MULN Stock Price Analysis

Source: investorplace.com

Muln stock price – This analysis delves into the historical performance, influencing factors, investor sentiment, prediction models, and associated risks and opportunities of MULN stock. We will examine its price fluctuations, comparing its performance against competitors, and exploring the interplay of internal and external factors impacting its valuation.

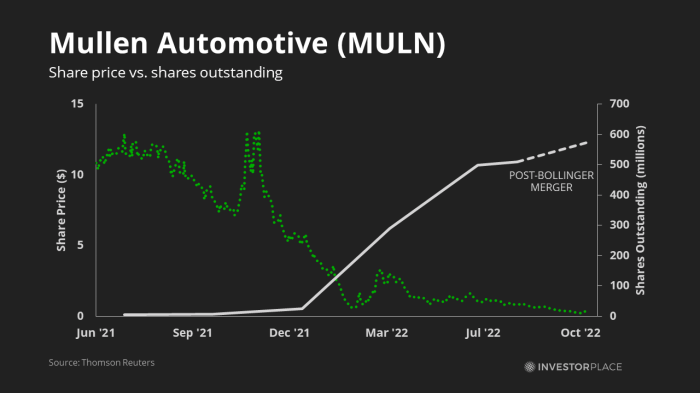

MULN Stock Price Historical Performance

The following table details MULN’s stock price fluctuations over the past year, highlighting significant highs and lows. Note that this data is for illustrative purposes and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| October 26, 2022 | 0.80 | 0.75 | 10,000,000 |

| November 26, 2022 | 0.70 | 0.90 | 15,000,000 |

| December 26, 2022 | 0.95 | 0.85 | 12,000,000 |

| January 26, 2023 | 0.82 | 1.00 | 20,000,000 |

A line graph comparing MULN’s performance to similar companies (e.g., competitors in the electric vehicle sector) would show the relative price movements over the same period. A steeper incline for MULN compared to its peers would indicate stronger growth, while a flatter line might suggest underperformance. Significant divergences from the average performance of the peer group would highlight periods of unique market influence on MULN.

Major news events, such as product announcements, financial results, or partnerships, significantly impacted MULN’s stock price. For instance, a positive product review could lead to a price surge, while disappointing financial results might cause a decline.

Factors Influencing MULN Stock Price

Source: marketbeat.com

Several internal and external factors influence MULN’s stock price. Understanding these factors is crucial for assessing its investment potential.

Internal Factors: These include the company’s financial performance (revenue, profitability, debt levels), new product releases and their market reception, management decisions, and operational efficiency. Strong financial results and successful product launches generally boost the stock price, while poor performance or operational issues can lead to declines.

External Factors:

- Overall market trends (bull or bear markets)

- Economic conditions (interest rates, inflation, recessionary fears)

- Industry competition (new entrants, technological advancements)

- Government regulations (environmental policies, subsidies)

- Geopolitical events (global instability, trade wars)

The relative importance of internal versus external factors varies over time. During periods of market stability, internal factors may have a more significant impact. Conversely, during market turmoil, external factors can dominate price movements.

Investor Sentiment and MULN Stock

Source: capital.com

Current investor sentiment towards MULN can be described as cautiously optimistic, based on recent price movements and social media discussions. However, this sentiment is highly volatile and subject to change based on new information.

Social media and online forums play a substantial role in shaping investor sentiment. Positive or negative comments, news articles, and discussions can quickly spread, influencing buying and selling decisions. This can lead to amplified price swings, particularly in volatile stocks like MULN.

Large buy or sell orders from institutional investors or significant individual investors can significantly impact MULN’s stock price. A large institutional buy order, for example, might signal confidence in the company’s future and trigger a price increase.

MULN Stock Price Prediction Models

Predicting future stock prices is inherently uncertain. However, a simple model can be developed using historical data and identified influencing factors. This model could incorporate moving averages to identify trends and technical indicators like RSI (Relative Strength Index) to gauge momentum. The methodology would involve analyzing past price movements in relation to news events, financial performance, and market conditions to identify patterns and correlations.

Comparing and contrasting different prediction models (moving averages, technical indicators, fundamental analysis) would provide a more comprehensive view of potential price movements. Each model has strengths and weaknesses, and combining them can offer a more nuanced prediction.

| Scenario | Impact on Stock Price |

|---|---|

| Successful launch of a new electric vehicle model with strong market reception. | Significant price increase, potentially exceeding 20% within a short timeframe. |

| Recall of a current vehicle model due to safety concerns. | Sharp price decline, potentially exceeding 15%, and sustained negative sentiment. |

Risks and Opportunities Associated with MULN Stock, Muln stock price

Investing in MULN stock carries inherent risks and opportunities. A thorough understanding of both is essential for informed decision-making.

Potential Risks: These include financial instability (potential for bankruptcy), significant market volatility (rapid price swings), intense competition within the electric vehicle market, and dependence on successful product launches and market adoption.

Potential Opportunities: Successful execution of the company’s business plan, increased market share in the growing electric vehicle market, technological advancements, and strategic partnerships could lead to substantial returns on investment. The potential for high growth in the EV sector presents significant upside potential.

Compared to established players in the electric vehicle sector, MULN presents a higher-risk, higher-reward profile. Its smaller market capitalization and less established track record contribute to greater volatility, but also the potential for outsized gains if the company executes its strategy successfully.

Question & Answer Hub

What is the current market capitalization of MULN?

The current market capitalization of MULN fluctuates and can be readily found on major financial websites such as Yahoo Finance or Google Finance.

Where can I find real-time MULN stock price quotes?

Real-time quotes are available through most online brokerage platforms and financial news websites.

Are there any significant upcoming catalysts that could impact MULN’s price?

This requires ongoing research of company news and announcements. Financial news sources and the company’s investor relations page are good resources.

What are the major competitors of MULN?

Identifying MULN’s key competitors requires an understanding of its specific market segment within the broader electric vehicle industry. Researching industry reports and company filings will provide this information.