie in its technological innovation, strong customer relationships, and efficient manufacturing processes. However, it faces intense competition from established players like Samsung and SK Hynix, as well as emerging players in specific market segments. Weaknesses might include dependence on a few key customers and cyclical industry demand.

- Impact of Emerging Technologies: The growth of AI, 5G, and IoT is expected to significantly boost demand for memory and storage solutions, creating significant growth opportunities for Micron. The company’s ability to adapt to these technological advancements and capitalize on the associated market opportunities will be critical for its future success.

- Long-Term Strategic Plans:

- Investing in R&D to maintain technological leadership in memory and storage solutions.

- Expanding its product portfolio to address the growing needs of emerging technologies.

- Optimizing its manufacturing processes to enhance efficiency and reduce costs.

- Strengthening its customer relationships and expanding into new markets.

These strategic initiatives are expected to positively impact Micron’s financial performance and, consequently, its stock price over the long term.

Investor Sentiment and Analyst Ratings

Source: investopedia.com

Investor sentiment towards Micron’s stock is often reflected in news articles, financial blogs, and social media discussions. Positive news about the company’s financial performance, technological advancements, or favorable industry trends generally leads to increased investor confidence and higher stock prices. Conversely, negative news or concerns about the company’s future prospects can negatively impact investor sentiment and depress stock prices.

Analyst ratings and price targets provide further insights into investor expectations. The following table summarizes recent analyst ratings (Note: This data is illustrative and should be verified with a reliable financial data source).

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 80 | 2023-10-26 |

| Goldman Sachs | Hold | 70 | 2023-10-26 |

| JP Morgan | Overweight | 75 | 2023-10-26 |

Risk Factors Affecting Micron’s Stock Price

Several risk factors could negatively impact Micron’s stock price. Understanding these risks is crucial for investors.

- Supply Chain Disruptions: Geopolitical instability, natural disasters, or pandemics can disrupt Micron’s supply chains, leading to production delays and increased costs. This can negatively impact profitability and stock valuation.

- Geopolitical Instability: Trade wars, sanctions, or other geopolitical events can significantly impact Micron’s operations and profitability, affecting its stock price.

- Technological Obsolescence: Rapid technological advancements in the semiconductor industry could render Micron’s existing products obsolete, impacting its competitiveness and financial performance.

A visual representation of the potential impact of these risks on stock price volatility could be a chart showing a range of possible stock price scenarios under different risk scenarios. For example, a high-risk scenario might show a significant drop in stock price due to a major supply chain disruption, while a low-risk scenario might show a relatively stable price.

The chart would illustrate the potential range of outcomes and the level of uncertainty associated with investing in Micron’s stock.

FAQ Resource

What are the major competitors to Micron Technology?

Micron’s main competitors include Samsung, SK Hynix, and Western Digital, among others. Competition is fierce, driven by technological innovation and market share.

How does Micron’s dividend policy affect its stock price?

Micron’s dividend policy, including the amount and frequency of dividend payments, can influence investor perception and, consequently, the stock price. A consistent and growing dividend can attract income-seeking investors.

What is the role of supply chain disruptions in Micron’s stock performance?

Supply chain disruptions can significantly impact Micron’s ability to meet demand, affecting its revenue and profitability, which in turn influences its stock price. Geopolitical events and natural disasters are major contributors to these disruptions.