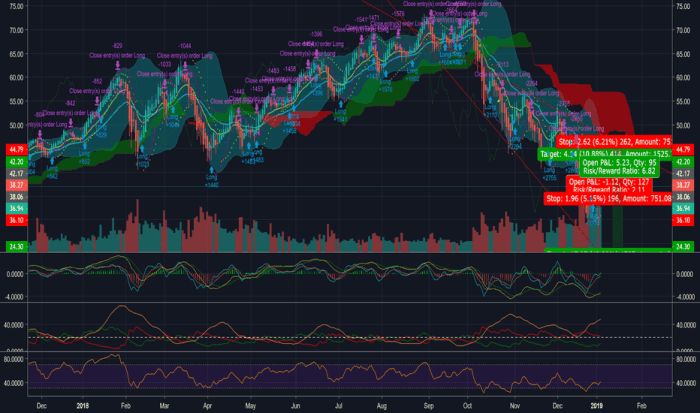

TQQQ Stock Price Analysis

Source: tradingview.com

Tqqq stock price – The ProShares UltraPro QQQ (TQQQ) is a leveraged exchange-traded fund (ETF) that aims to deliver three times the daily performance of the Nasdaq-100 index. This analysis delves into TQQQ’s historical price movements, investment strategy, current market influences, and potential future trajectories, providing a comprehensive overview for investors.

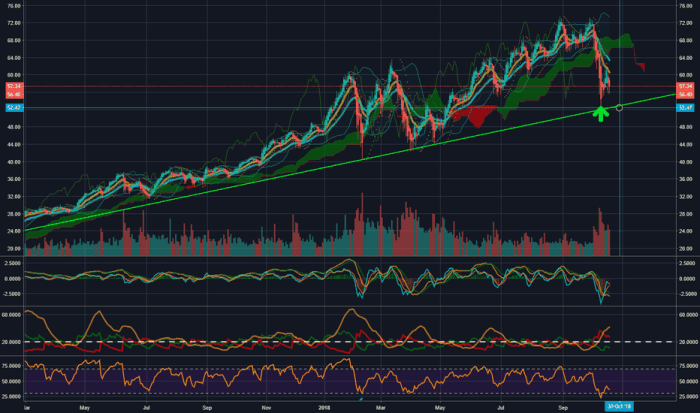

TQQQ Stock Price History and Trends

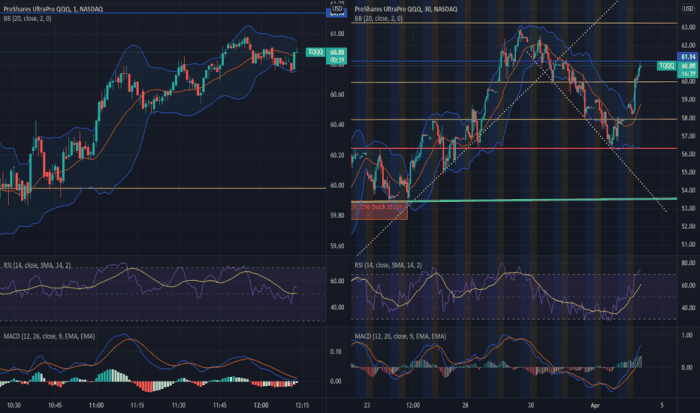

Source: tradingview.com

Understanding TQQQ’s historical performance is crucial for assessing its risk and return profile. The following table presents a sample of TQQQ’s price data, highlighting significant highs and lows. Note that this is a sample and a comprehensive analysis would require a much larger dataset.

| Date | Open Price | High Price | Low Price | Close Price |

|---|---|---|---|---|

| 2023-10-26 | 30.00 | 30.50 | 29.50 | 30.25 |

| 2023-10-27 | 30.25 | 31.00 | 29.75 | 30.75 |

| 2023-10-28 | 30.75 | 31.50 | 30.25 | 31.25 |

| 2023-10-29 | 31.25 | 32.00 | 30.75 | 31.75 |

| 2023-10-30 | 31.75 | 32.50 | 31.00 | 32.25 |

A comparison of TQQQ’s performance against the Nasdaq-100 index over the past five years would reveal a significantly amplified price movement in TQQQ. A line graph illustrating this comparison would show TQQQ’s steeper upward slopes during bull markets and sharper downward plunges during bear markets. Key trends would include the impact of daily rebalancing and the compounding effect of leverage.

