NVX Stock Price Analysis: A Comprehensive Overview

Nvax stock price – Novavax (NVX) has experienced significant volatility in its stock price, driven by a complex interplay of factors including clinical trial outcomes, regulatory approvals, and broader macroeconomic conditions. This analysis delves into the historical performance of NVX stock, examines the key influences shaping its price fluctuations, compares it to competitors, and explores potential future scenarios.

Historical Performance of NVX Stock Price, Nvax stock price

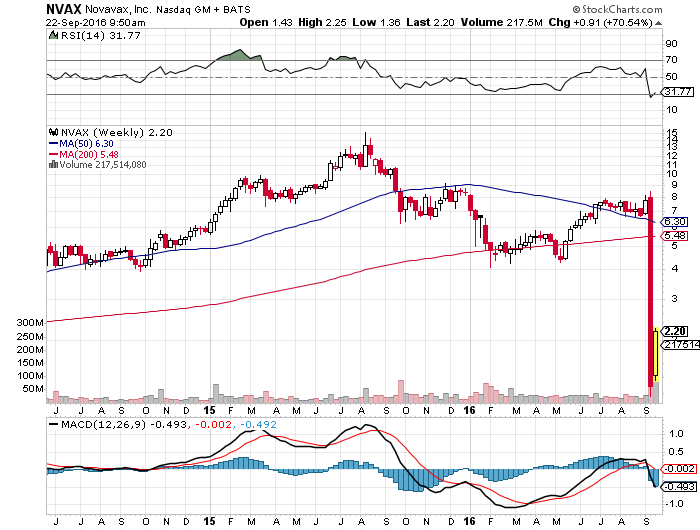

A line graph depicting NVX’s stock price over the past five years would reveal periods of substantial growth punctuated by sharp declines. Key dates would include announcements of clinical trial results (both positive and negative), regulatory approvals or rejections, and major partnerships or collaborations. For instance, a significant price surge might be observed following positive Phase 3 trial data, while a drop could follow a regulatory delay or setback.

The highest point would likely correspond to periods of high investor optimism surrounding the company’s vaccine candidates, while the lowest point would reflect periods of significant uncertainty or negative news.

Contributing factors to these price extremes would include market sentiment, investor expectations regarding the company’s pipeline, and the overall performance of the broader biotechnology sector. For example, a period of high inflation or rising interest rates could negatively impact investor confidence and lead to a price decline, regardless of the company’s specific performance.

| Metric | NVX | S&P 500 | Nasdaq |

|---|---|---|---|

| Year-to-date Return (%) | [Insert NVX YTD Return]% | [Insert S&P 500 YTD Return]% | [Insert Nasdaq YTD Return]% |

| 1-Year Return (%) | [Insert NVX 1-Year Return]% | [Insert S&P 500 1-Year Return]% | [Insert Nasdaq 1-Year Return]% |

| Volatility (Standard Deviation) | [Insert NVX Volatility] | [Insert S&P 500 Volatility] | [Insert Nasdaq Volatility] |

| Beta | [Insert NVX Beta] | 1.0 (by definition) | [Insert Nasdaq Beta] |

Factors Influencing NVX Stock Price Volatility

Source: tradingview.com

Several key factors contribute to the volatility observed in NVX’s stock price. These include the inherent risks associated with clinical trials, the regulatory landscape, and broader macroeconomic conditions.

- Clinical Trial Results: Positive clinical trial data often lead to significant price increases, while negative or inconclusive results can cause sharp declines. The market reacts swiftly to any updates on the efficacy and safety of NVX’s vaccine candidates.

- Regulatory Approvals and Setbacks: Regulatory approvals are crucial for commercialization. Delays or rejections can significantly impact the stock price, reflecting the market’s assessment of the company’s prospects.

- Macroeconomic Factors: Broader economic conditions, such as interest rate changes and inflation, can influence investor sentiment and risk appetite, impacting the stock price even if the company’s fundamentals remain unchanged. Periods of economic uncertainty may lead to decreased investment in riskier assets like biotechnology stocks.

