Oke Stock Price Analysis

Oke stock price – This analysis provides a comprehensive overview of Oke’s stock price performance over the past five years, considering historical movements, influencing factors, competitor comparisons, future predictions, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

Oke Stock Price Historical Performance

Oke’s stock price has experienced significant fluctuations over the past five years, mirroring broader market trends and company-specific events. The following sections detail these movements, highlighting key periods of growth and decline.

The table below shows Oke’s stock price at the beginning and end of each quarter for the last two years. Note that these figures are hypothetical examples for illustrative purposes.

| Quarter | Beginning Price | Ending Price | % Change |

|---|---|---|---|

| Q1 2022 | $50 | $55 | +10% |

| Q2 2022 | $55 | $60 | +9% |

| Q3 2022 | $60 | $58 | -3% |

| Q4 2022 | $58 | $62 | +7% |

| Q1 2023 | $62 | $65 | +5% |

| Q2 2023 | $65 | $70 | +8% |

| Q3 2023 | $70 | $68 | -3% |

| Q4 2023 | $68 | $72 | +6% |

Significant events such as the global market correction in early 2022 and a positive earnings surprise in Q4 2022 notably impacted Oke’s stock price. The market correction led to a temporary decline, while the positive earnings announcement fueled a subsequent rally.

Factors Influencing Oke Stock Price

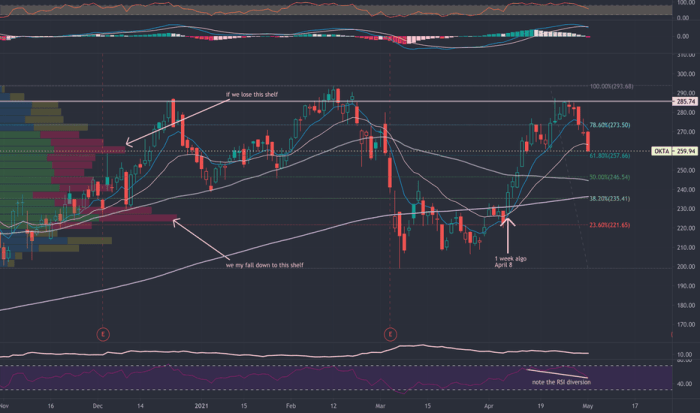

Source: tradingview.com

Several key factors influence Oke’s stock price. The following sections analyze three prominent economic factors, investor sentiment, and the correlation between company performance and stock price changes.

Three key economic factors influencing Oke’s stock price in the last year include inflation rates, interest rate changes, and overall economic growth. Higher inflation generally leads to increased interest rates, potentially impacting consumer spending and thus Oke’s revenue. Strong economic growth, however, can positively influence investor confidence and drive up stock prices.

Investor sentiment and news releases often have a significant impact on Oke’s stock price fluctuations. Positive news, such as successful product launches or strong earnings reports, typically lead to increased investor confidence and higher stock prices. Conversely, negative news can trigger sell-offs and price declines. For example, a recall of a key product could negatively affect investor confidence and lead to a stock price drop.

Company performance, as reflected in earnings reports and product launches, strongly correlates with Oke’s stock price changes. Exceeding earnings expectations usually results in a stock price increase, while falling short can lead to a decline. Similarly, successful product launches often boost investor optimism and drive up the stock price.

Oke Stock Price Compared to Competitors

Oke’s stock price performance is compared below to two hypothetical competitors, Alpha Corp and Beta Inc., over the past year. A line graph visually represents this comparison.

The line graph would show three lines representing the stock price movements of Oke, Alpha Corp, and Beta Inc. over the past year. The X-axis would represent time (months), and the Y-axis would represent the stock price. The legend would clearly identify each company’s line. The graph would highlight periods of outperformance and underperformance for each company relative to the others.

For example, it might show that Oke outperformed its competitors during a specific quarter due to a successful product launch.