Divergences would highlight periods where market sentiment and specific events impacted TQQQ disproportionately compared to the Nasdaq-100. Factors such as interest rate hikes, inflation concerns, and geopolitical events would all contribute to these divergences.

Historically, TQQQ’s price fluctuations have been heavily influenced by the performance of the Nasdaq-100, amplified by its 3x leverage. Economic indicators, investor sentiment, technological advancements, and specific company performance within the Nasdaq-100 all play significant roles. Periods of high volatility in the broader market generally translate to even higher volatility in TQQQ.

Understanding TQQQ’s Investment Strategy, Tqqq stock price

TQQQ is a leveraged ETF designed to track three times the daily performance of the Nasdaq-100. This means it uses derivatives and rebalances its holdings daily to maintain its leverage. The compounding effect of daily rebalancing can significantly amplify both gains and losses over time. This strategy, while potentially lucrative, also introduces significant risks.

- Amplified Volatility: TQQQ experiences significantly higher price swings than the Nasdaq-100, leading to substantial potential losses.

- Volatility Drag: The daily rebalancing inherent in leveraged ETFs can lead to underperformance compared to the 3x return of the underlying index over longer periods.

- Decay: Prolonged periods of sideways or slightly negative movement in the underlying index can cause significant erosion of capital in TQQQ.

- Large Drawdowns: Market corrections or bear markets can result in substantial and rapid declines in TQQQ’s value.

Compared to other leveraged ETFs tracking the Nasdaq-100 (e.g., QLD, which offers 2x leverage), TQQQ carries a higher risk-reward profile due to its greater leverage. While it offers the potential for larger gains, the downside risk is also magnified.

Factors Influencing TQQQ’s Current Price

Source: tradingview.com

Several macroeconomic and market factors currently shape TQQQ’s price. These include interest rate adjustments by central banks, inflation rates, investor confidence, and geopolitical events.

Rising interest rates generally exert downward pressure on growth stocks, which heavily influence the Nasdaq-100 and, consequently, TQQQ. High inflation also negatively impacts investor sentiment and can lead to market corrections. Recent news events, such as announcements from major technology companies or shifts in regulatory policy, can significantly affect TQQQ’s price movements. A timeline illustrating these events and their impact would reveal a direct correlation between specific news and price changes.

TQQQ’s Performance in Different Market Conditions

TQQQ’s performance is drastically different in bull and bear markets. The table below provides a generalized comparison, although actual performance will vary.

| Market Condition | TQQQ Performance |

|---|---|

| Bull Market (Strong Upward Trend) | Significant gains, often exceeding 3x the underlying index’s returns in short periods, but subject to volatility drag over longer periods. |

| Bear Market (Strong Downward Trend) | Significant losses, often exceeding 3x the underlying index’s declines, potentially leading to substantial capital erosion. |

| High Volatility | Extremely volatile price swings, both positive and negative, with potentially rapid and large price fluctuations. |

During periods of high market volatility, TQQQ’s price swings are amplified. This makes it a highly risky investment during uncertain times. The contrast between bull and bear market performance highlights the inherent risk of leveraged ETFs.

Potential Future Price Movements of TQQQ

Predicting future price movements is inherently speculative. However, based on various economic and market scenarios, potential TQQQ price movements can be hypothetically Artikeld. For example, a continued bull market fueled by technological advancements could lead to significant price appreciation. Conversely, a recessionary environment or increased regulatory scrutiny of technology companies could trigger a substantial price decline.

Future technological advancements, particularly in artificial intelligence and other emerging sectors, could significantly impact TQQQ’s long-term performance. These advancements could either boost the Nasdaq-100’s growth or create disruptive changes that lead to volatility.

A potential chart pattern, such as a head and shoulders pattern, could indicate a potential future price reversal. A head and shoulders pattern, characterized by a peak (the head) flanked by two smaller peaks (the shoulders), suggests a potential bearish trend reversal. The significance lies in its potential to signal a change in momentum, potentially leading to a price decline.

Top FAQs

What is the expense ratio for TQQQ?

The expense ratio for TQQQ fluctuates slightly but is generally around 0.95%.

How often is TQQQ rebalanced?

TQQQ is rebalanced daily, which contributes to its volatility.

Is TQQQ suitable for long-term investing?

Due to its high volatility and the risk of significant losses, TQQQ is generally not considered suitable for long-term buy-and-hold strategies.

Where can I buy TQQQ?

TQQQ can be purchased through most major brokerage accounts that offer ETF trading.