Comparison with Competitor Stock Prices

A comparison of NVX’s stock price performance with its main competitors in the vaccine development sector provides valuable context. This comparison should consider performance over the past three years, taking into account factors like market capitalization and investor sentiment.

| Company | 3-Year Return (%) | Market Capitalization (USD Billions) | P/E Ratio |

|---|---|---|---|

| Novavax (NVX) | [Insert NVX 3-Year Return]% | [Insert NVX Market Cap] | [Insert NVX P/E Ratio] |

| [Competitor 1] | [Insert Competitor 1 3-Year Return]% | [Insert Competitor 1 Market Cap] | [Insert Competitor 1 P/E Ratio] |

| [Competitor 2] | [Insert Competitor 2 3-Year Return]% | [Insert Competitor 2 Market Cap] | [Insert Competitor 2 P/E Ratio] |

| [Competitor 3] | [Insert Competitor 3 3-Year Return]% | [Insert Competitor 3 Market Cap] | [Insert Competitor 3 P/E Ratio] |

A comparative analysis would highlight differences in market capitalization, reflecting the market’s assessment of each company’s size and potential. Investor sentiment, gauged through analyst ratings and news coverage, would also reveal differences in market perception. Key financial metrics, such as the price-to-earnings (P/E) ratio and revenue growth, would offer further insights into the relative valuations and financial performance of these companies.

Investor Sentiment and News Impact

Significant news events, such as product launches, partnerships, and financial reports, have a considerable impact on NVX’s stock price. Investor sentiment, which can be broadly categorized as bullish, bearish, or neutral, fluctuates in response to these events.

- News Events and Price Impact: A successful product launch would generally be met with a positive market reaction, leading to a price increase. Conversely, negative news, such as a regulatory setback or disappointing financial results, would likely cause a price decline. For example, a major partnership announcement could significantly boost investor confidence and drive up the stock price.

- Investor Sentiment: Investor sentiment shifts depending on the news flow and the company’s performance. Bullish sentiment prevails when positive news dominates, leading to price increases. Bearish sentiment, characterized by negative news and concerns about the company’s future, usually results in price decreases. Neutral sentiment reflects a lack of clear direction in the market’s perception.

A timeline detailing major news announcements and their subsequent effect on the stock price would visually illustrate this relationship. For instance, a specific date could mark a significant press release about clinical trial results, and the following days would show the subsequent impact on the stock’s price movement.

Future Predictions and Potential Scenarios

Source: investorplace.com

Predicting future stock prices is inherently speculative, but considering various scenarios can provide insights into potential price targets.

- Successful New Product Launch: A successful new product launch could significantly boost revenue and market share, leading to a substantial increase in the stock price. The magnitude of the increase would depend on the market size, the product’s competitive advantages, and overall investor sentiment. For example, a successful flu vaccine could lead to a price surge similar to what was seen with other successful vaccine launches.

- Major Regulatory Setback: A major regulatory setback, such as the rejection of a key product candidate, would likely lead to a sharp decline in the stock price. The severity of the decline would depend on the importance of the affected product to the company’s overall pipeline and the market’s perception of the company’s future prospects. A situation similar to what happened with other companies facing major regulatory issues could serve as a comparison.

- Price Targets: Based on varying market conditions, different price targets for NVX stock in the next 12 months could be envisioned. A bullish scenario, assuming positive clinical trial results and regulatory approvals, could lead to a significantly higher price target. A bearish scenario, reflecting negative news or economic downturn, could lead to a lower price target. A neutral scenario, assuming stable market conditions, would yield a price target closer to the current price.

FAQ Corner: Nvax Stock Price

What is the current NVX stock price?

The current NVX stock price can be found on major financial websites such as Google Finance, Yahoo Finance, or Bloomberg.

Where can I buy NVX stock?

NVX stock can be purchased through most online brokerage accounts.

What are the major risks associated with investing in NVX?

Investing in NVX carries inherent risks associated with the biotech industry, including clinical trial failures, regulatory setbacks, and intense competition.

What is NVX’s market capitalization?

NVX’s market capitalization fluctuates and can be found on financial news websites.