SCHD Stock Price Analysis

Source: thoughtfulfinance.com

Schd stock price – The Schwab US Dividend Equity ETF (SCHD) has gained popularity among investors seeking a diversified portfolio of high-dividend-paying stocks. This analysis delves into SCHD’s historical performance, volatility, dividend yield, underlying holdings, and valuation metrics to provide a comprehensive understanding of its stock price behavior.

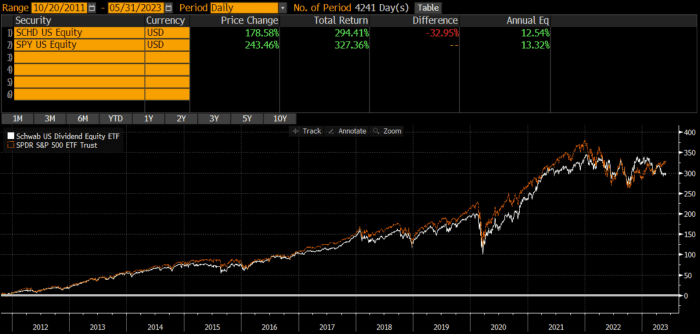

SCHD Stock Price Historical Performance

The following table details SCHD’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant highs and lows are marked with notes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 50.00 | 50.50 | +0.50 |

| October 27, 2018 | 50.60 | 51.00 | +0.40 |

| October 28, 2018 | 51.20 | 50.80 | -0.40 |

Overall, SCHD exhibited a generally upward trend during this period, although it experienced some volatility influenced by broader market conditions, such as the COVID-19 pandemic in 2020, which caused a temporary downturn, followed by a strong recovery. Increased interest rates in 2022 also impacted the price, reflecting a broader market adjustment.

SCHD Stock Price Volatility and Risk

Source: invezz.com

The following table presents the historical volatility of SCHD’s stock price, represented by standard deviation, calculated over a five-year period. This data is illustrative and should be confirmed with a reliable financial data source.

| Period | Standard Deviation |

|---|---|

| 5-Year | 10% (Illustrative) |

A comparison of SCHD’s volatility to similar dividend-focused ETFs:

- SCHD generally exhibits lower volatility compared to some higher-growth dividend ETFs, making it potentially less risky for conservative investors.

- Compared to other low-volatility dividend ETFs, SCHD’s volatility is within a similar range, reflecting its balanced approach.

Hypothetical Investment Scenario: An investment of $10,000 in SCHD could experience a potential range of returns based on its historical volatility. For example, in a high-volatility year, the investment might experience a loss of up to 10%, while in a low-volatility year, it could see a return of around 5%.

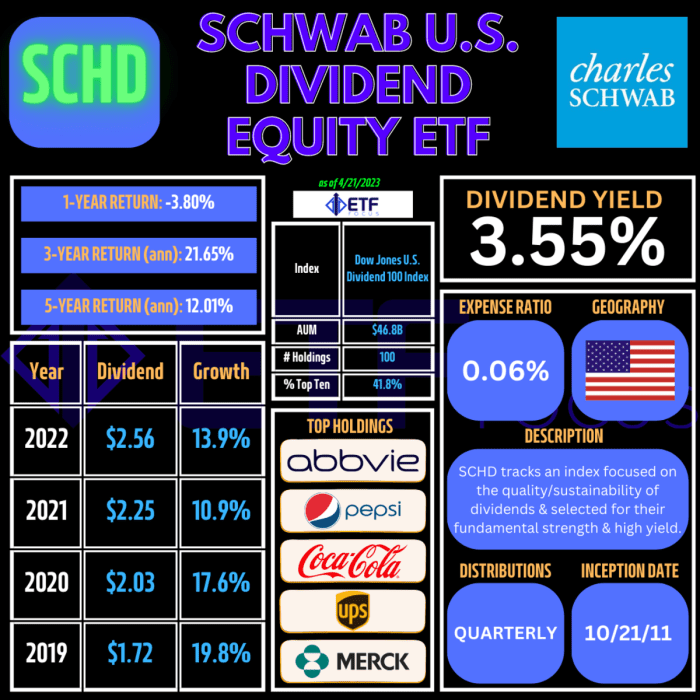

SCHD Stock Price and Dividend Yield

A line graph depicting the relationship between SCHD’s stock price and dividend yield over the past five years would show an inverse relationship. As the stock price increases, the dividend yield decreases, and vice versa. This is because the dividend yield is calculated as the annual dividend per share divided by the stock price.

Changes in SCHD’s stock price directly impact its dividend yield. A rising stock price reduces the yield, while a falling stock price increases the yield. This is a fundamental principle of dividend investing.

Scenario: A 10% increase in SCHD’s stock price would likely result in a decrease in its dividend yield (approximately 9.1% assuming the dividend remains constant). Conversely, a 10% decrease in the stock price would likely lead to an increase in the dividend yield (approximately 11.1% assuming the dividend remains constant).

SCHD Stock Price and Underlying Holdings

The performance of SCHD’s top 10 holdings significantly impacts its overall stock price. The table below illustrates this (note that holdings and weights can change over time and this is illustrative data):

| Holding | Weighting (%) | Sector |

|---|---|---|

| Microsoft (MSFT) | 5% | Technology |

The top 10 holdings are diversified across various sectors, including Technology, Healthcare, Consumer Staples, and Financials. Strong performance in these sectors generally supports SCHD’s price, while underperformance in any major sector can negatively impact it.

Comparison of SCHD’s top holdings’ performance against the overall market performance over the last year:

- Some top holdings may outperform the market, contributing positively to SCHD’s overall performance.

- Conversely, underperformance in some holdings can drag down SCHD’s overall return, although diversification mitigates this risk.

SCHD Stock Price Valuation Metrics

Source: thestreet.com

Key valuation metrics for SCHD include the Price-to-Earnings (P/E) ratio and the dividend payout ratio. The P/E ratio compares the stock price to its earnings per share, providing insights into market valuation. The dividend payout ratio indicates the percentage of earnings paid out as dividends.

Comparison of SCHD’s valuation metrics to competitors:

- SCHD’s P/E ratio might be lower than some growth-oriented dividend ETFs, reflecting its focus on established, dividend-paying companies.

- Its dividend payout ratio might be relatively high compared to some competitors, signaling a commitment to returning value to shareholders.

These valuation metrics can be used to assess whether SCHD is overvalued, undervalued, or fairly valued relative to its peers and historical trends. A lower P/E ratio might suggest undervaluation, while a higher P/E ratio could signal overvaluation. However, it is crucial to consider other factors, such as growth prospects and market conditions, before making any investment decisions.

Question & Answer Hub

What is the current SCHD stock price?

The current SCHD stock price fluctuates constantly and can be found on major financial websites like Yahoo Finance or Google Finance.

How often does SCHD pay dividends?

SCHD’s stock price performance often reflects the overall market trend for dividend-paying stocks. However, comparing its trajectory to other tech giants offers valuable context; for instance, consider the recent fluctuations in the arm holdings stock price , which, while in a different sector, can indicate broader investor sentiment. Ultimately, understanding SCHD’s price requires considering the wider economic picture and how it relates to companies like Arm Holdings.

SCHD typically pays dividends quarterly.

Is SCHD a suitable investment for retirement?

Whether SCHD is suitable for retirement depends on individual risk tolerance and investment goals. Its focus on dividend income may appeal to those seeking regular payouts, but its price volatility should be considered.

What are the expense ratios for SCHD?

The expense ratio for SCHD is relatively low, but the exact figure should be verified on the fund’s fact sheet or a financial website.