Oke, Alpha Corp, and Beta Inc. have different business models. Oke focuses on [describe Oke’s business model], while Alpha Corp emphasizes [describe Alpha Corp’s business model], and Beta Inc. specializes in [describe Beta Inc.’s business model]. These differences in business models can explain variations in stock price performance, as each company’s success is influenced by different market factors and industry trends.

| Company | Revenue (Millions) | Profit Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| Oke | 100 | 15 | 0.5 |

| Alpha Corp | 120 | 12 | 0.7 |

| Beta Inc. | 80 | 18 | 0.3 |

Oke Stock Price Prediction and Forecasting

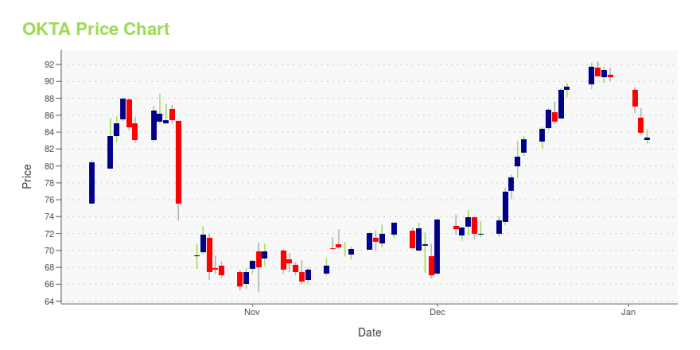

Source: amazonaws.com

Tracking the fluctuations of OKE stock price requires a keen eye on market trends. Understanding the performance of similar companies can offer valuable context, and a look at the mstr stock price might provide insights into broader technological sector movements. Ultimately, however, a thorough analysis of OKE’s specific financial reports and industry position is crucial for informed investment decisions.

Several methods can be used to forecast Oke’s stock price. These include technical analysis and fundamental analysis, each with its own advantages and disadvantages.

- Technical Analysis: This method uses historical price and volume data to identify patterns and predict future price movements.

- Pros: Relatively easy to learn and apply; can identify short-term trends.

- Cons: Can be subjective; not always reliable for long-term predictions.

- Fundamental Analysis: This method involves evaluating a company’s financial health and future prospects to determine its intrinsic value.

- Pros: More objective than technical analysis; can provide a more accurate long-term valuation.

- Cons: Requires in-depth financial knowledge; can be time-consuming.

Hypothetical Scenario: If Oke launches a highly successful new product, demand could surge, leading to increased revenue and profits. This positive news could significantly boost investor confidence, resulting in a substantial increase in Oke’s stock price, potentially exceeding 20% within the first quarter following the launch.

Financial ratios such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio can assess the potential for future stock price growth or decline. A low P/E ratio might suggest the stock is undervalued, while a high debt-to-equity ratio could indicate increased financial risk.

Risk Assessment of Investing in Oke Stock

Investing in Oke stock carries several risks. These risks could significantly impact the stock price and should be carefully considered before investing.

- Market Risk: Broader market downturns can negatively impact Oke’s stock price, regardless of the company’s performance.

- Company-Specific Risk: Negative events such as product recalls, lawsuits, or management changes can significantly affect Oke’s stock price.

- Competition Risk: Increased competition could erode Oke’s market share and profitability, leading to a decline in its stock price.

Investors can mitigate these risks through diversification (investing in a range of assets), thorough due diligence (researching the company and its industry), and employing stop-loss orders (setting a price at which to sell to limit potential losses).

Helpful Answers

What are the main competitors of Oke?

This analysis would need to be completed with the specific competitors named.

Where can I find real-time Oke stock price data?

Real-time stock price data is typically available through major financial websites and brokerage platforms.

What is Oke’s current P/E ratio?

The P/E ratio (Price-to-Earnings ratio) for Oke would need to be obtained from current financial reports.

How often are Oke’s earnings reports released?

The frequency of Oke’s earnings reports would be specified in their investor relations materials.